Dec-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

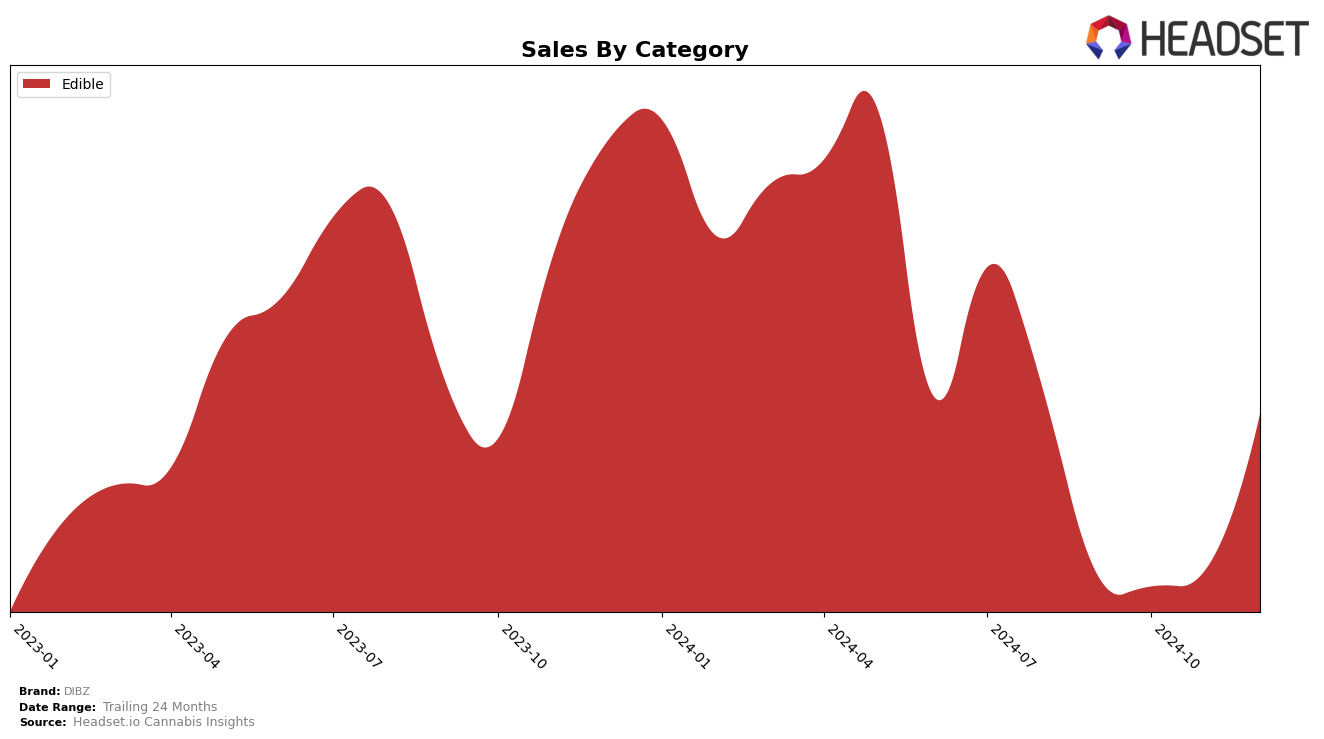

DIBZ has shown a fluctuating performance in the Edible category within Illinois over the last few months. Starting with a rank of 27 in September 2024, the brand experienced a slight dip to 29 in both October and November, before rebounding to 26 in December. This movement indicates a potential resurgence in popularity or market strategy effectiveness towards the end of the year. Despite not being consistently high in the rankings, the increase in sales from November to December suggests a strong finish to the year, possibly driven by holiday demand or successful promotional efforts.

The consistent presence of DIBZ in the top 30 brands in Illinois's Edible category is noteworthy, especially considering the competitive nature of the cannabis market. Unlike other states where DIBZ might not have made it to the top 30, their ability to maintain visibility in Illinois could be attributed to a loyal customer base or effective distribution strategies. The absence of rankings in other states might indicate either a focus on specific markets or challenges in expanding their footprint. This selective presence raises questions about their strategic priorities and potential areas for growth or improvement in the coming months.

Competitive Landscape

In the competitive landscape of the Edible category in Illinois, DIBZ has shown a notable improvement in its rank from September to December 2024, moving from 27th to 26th place. This upward trend is particularly significant given the competitive pressure from brands like Midweek Friday, which experienced a more volatile ranking, peaking at 21st in November before dropping to 24th in December. Meanwhile, Tastebudz and Bedford Grow have consistently hovered around the lower 20s, indicating a stable yet less dynamic market presence compared to DIBZ. Despite a slight dip in sales in October, DIBZ's December sales surged, surpassing Bubby's Baked, which maintained a steady climb in rankings but did not break into the top 20. This suggests that DIBZ's strategic initiatives may be effectively capturing consumer interest, positioning it for continued growth in the Illinois edibles market.

Notable Products

In December 2024, DIBZ's top-performing product was the CBD/THC 1:1 Dragon Fruit Fast Acting Gummies 20-Pack, which climbed to the first rank with impressive sales of 2966 units. White Peach Gummies 10-Pack followed closely in second place, maintaining a strong presence after being the top product in October. The THC/CBN 2:1 Huckleberry Lemonade Gummies 10-Pack, despite a dip in October, secured the third position, showing resilience in its sales figures. Pineapple Mango Fast Acting Gummies 20-Pack consistently held the fourth rank throughout the last four months, indicating stable demand. Notably, Yellow Raspberry Gummies 10-Pack made its debut in December rankings at fifth place, highlighting its potential in the market.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.