Dec-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

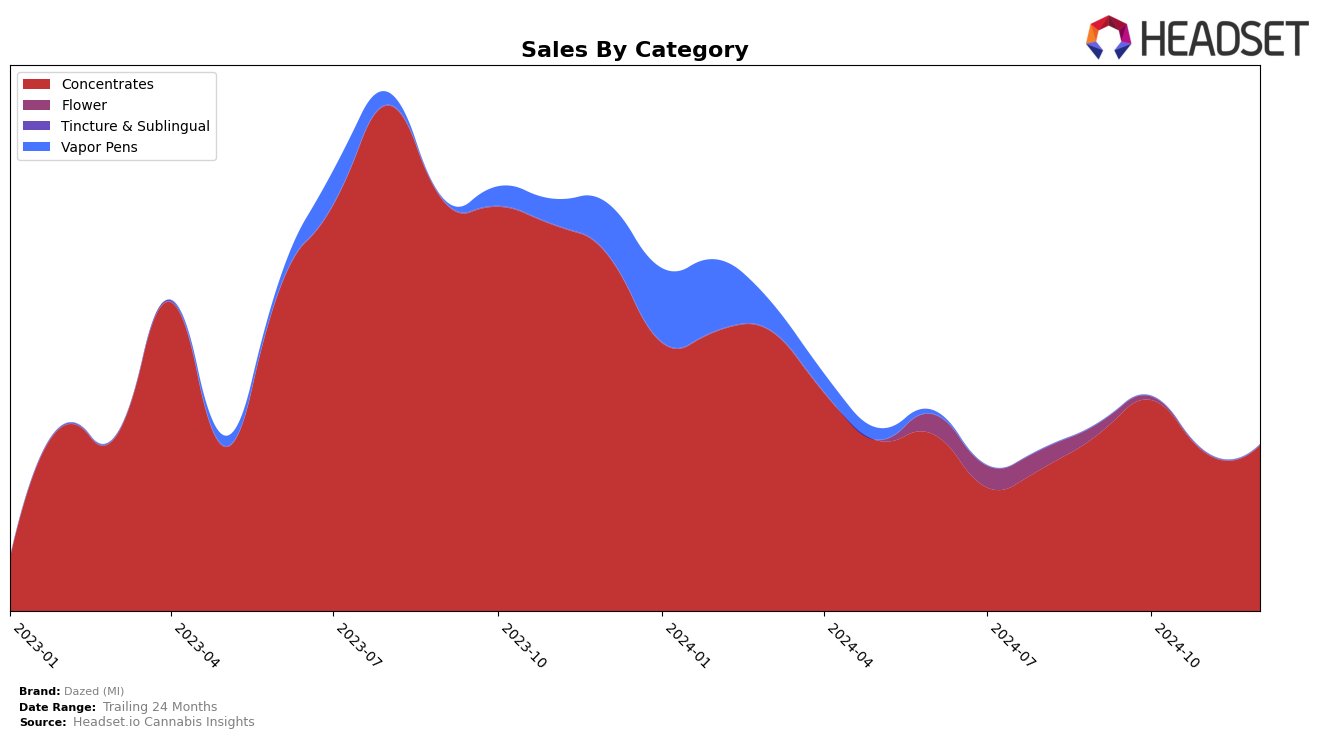

Dazed (MI) has shown a fluctuating performance in the Concentrates category within the state of Michigan. In September 2024, the brand held the 26th position, which improved slightly to 24th in October. However, November saw a decline as Dazed (MI) fell out of the top 30 rankings, highlighting a challenging period for the brand. By December, they managed to regain their footing and re-entered the rankings at 30th place. This volatility in rankings suggests that while Dazed (MI) can compete effectively within the market, maintaining a consistent presence in the top tier remains a challenge.

Despite the ups and downs in rankings, Dazed (MI) experienced notable sales dynamics. October marked a peak in sales, which coincided with their highest ranking during this period, suggesting a positive correlation between sales volume and ranking position. However, the subsequent drop in November sales and ranking indicates potential challenges in sustaining momentum. December's slight recovery in both sales and ranking positions shows resilience, yet the brand's absence from the top 30 in November underscores the competitive nature of the Concentrates category in Michigan. This performance pattern highlights the importance of strategic adjustments to maintain a competitive edge in such a dynamic market.

Competitive Landscape

In the competitive landscape of the Michigan concentrates market, Dazed (MI) has experienced fluctuating rankings over the last few months, indicating a dynamic competitive environment. In September 2024, Dazed (MI) was ranked 26th, improving slightly to 24th in October, but then dropping to 36th in November before climbing back to 30th in December. This volatility suggests that while Dazed (MI) is maintaining a presence in the market, it faces stiff competition from brands like Element, which consistently ranked higher, peaking at 14th in September and maintaining a top 30 position throughout the period. Additionally, Bamn showed a strong performance, reaching as high as 10th in November, indicating potential challenges for Dazed (MI) in capturing market share. Meanwhile, Mischief demonstrated a notable rise in November, surpassing Dazed (MI) with a 22nd place rank, before dropping slightly in December. These shifts highlight the competitive pressures Dazed (MI) faces, emphasizing the need for strategic initiatives to enhance its market position and sales performance.

Notable Products

In December 2024, the top-performing product for Dazed (MI) was the Dazed THC Full Spectrum RSO Syringe (1g) in the Concentrates category, maintaining its number one rank consistently from September through December, with a notable sales figure of 12,433 units. The CBD/THC 1:1 Full Spectrum RSO Syringe (1g) also held its steady position at rank two throughout the same period. Chocolate Diesel Live Resin (1g) emerged in December to secure the third position, marking its debut in the rankings. Both Candy Land Live Resin Baller Bucket (3.5g) and Dragon's Breath Live Resin (1g) tied at the fourth rank, appearing for the first time in the December rankings. This month saw a consistent dominance of the Full Spectrum RSO Syringe products, with new entries in the live resin segment making notable appearances.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.