Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

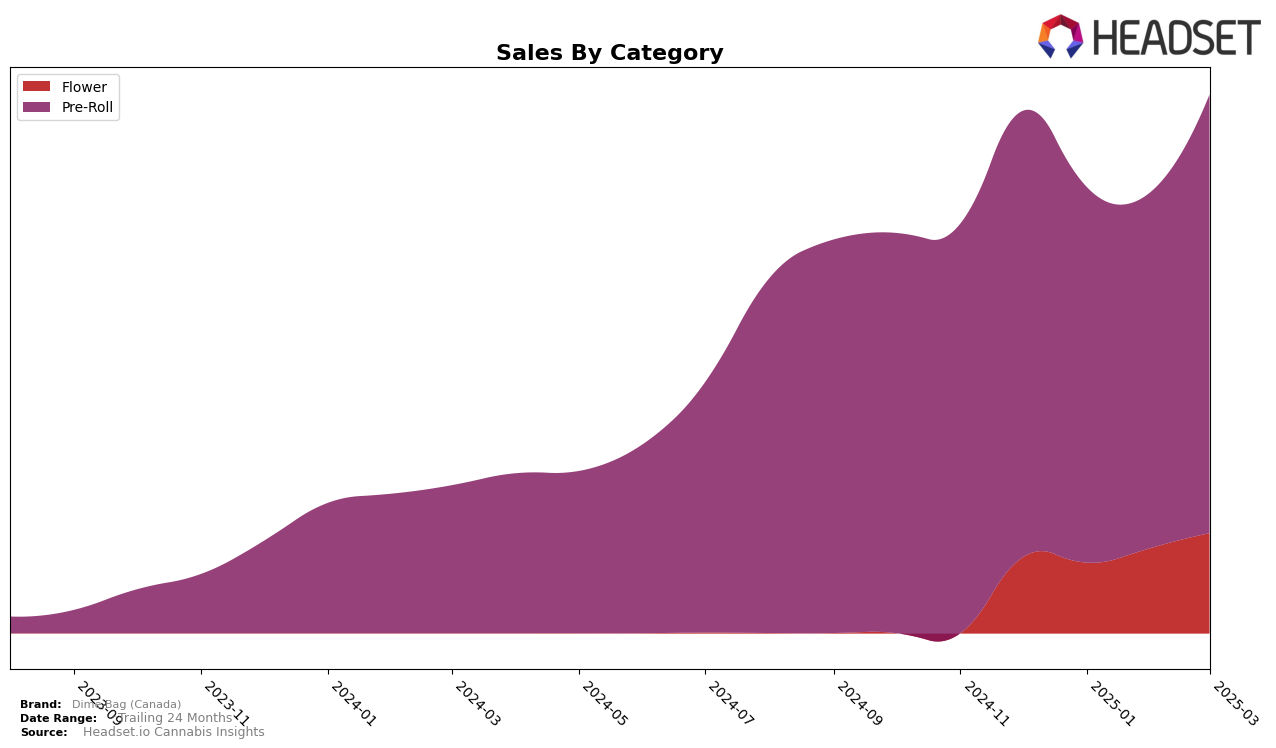

Dime Bag (Canada) has shown varied performance across different Canadian provinces and product categories. In Alberta, the brand's presence in the Pre-Roll category has been relatively unstable, with rankings fluctuating from 72nd in December 2024 to 80th by March 2025. This inconsistency might be a concern, especially since they were not able to break into the top 30, indicating a need for strategic adjustments. Conversely, in British Columbia, Dime Bag (Canada) has made notable strides in the same category, climbing from 76th to 51st over the same period, suggesting a strengthening market presence in that region.

In Ontario, Dime Bag (Canada) has maintained a strong foothold, particularly in the Pre-Roll category, where it consistently holds the 6th position. This stability in a competitive market highlights its solid consumer base and effective market strategies. The Flower category in Ontario also shows positive momentum, moving from 49th to 33rd, indicating growing consumer interest and potential for further growth. This upward trend in Ontario could potentially offset the challenges faced in Alberta, providing a balanced overall performance for the brand across Canada.

Competitive Landscape

In the competitive landscape of the Ontario pre-roll market, Dime Bag (Canada) has maintained a steady rank at 6th place from January to March 2025, following a slight improvement from 7th place in December 2024. This stability in ranking is noteworthy given the dynamic shifts among competitors. For instance, Claybourne Co. demonstrated significant upward mobility, climbing from 9th in December 2024 to 4th by March 2025, indicating a robust increase in consumer preference or strategic market positioning. Meanwhile, Redecan and Shred experienced slight declines, with Redecan dropping from 4th to 5th and Shred maintaining a 7th place rank since January 2025. These shifts suggest that while Dime Bag (Canada) has managed to hold its ground, there is competitive pressure from brands like Claybourne Co., which could potentially impact Dime Bag's market share if trends continue. This analysis underscores the importance of strategic adjustments to maintain or improve positioning in a competitive market.

Notable Products

In March 2025, Dime Bag (Canada) saw the Diesel Pocket Puffs Pre-Roll 4-Pack (2g) maintain its top position in the Pre-Roll category, with impressive sales of 63,492 units. The Tropical Pocket Puffs Pre-Roll 4-Pack (2g) also held steady in second place, showing a notable increase in sales compared to previous months. The Sweet Pocket Puffs Pre-Roll 4-Pack (2g) remained in third place, while the Funky Pocket Puffs Pre-Roll 4-Pack (2g) climbed slightly to secure the fourth position. Meanwhile, the Spicy Pocket Puffs Pre-Roll 4-Pack (2g) rounded out the top five, although its sales figures dipped slightly from earlier in the year. Overall, the rankings have remained largely consistent, with only minor shifts in sales performance among the top products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.