Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

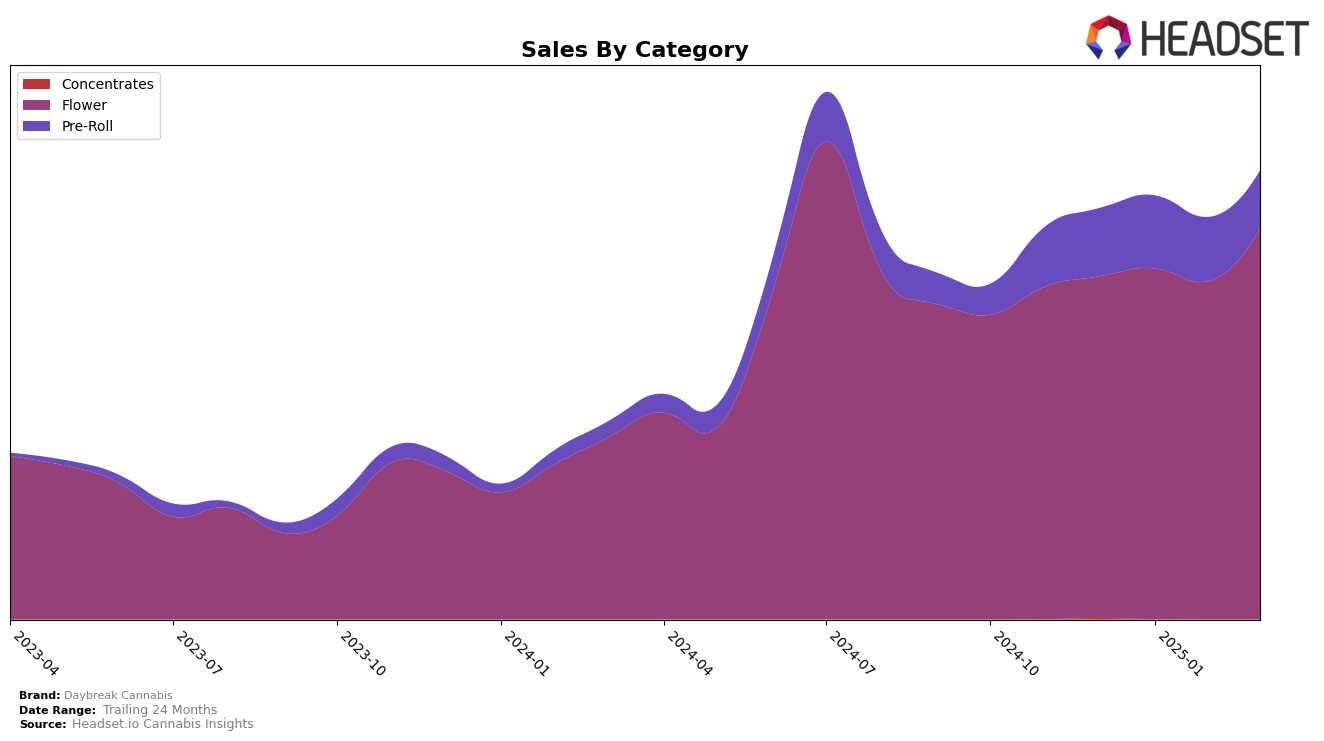

Daybreak Cannabis has shown consistent performance in the Missouri market, particularly in the Flower category. Over the months from December 2024 to March 2025, the brand maintained a steady position at rank 9, demonstrating a stable presence among top competitors. Notably, there was a significant increase in sales from February to March, indicating a positive trend in consumer demand for their Flower products. This consistency in ranking and sales growth suggests a strong foothold in the Missouri Flower market, a crucial segment for cannabis brands.

In contrast, Daybreak Cannabis's performance in the Pre-Roll category within Missouri has been more volatile. The brand experienced a drop in rank from 11 in January to 18 in March, accompanied by fluctuating sales figures. This decline in ranking could signal challenges in maintaining market share against competitors, or it might reflect a strategic shift in focus away from Pre-Rolls. The absence of Daybreak Cannabis from the top 30 in other states or provinces suggests opportunities for expansion or areas needing improvement to enhance their market presence across different regions.

Competitive Landscape

In the competitive landscape of the Missouri flower category, Daybreak Cannabis has maintained a consistent rank at 9th place from January to March 2025, reflecting a steady performance amidst fluctuating market dynamics. Notably, Sinse Cannabis and Good Day Farm have shown resilience by securing higher ranks, consistently staying within the top 8, which indicates a stronger market presence. Meanwhile, Local Cannabis Co. has experienced a slight decline, moving from 9th to 10th place, suggesting potential vulnerabilities that Daybreak Cannabis could capitalize on. Additionally, Rooted (MO) has shown significant improvement, climbing from 19th in December 2024 to 11th by March 2025, which could pose a future threat if their upward trajectory continues. Daybreak Cannabis's sales have shown a positive trend, particularly with a notable increase in March 2025, suggesting effective strategies in place to capture market share despite the competitive pressures.

Notable Products

In March 2025, Golden Goat Pre-Roll (1g) emerged as the top-performing product for Daybreak Cannabis, achieving the highest sales in the Pre-Roll category with a notable figure of 2545 units sold. Following closely, Detroit Cookie Pre-Roll (1g) secured the second spot, also in the Pre-Roll category. A.B. Parfait Popcorn (1g) ranked third, leading the Flower category. Apple Jack (Bulk) and Velvet Pie x GG4 (Bulk) took the fourth and fifth positions, respectively, within the Flower category. Compared to previous months, these products have maintained consistent rankings, indicating steady consumer preference and demand.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.