Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

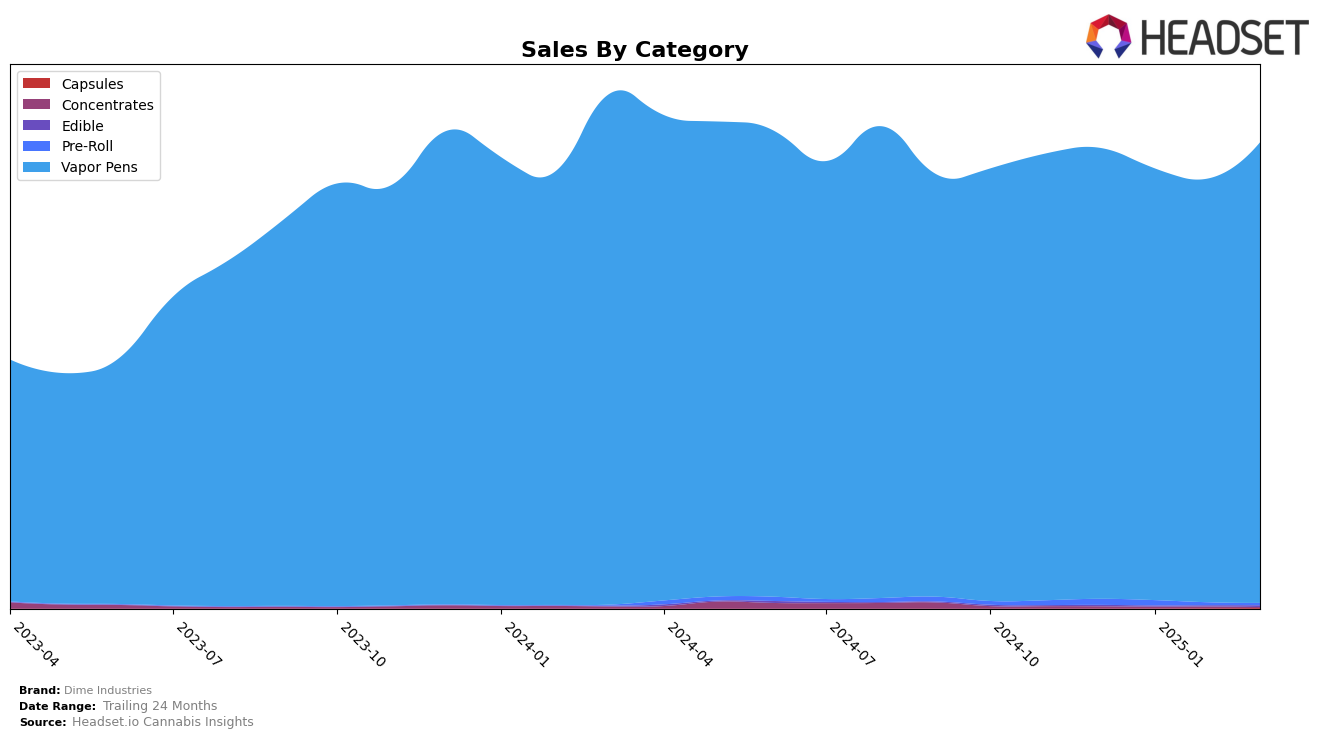

Dime Industries has shown varied performance across different states in the Vapor Pens category. In Arizona, the brand has maintained a strong presence, consistently ranking within the top 6 positions from December 2024 to March 2025, although there is a noticeable downward trend in sales figures over the months. In contrast, California has seen Dime Industries hold steady in the 11th to 12th positions, with a notable sales increase in March 2025, suggesting a potential resurgence. Meanwhile, in Massachusetts, Dime Industries has been unable to break into the top 30, indicating a challenging market presence there.

In Nevada, Dime Industries experienced a fluctuation, with the brand falling out of the top 30 in February 2025, only to rebound to 18th place by March. This suggests a volatile market position that could benefit from strategic adjustments. On a more positive note, New York has shown promising growth for Dime Industries, with a consistent climb in rankings from 28th in December 2024 to 23rd by March 2025, accompanied by a strong upward trend in sales. This indicates a strengthening foothold in the New York market, which could be a key area for future growth and investment.

Competitive Landscape

In the competitive landscape of vapor pens in California, Dime Industries has shown consistent performance, maintaining its rank at 11th place in both February and March 2025, an improvement from its 12th place in December 2024 and January 2025. This steady climb suggests a positive reception of their products amidst a competitive market. Notably, Rove and Cold Fire have consistently outperformed Dime Industries, holding ranks within the top 10, indicating a strong brand presence and possibly higher sales figures. Meanwhile, Jeeter and Dabwoods Premium Cannabis have fluctuated in ranks, with Jeeter moving between 11th and 14th place and Dabwoods Premium Cannabis showing a similar pattern. This fluctuation among competitors highlights the dynamic nature of the market, where Dime Industries' stable rank could be seen as a strategic advantage, suggesting a loyal customer base and effective market strategies.

Notable Products

In March 2025, the top-performing product for Dime Industries was the Signature Line - Berry White Distillate Disposable (1g) in the Vapor Pens category, reclaiming the number one rank with sales of 5905 units. Watermelon Kush Distillate Disposable (1g) made a notable entry at the second position, while Signature Line - Banana Punch Distillate Disposable (1g) slipped to third place from its previous top rank in January and February. The Signature Line- Blueberry Lemon Haze Distillate Cartridge (1g) improved its position to fourth, up from fifth in February. Lastly, Signature Line- Cantaloupe Dream Distillate Disposable (1g) experienced a decline, falling to fifth place from its earlier lead in December. These shifts indicate dynamic changes in consumer preferences within the Vapor Pens category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.