Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

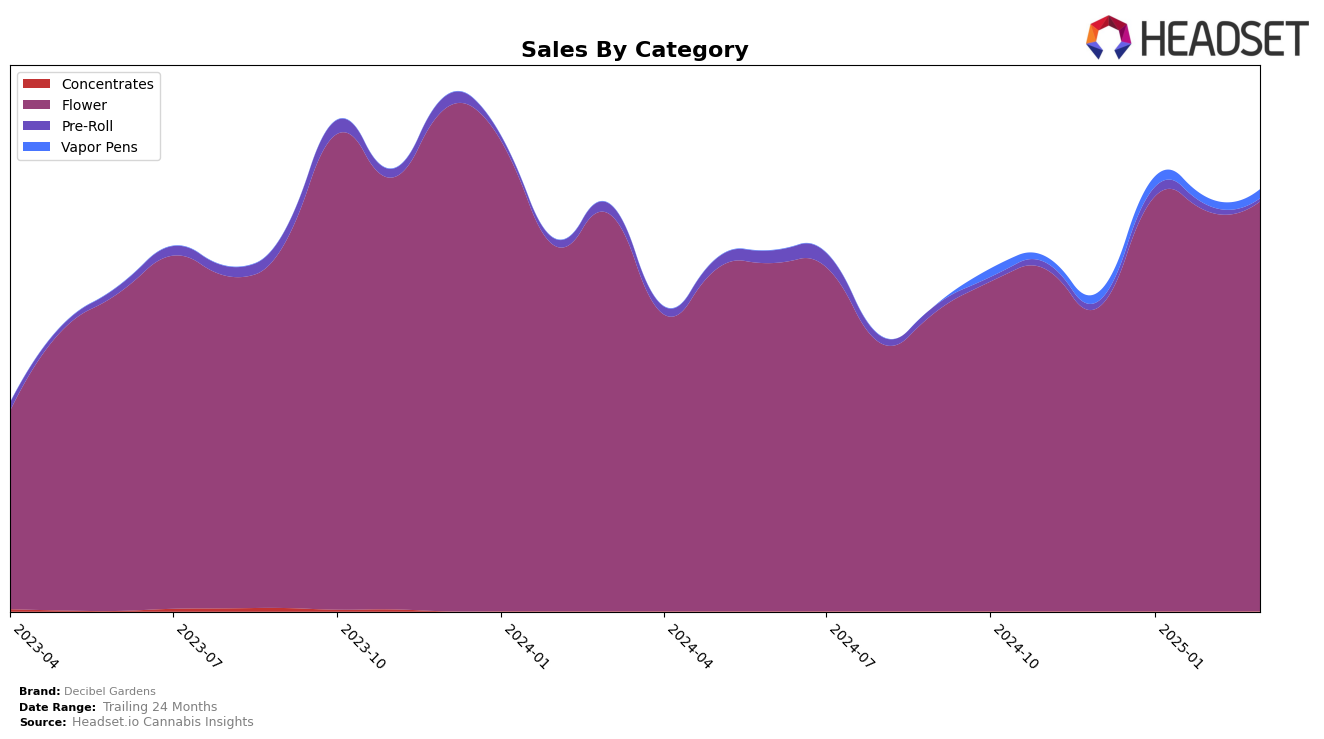

In the state of California, Decibel Gardens has shown a notable improvement in its performance within the Flower category. Beginning in December 2024, Decibel Gardens was ranked 39th, but by January 2025, it had climbed to 29th place. This upward momentum continued into February 2025 with a further rise to 25th, before slightly dropping to 30th in March 2025. This fluctuation indicates a competitive market landscape where Decibel Gardens is making significant strides, although it did not consistently maintain its position within the top 30 across all months. The brand's sales figures during this period reveal a strong upward trend, particularly from December to January, which could be attributed to strategic marketing efforts or seasonal demand shifts.

While the Flower category in California seems to be where Decibel Gardens is making its mark, the absence of rankings in other categories suggests that the brand is either not competing or not performing as strongly outside of Flower. This could be seen as a potential area for growth or diversification for Decibel Gardens. The brand's ability to break into the top 30 in January and maintain a presence through March, despite a slight dip, highlights its potential to capitalize on its current momentum. However, the lack of presence in other categories might indicate a need for strategic expansion or a more focused approach to solidify its standing within the Flower category.

Competitive Landscape

In the competitive California flower market, Decibel Gardens has shown a promising upward trajectory in rankings and sales over the past few months. Starting from a rank of 39 in December 2024, Decibel Gardens improved its position to 29 in January 2025, further climbing to 25 in February before slightly dipping to 30 in March. This positive trend is bolstered by a significant increase in sales, peaking in January with a notable surge compared to December. In contrast, Team Elite Genetics and Almora Farms have not been able to break into the top 20, with fluctuating ranks that suggest instability in their market positions. Meanwhile, Dab Daddy and Traditional Co. have maintained relatively stronger positions, although Dab Daddy experienced a rank drop in March, aligning closely with Decibel Gardens' performance. These dynamics indicate that Decibel Gardens is effectively capitalizing on market opportunities, positioning itself as a rising competitor in the California flower sector.

Notable Products

In March 2025, Roswell 47 (3.5g) maintained its position as the top-performing product for Decibel Gardens, with sales reaching 4642 units. Miyazaki Mango (3.5g) consistently held the second rank, showing a steady increase in sales from previous months. Alien Orange (3.5g) climbed to the third position in February and maintained it through March, reflecting a positive trend in its popularity. Watermelon Punch (3.5g) remained stable at the fourth rank, while Omerta OG (3.5g) consistently held the fifth position, with a slight increase in sales. These rankings indicate a stable preference pattern among consumers, with Roswell 47 (3.5g) leading the sales figures significantly.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.