Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

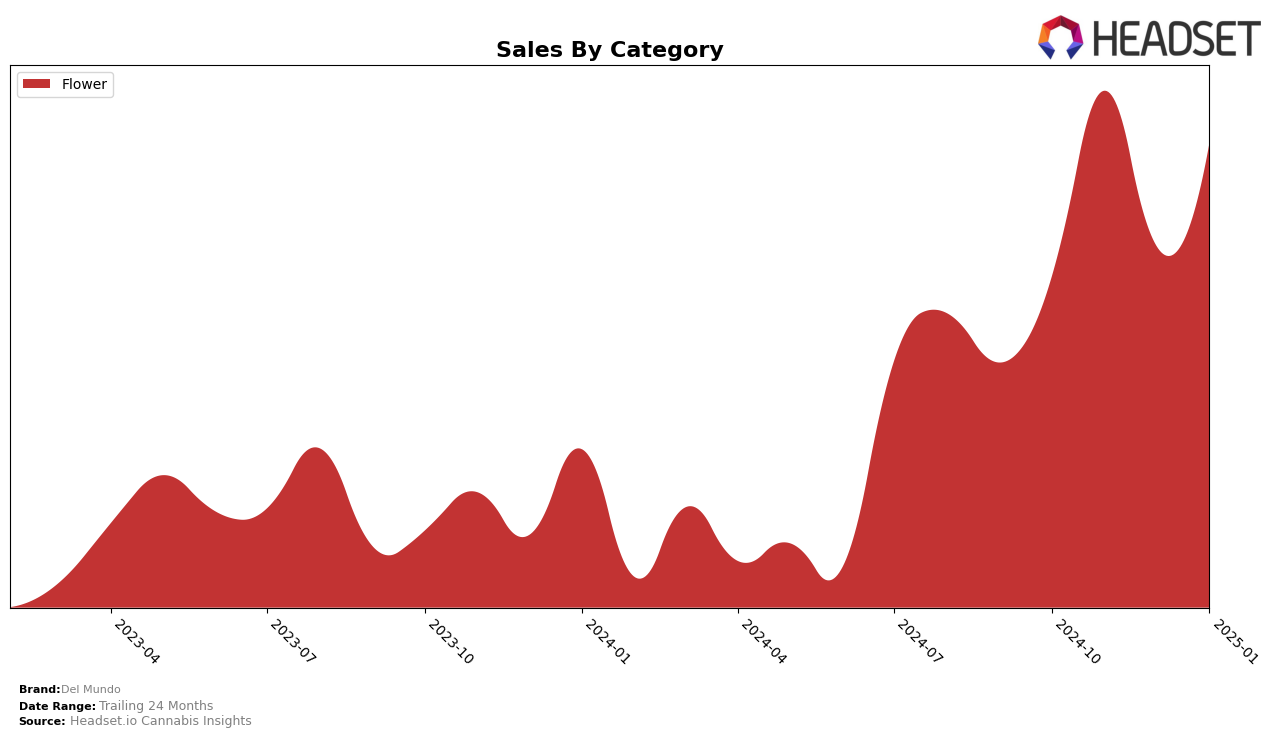

Del Mundo has shown a dynamic performance across various categories and states, with notable improvements in rankings over the recent months. In the Colorado market, Del Mundo's Flower category experienced a significant upward trajectory. Beginning in October 2024, the brand was ranked 31st, but by January 2025, it had climbed to the 19th position. This movement indicates a solid gain in market presence within the state, reflecting a successful strategy or increased consumer interest. The brand's sales in Colorado also saw a notable increase from $229,635 in October 2024 to $320,955 in January 2025, underscoring the brand's growing appeal in this region.

While Del Mundo's performance in Colorado has been promising, the absence of rankings in other states and categories suggests areas where the brand may not yet have established a significant foothold or where competition is particularly stiff. This lack of presence in the top 30 rankings outside of Colorado could be seen as a potential opportunity for expansion or a challenge to overcome. The brand's strategic focus and market penetration in states beyond Colorado will be crucial for its continued growth and success. Observing how Del Mundo navigates these markets in the coming months will provide further insights into its overall market strategy and adaptability.

Competitive Landscape

In the competitive landscape of the Flower category in Colorado, Del Mundo has shown a notable fluctuation in its rankings, reflecting a dynamic market presence. From October 2024 to January 2025, Del Mundo's rank improved from 31st to 19th, indicating a positive trend in market positioning. This improvement is significant when compared to competitors like Bloom County, which experienced a decline in rank from 15th to 17th over the same period. Meanwhile, Natty Rems and Host have shown upward mobility, with Natty Rems climbing from 37th to 18th and Host from 28th to 20th, suggesting increased competition in the mid-tier ranks. Notably, Dro saw a dramatic rise to 9th place in December 2024, before falling back to 21st in January 2025, highlighting the volatility and competitive pressure within the market. Del Mundo's sales trajectory, with a peak in November 2024, suggests that while it faces stiff competition, it is capable of capitalizing on market opportunities to enhance its standing.

Notable Products

In January 2025, Blue Dream Kush (Bulk) secured the top position among Del Mundo's products with impressive sales figures of 10,825 units, marking a significant rise from its previous second-place rank in October 2024. Strawnana (Bulk) followed closely in second place, maintaining a strong performance since its third-place ranking in November 2024. Guava Gator (Bulk) achieved the third spot, showing a consistent presence since its fifth-place position in November 2024. LA Kush Cake (Bulk) experienced a drop, moving from second in November 2024 to fourth in January 2025. Cajun Mints (Bulk) rounded out the top five, climbing up from its fourth-place finish in December 2024.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.