Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

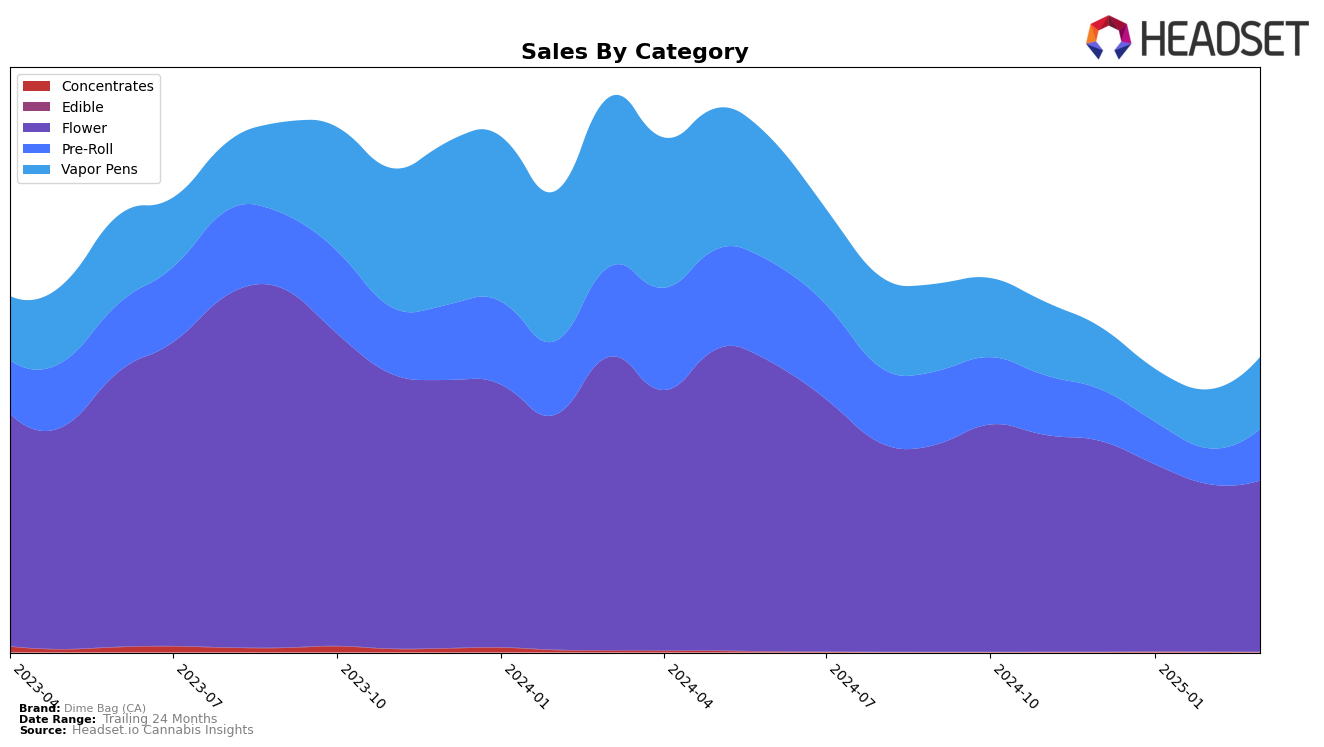

Dime Bag (CA) has shown a nuanced performance across different cannabis product categories in California. In the Flower category, the brand has experienced a slight decline in ranking from December 2024 to March 2025, moving from 15th to 18th place. This movement is accompanied by a decrease in sales, with a notable drop from December's figures to a smaller sales number in February, before a slight recovery in March. In the Pre-Roll category, Dime Bag (CA) has managed to break into the top 30 by March 2025, marking a positive shift from being outside the top 30 in earlier months. This upward movement could indicate a strategic focus or consumer preference shift that may be worth further exploration.

In the Vapor Pens category, Dime Bag (CA) has shown a consistent improvement in ranking, moving from 42nd place in December 2024 to 37th place by March 2025. This positive trajectory is supported by an increase in sales, particularly noticeable from February to March, suggesting a growing consumer interest or successful marketing efforts in this segment. However, it is important to note that while the brand has made strides in certain categories, it has not yet secured a position within the top 30 across all categories, which could imply potential areas for growth or needed adjustments in strategy. The overall performance of Dime Bag (CA) in California reflects both challenges and opportunities that can be leveraged for future growth.

Competitive Landscape

In the competitive landscape of the California flower category, Dime Bag (CA) has experienced notable fluctuations in its ranking, moving from 15th in December 2024 to 18th by March 2025. Despite this slight decline, Dime Bag (CA) maintains a competitive edge over brands like West Coast Cure, which consistently ranks lower, holding the 20th position in March 2025. Meanwhile, Coastal Sun Cannabis shows a more stable performance, slightly outperforming Dime Bag (CA) by securing the 19th rank in March 2025. Interestingly, Eighth Brother, Inc. has shown resilience, ranking 17th in March 2025, just ahead of Dime Bag (CA), despite a downward sales trend. The most striking development is the rapid ascent of Quiet Kings, which surged from 42nd in December 2024 to 16th by March 2025, indicating a potential shift in consumer preferences that could impact Dime Bag (CA)'s market position if not addressed strategically.

Notable Products

In March 2025, Pink Picasso Pre-Roll (1g) emerged as the top-performing product for Dime Bag (CA), leading the sales with 2808 units sold. Following closely, Tropicana Cherry Pre-Roll (1g) secured the second position, with GMO Fuel Pre-Roll (1g) taking the third spot. Dark Star Pre-Roll (1g) and Sour Joker Pre-Roll (1g) rounded out the top five, ranking fourth and fifth respectively. Notably, these products were not ranked in the previous months, indicating a significant surge in popularity. The pre-roll category dominated the rankings, showcasing a strong consumer preference for these products in March 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.