Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

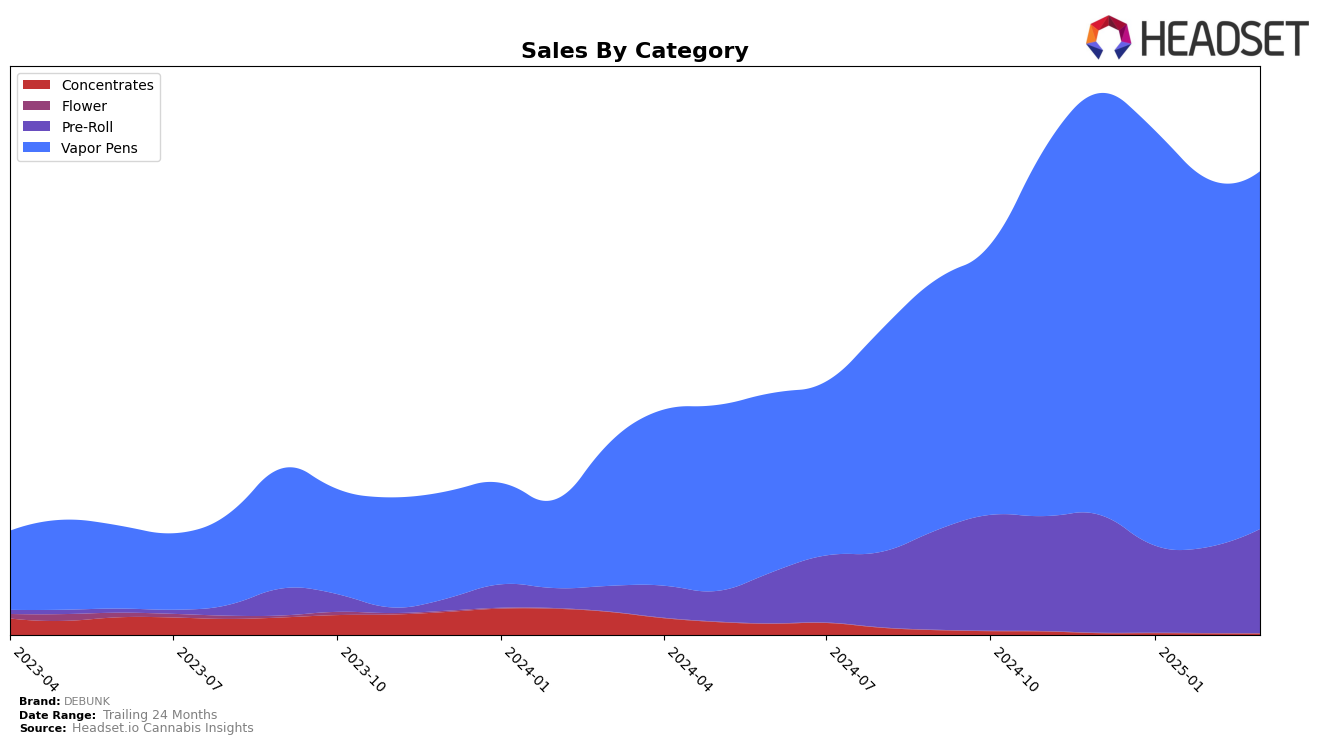

DEBUNK's performance in the Pre-Roll category shows varied results across different provinces. In Alberta, the brand experienced a declining trend, with its rank slipping from 21st in December 2024 to 29th by March 2025. This indicates a challenging market landscape or possibly increased competition in the Pre-Roll segment. Meanwhile, in British Columbia, DEBUNK maintained a more stable position, starting and ending the period at 20th, with a notable improvement in February 2025 when it climbed to 19th. In contrast, in Ontario, DEBUNK did not make it to the top 30, highlighting potential growth opportunities or market entry challenges in this region.

In the Vapor Pens category, DEBUNK has shown strong performance, particularly in British Columbia, where it consistently held the 3rd position throughout the observed months. This suggests a strong brand presence and consumer preference in this category. In Alberta, DEBUNK's rank fluctuated slightly, peaking at 6th in January and February before returning to 8th by March 2025. In Ontario, the brand maintained a top 4 position until March, when it dropped to 6th, indicating a slight competitive pressure. Meanwhile, in Saskatchewan, DEBUNK's ranking alternated between 7th and 9th, which could suggest a dynamic competitive environment or shifts in consumer preferences.

Competitive Landscape

In the competitive landscape of vapor pens in Ontario, DEBUNK has experienced notable fluctuations in its market position from December 2024 to March 2025. Initially holding a strong 4th rank, DEBUNK maintained this position through February 2025, before slipping to 6th place in March. This decline in rank coincides with a decrease in sales, suggesting a potential loss of market share to competitors. Notably, General Admission consistently outperformed DEBUNK, improving from 5th to 4th place by March 2025, likely benefiting from a steady increase in sales. Meanwhile, Spinach showed a strong recovery, climbing from 8th to 5th place, which may have contributed to DEBUNK's drop in rank. The competitive dynamics indicate that while DEBUNK remains a key player, it faces significant pressure from brands like General Admission and Spinach, necessitating strategic adjustments to regain its competitive edge in the Ontario vapor pen market.

Notable Products

In March 2025, the ICE- Moon Drops Liquid Diamonds Cartridge (1g) maintained its top position in the Vapor Pens category for the fourth consecutive month, despite a slight decrease in sales to 21,190 units. The 24k Gold Infused Pre-Roll 5-Pack (2.5g) rose to second place, marking a notable increase in sales compared to previous months, as it surpassed the ICE- Kiwi Kush Liquid Diamonds Cartridge (1g), which fell to fourth place. The newly introduced 24K Gold Apricot Mango Kush Full Spectrum Cartridge (1g) debuted strong in third place in the Vapor Pens category. Meanwhile, the ICE - Melonade Liquid Diamond Cartridge (1g) held steady at fifth place, showing a slight sales increase from February 2025. Overall, March saw a reshuffling in rankings, with significant gains for pre-rolls.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.