Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

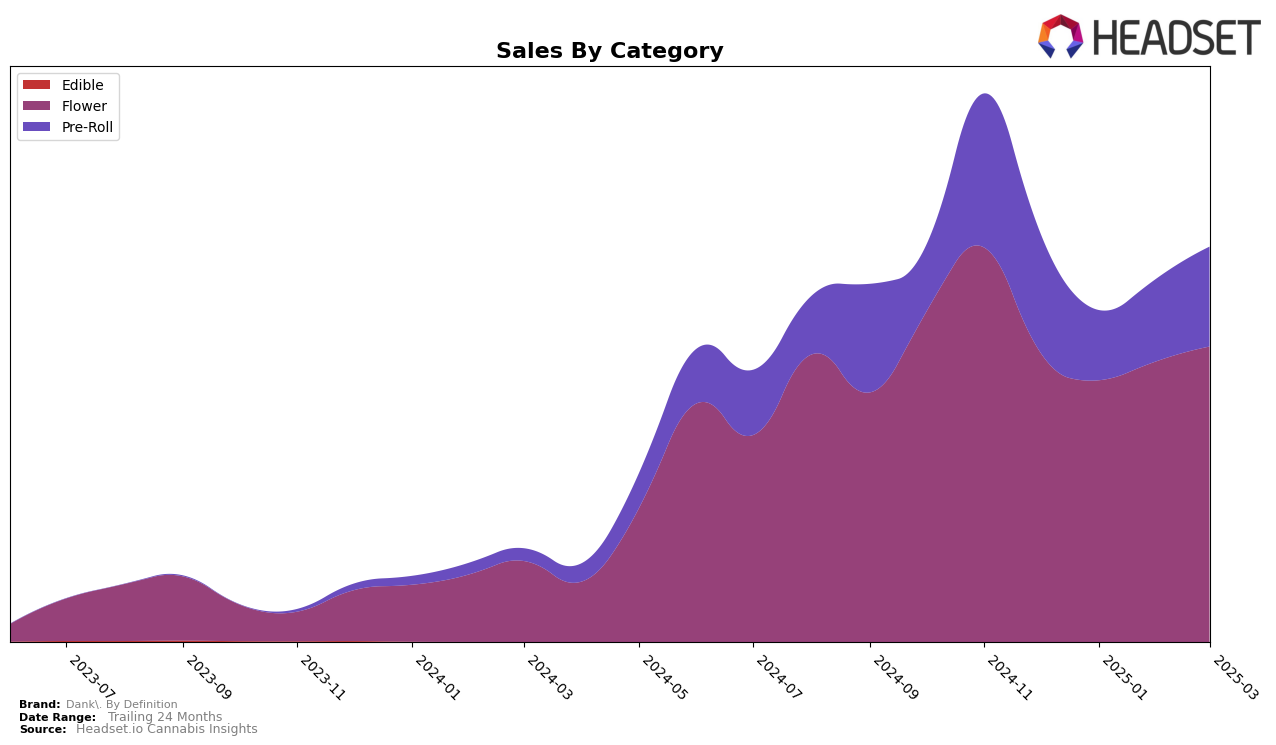

Dank. By Definition has consistently maintained a strong presence in the New York market, particularly in the Flower category, where it has held the number one ranking from December 2024 through March 2025. This indicates a robust and stable demand for their Flower products in this state. Despite a slight dip in sales from December to January, the sales figures rebounded in February and March, suggesting effective strategies to counteract any seasonal or market fluctuations. In contrast, their performance in the Pre-Roll category, while still impressive, has consistently ranked second, indicating strong competition or a slightly less dominant market position compared to their Flower offerings.

Interestingly, the absence of Dank. By Definition from the top 30 rankings in other states or provinces could be seen as a missed opportunity for expansion or a strategic focus on their core market in New York. This absence might suggest that while they have a solid foothold in New York, there is potential for growth in other regions if they choose to expand their market reach. The consistent ranking in New York's Pre-Roll category, despite being second, indicates a steady consumer base and a potential area for growth if they can surpass their competitors. Further analysis of their strategies and market conditions in other states could provide insights into potential expansion opportunities.

Competitive Landscape

In the competitive landscape of the New York flower category, Dank. By Definition has consistently maintained its top position from December 2024 through March 2025. This brand's unwavering rank as number one highlights its strong market presence and consumer preference, despite fluctuations in sales figures. In contrast, LivWell has held steady at the second position during the same period, indicating a stable yet less dominant market influence compared to Dank. By Definition. Meanwhile, Rolling Green Cannabis has shown a notable upward trend, climbing from fifth to third place, suggesting a growing competitive threat. This shift underscores the dynamic nature of the market and the importance for Dank. By Definition to continue innovating and reinforcing its brand loyalty to maintain its leading position.

Notable Products

In March 2025, the top-performing product for Dank. By Definition was Alaskan Thunderfuck Pre-Roll (1g) within the Pre-Roll category, achieving the number one rank with sales of 6688 units. Following closely was Alien Cookies Pre-Roll (1g), also in the Pre-Roll category, securing the second position. Alaskan Thunder Fuck (3.5g) from the Flower category dropped to third place after leading in January and February. Megan Foxxx (3.5g), a new entry in the rankings, debuted at fourth place. Papaya Cake Pre-Roll (0.5g) rounded out the top five, marking its first appearance in the rankings.

```Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.