Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

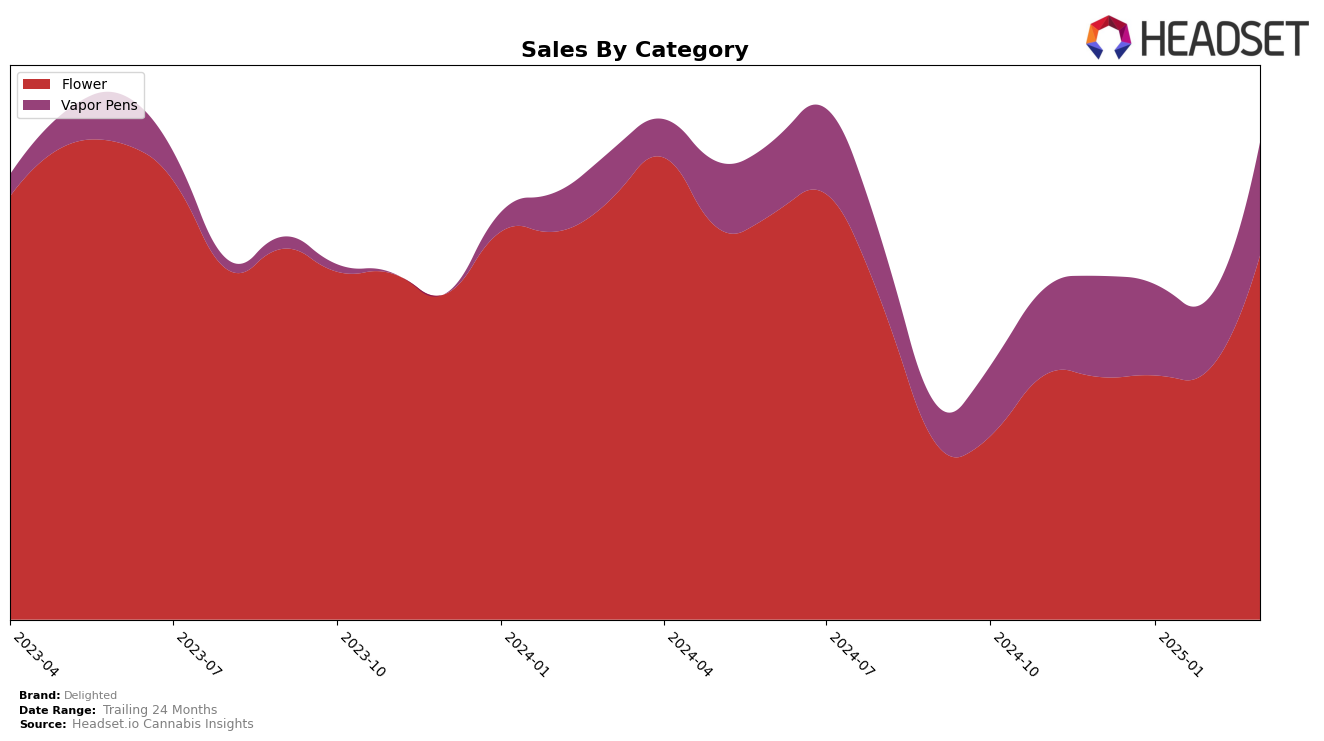

In the state of California, Delighted has shown a noteworthy upward trajectory in the Flower category. Starting from a rank of 27 in December 2024, the brand climbed to 14 by March 2025, indicating a significant improvement in market presence and consumer preference. This positive movement suggests a growing acceptance and popularity of Delighted's Flower products among consumers in California. The sales figures corroborate this trend, with a marked increase from December to March, culminating in a substantial sales figure of over 1.4 million in March. However, Delighted's performance in the Vapor Pens category tells a different story, as the brand consistently ranked outside the top 30, with a slight improvement to 41 in March 2025. This indicates potential challenges in capturing the Vapor Pens market, despite a sales uptick in March.

While Delighted's progress in California's Flower category is commendable, the brand's absence from the top 30 in the Vapor Pens category for most of the observed months highlights a key area for potential growth and strategy refinement. The contrasting performance across these categories in California underscores the importance of tailored marketing and product development strategies to address varying consumer preferences. The brand's ability to significantly improve its ranking in Flower suggests that similar strategic efforts could potentially enhance its standing in the Vapor Pens category. For those interested in a deeper dive into Delighted's market performance and strategies, further data and analysis could provide valuable insights into how the brand can leverage its strengths and address its challenges in different categories and markets.

Competitive Landscape

In the competitive landscape of the Flower category in California, Delighted has demonstrated a significant upward trajectory, climbing from a rank of 27 in December 2024 to 14 by March 2025. This notable improvement in rank reflects a strategic gain in market presence, especially when compared to competitors like Alien Labs, which experienced a decline from rank 8 to 15 over the same period. Meanwhile, Glass House Farms (CA) maintained a steady position at rank 12, indicating stable performance but not matching Delighted's rapid ascent. Additionally, West Coast Treez showed a gradual improvement, moving from rank 19 to 13, closely trailing Delighted's current standing. The substantial increase in Delighted's sales, particularly in March 2025, suggests that their market strategies are effectively translating into higher consumer demand, positioning them as a formidable competitor in the California Flower market.

Notable Products

In March 2025, Alien Kush (3.5g) from Delighted maintained its top position in the Flower category, significantly increasing its sales to 9626 units. Lemon Lavender (3.5g) rose to the second rank, showing a notable improvement from its fifth position in January 2025. Bonita Applebum (3.5g) debuted at the third position with impressive sales figures, marking its first appearance in the rankings. LA Kush Cake (3.5g) and Sunset Zerb (3.5g) secured the fourth and fifth positions respectively, both new entries for March 2025. This shift in rankings indicates a dynamic change in consumer preferences within Delighted's product lineup.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.