Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

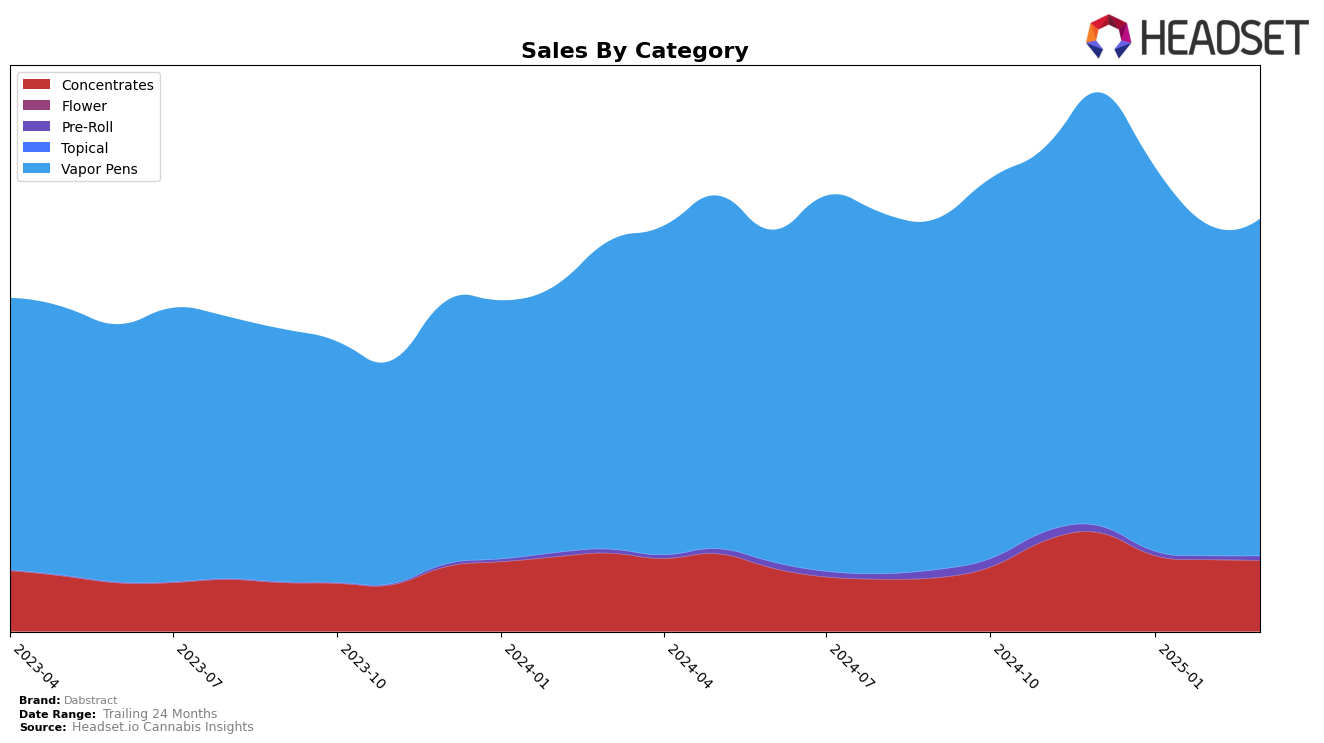

Dabstract's performance across various states and categories highlights a mix of stability and challenges. In Illinois, the brand has shown consistency in the Concentrates category, maintaining a presence within the top 30, with a slight improvement from rank 26 in December 2024 to 24 by March 2025. However, their Vapor Pens category has seen more fluctuation, although they managed to climb from rank 30 in February to 27 in March. This indicates a potential recovery or strategic adjustment in their approach. On the other hand, Michigan presents a stark contrast, where Dabstract's Vapor Pens have steadily declined in rankings, falling from 35 in December 2024 to 69 in March 2025, suggesting significant challenges in maintaining market share in this state.

In Missouri, Dabstract's presence in the Concentrates category has dwindled, as they dropped out of the top 30 by March 2025, after being ranked 20 in December 2024. This indicates a potential need for strategic reevaluation in this market. Conversely, Washington remains a stronghold for Dabstract, where they have consistently performed well in both Concentrates and Vapor Pens categories. They achieved an impressive rank of 7 in Concentrates by March 2025, showcasing a robust market position. The Vapor Pens category, while experiencing minor rank shifts, remains strong, maintaining a position around the 8th to 9th rank, signaling a stable performance in this competitive market.

Competitive Landscape

In the Washington Vapor Pens category, Dabstract has maintained a consistent presence, ranking 8th in December 2024 and January 2025, before slightly dropping to 9th in February and March 2025. This stability, however, contrasts with the performance of competitors like EZ Vape, which consistently held the 7th position throughout the same period, and Snickle Fritz, which improved its rank from 9th in December 2024 to 8th in February and March 2025. Despite these shifts, Dabstract's sales experienced a notable decrease from January to February, which could be attributed to the competitive pressure from brands like Snickle Fritz, whose sales surged during the same period. Meanwhile, brands like Ooowee and Regulator showed fluctuating ranks and sales, indicating a less stable market position compared to Dabstract. This competitive landscape suggests that while Dabstract remains a strong contender, there is a need to strategize against upward-moving competitors to maintain or improve its market position.

Notable Products

In March 2025, the top-performing product for Dabstract was the Golden Pineapple Live Resin Cartridge (1g) within the Vapor Pens category, achieving the number one rank with notable sales of 2478 units. Following closely, the Golden Pineapple Live Resin Disposable (1g) secured the second position. Super Silver Haze Live Resin Cartridge (1g) and Triangle Kush Live Resin Cartridge (1g) took the third and fourth spots, respectively, while Banana Cake Live Resin Cartridge (1g) rounded out the top five. Notably, the Golden Pineapple Live Resin Cartridge (1g) climbed from the fifth position in February to first in March, indicating a significant increase in popularity. This upward trend suggests a strong consumer preference for Golden Pineapple products within the Vapor Pens category during this period.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.