Sep-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

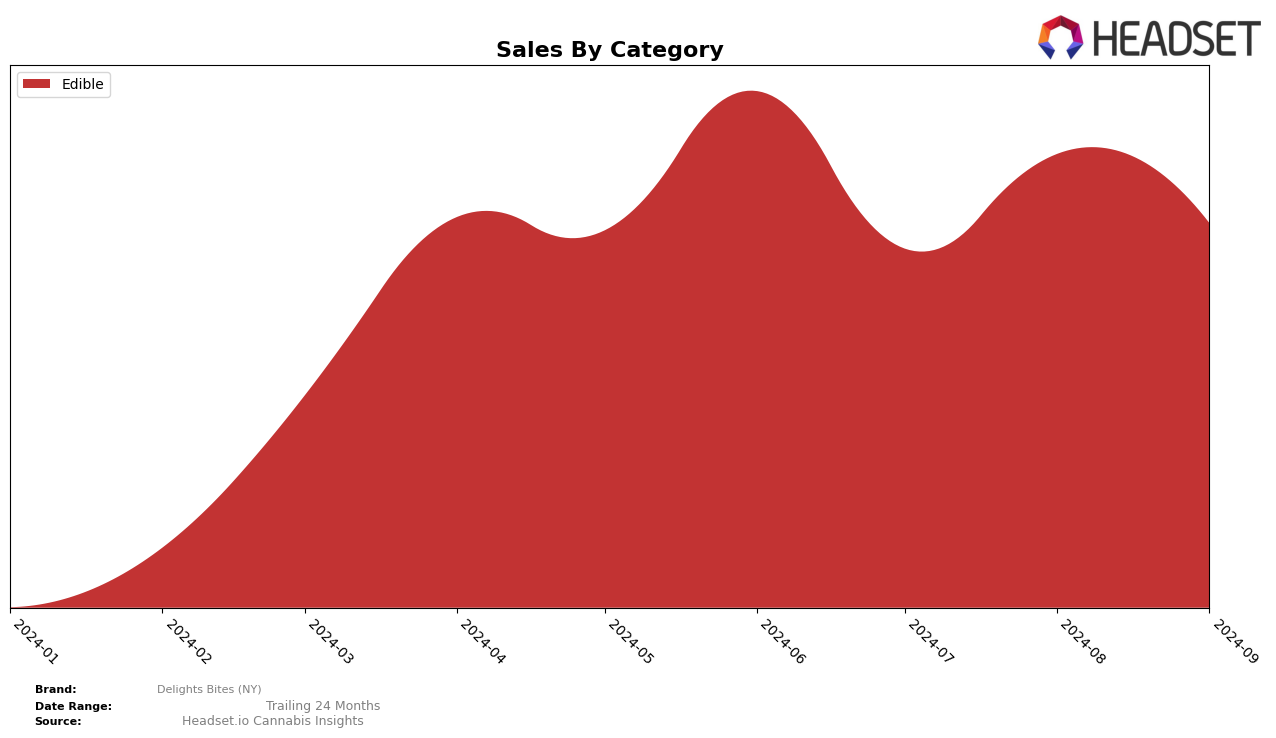

Delights Bites (NY) has shown a consistent presence in the New York market within the Edible category over the past few months. Starting in June 2024, the brand was ranked 25th, but it experienced a gradual decline, reaching the 30th position by September 2024. This downward trend might be a cause for concern, as it indicates a struggle to maintain a competitive edge in a rapidly evolving market. Despite this, Delights Bites (NY) has managed to stay within the top 30 brands, which suggests that there is still a significant consumer base for their products in New York.

Sales figures for Delights Bites (NY) show some fluctuations, with a notable drop from June to July, followed by a slight rebound in August before decreasing again in September. This pattern suggests that while there is some volatility in their sales performance, the brand is still managing to capture consumer interest periodically. The fact that they remained in the top 30 throughout the summer months could point to seasonal influences or marketing efforts that temporarily boosted their rankings. However, the challenge remains for Delights Bites (NY) to regain and improve their standing in the competitive edible market in New York.

```Competitive Landscape

In the competitive landscape of the New York edible market, Delights Bites (NY) has experienced a dynamic shift in its ranking and sales performance over recent months. While Delights Bites (NY) held a steady position in the top 30, its rank slightly declined from 25th in June to 30th by September 2024. This change is notable when compared to competitors such as FINCA, which maintained a higher rank throughout the same period, fluctuating between 21st and 29th place. Despite this, Delights Bites (NY) outperformed High Peaks in sales during June and August, although High Peaks saw a significant drop in September. Meanwhile, Senior Moments remained consistently ranked in the 30s, indicating a stable but less competitive position compared to Delights Bites (NY). The most dramatic shift was observed with Love Oui'd, which surged from 49th to 28th place by September, showcasing a remarkable increase in sales, potentially posing a future threat to Delights Bites (NY)'s market share. These insights suggest that while Delights Bites (NY) maintains a competitive edge, it faces increasing pressure from both established and emerging brands in the New York edible market.

Notable Products

In September 2024, the top-performing product for Delights Bites (NY) was the Peanut Butter Milk Chocolates 10-Pack (100mg) in the Edible category, which reclaimed its number one position with sales of 174 units. Mint Milk Chocolate Bites 10-Pack (100mg) rose to the second spot, showing a notable increase in sales compared to previous months. Banana Cream Pie White Chocolates 10-Pack (100mg) entered the rankings at third place, highlighting its growing popularity. Strawberry Cream Pie White Chocolates 10-Pack (100mg) maintained a consistent presence, ranking fourth in September. Caramel Milk Chocolates 10-Pack (100mg) experienced a drop to fifth place after leading in August, indicating a shift in consumer preferences.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.