Jul-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

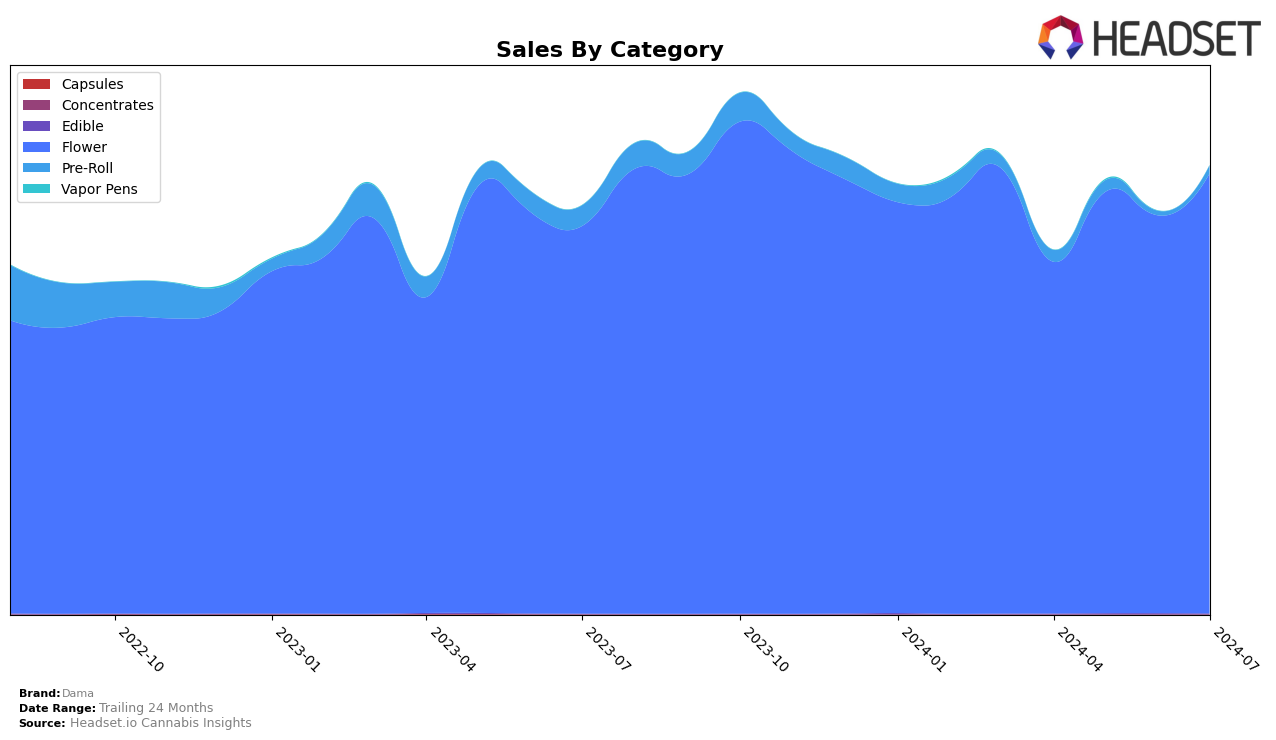

Dama has shown a noteworthy performance in the Washington market, especially in the Flower category. Starting off in April 2024, Dama was ranked 39th, which was outside the top 30 brands. However, the brand made significant strides by climbing to the 28th position in both May and June, and further improving to the 25th spot in July. This upward trend indicates a growing consumer preference and market penetration for Dama's Flower products in Washington. The consistent rise in ranking over the months signals effective brand strategies and potentially an increase in market share within this category.

While Dama's performance in Washington's Flower category has been commendable, it's important to note that the brand was not in the top 30 in April, highlighting an initial struggle to break into the leading ranks. The improvement from being unranked to securing a spot within the top 25 by July is a positive indicator of the brand's resilience and ability to adapt to market demands. This movement suggests that Dama may continue to climb the ranks if the current trajectory is maintained. The sales figures also reflect this positive trend, with a visible increase from April to July, demonstrating growing consumer acceptance and market presence.

Competitive Landscape

In the competitive landscape of the Flower category in Washington, Dama has shown a notable upward trend in rankings over the past few months, moving from 39th place in April 2024 to 25th place by July 2024. This improvement in rank is significant when compared to competitors like Sky High Gardens and Khush Kush, who also experienced positive rank changes but did not achieve as steep an ascent. For instance, Sky High Gardens improved from 33rd to 23rd place, while Khush Kush moved from 53rd to 26th place within the same period. Meanwhile, Hemp Kings and Falcanna have maintained relatively stable positions, with Hemp Kings consistently staying within the top 30 and Falcanna fluctuating slightly but remaining competitive. Dama's consistent rise in rank indicates a strong market presence and growing consumer preference, which could be attributed to effective marketing strategies and product quality. This positive trend suggests that Dama is gaining traction and could potentially continue to climb the ranks, making it a brand to watch in the Washington Flower market.

Notable Products

In July 2024, the top-performing product for Dama was Oreoz Budlets (3.5g) in the Flower category, maintaining its leading position from June with notable sales of $1,059. Tringle Mints Budlets (3.5g) secured the second spot, marking its debut in the rankings. Blueberry Treat Budlets (3.5g) climbed from fourth to third place, showing a significant increase in sales. Deep Fried Ice Cream Budlets (3.5g) entered the rankings at fourth place, while Wedding Pie Budlets (3.5g) rounded out the top five. This reshuffling indicates dynamic changes in consumer preferences and product performance over the past months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.