Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

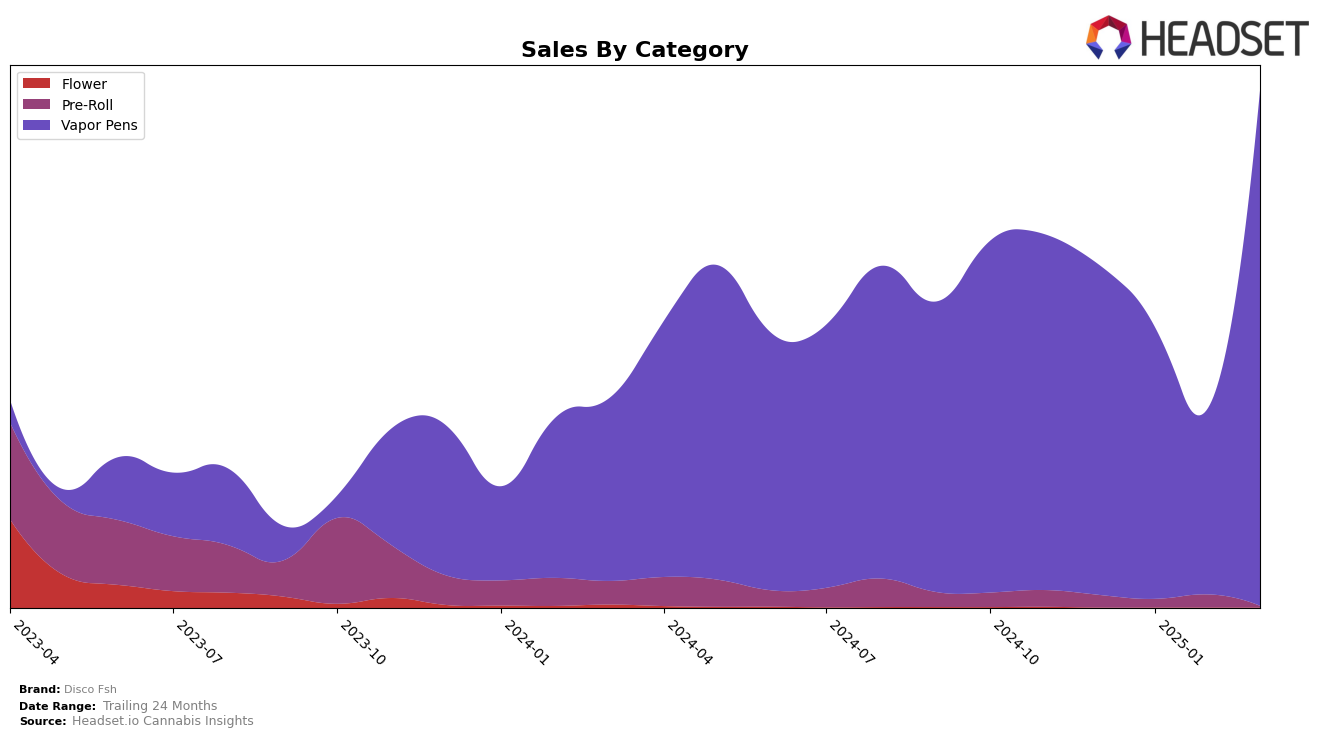

Disco Fsh has shown notable fluctuations in its performance across different Canadian provinces, particularly in the Vapor Pens category. In Alberta, the brand's ranking has been consistently outside the top 30, with a slight upward movement from 38th in December 2024 to 33rd by March 2025. This improvement suggests a positive trend, although the brand is still striving to break into the top 30. Meanwhile, in British Columbia, Disco Fsh's rankings were absent for December 2024 and February 2025, indicating that the brand did not make it into the top 30 during those months. However, it managed to secure the 58th position in January 2025 and improved slightly to 57th in March 2025, hinting at some traction in this market.

In Ontario, Disco Fsh's presence in the Vapor Pens category has been less stable, with the brand ranking 88th in both December 2024 and January 2025, before disappearing from the top 100 in February and re-emerging at 99th in March 2025. This volatility reflects challenges in maintaining a steady market position. Conversely, in Saskatchewan, Disco Fsh made a significant leap by entering the top 30, attaining the 12th position by March 2025, a remarkable achievement given the absence of prior rankings. This suggests a strong market acceptance and potential growth opportunity in Saskatchewan, contrasting with the mixed performance in other provinces.

Competitive Landscape

In the competitive landscape of vapor pens in Saskatchewan, Disco Fsh has made a notable entry by securing the 12th rank in March 2025, despite not being in the top 20 in the preceding months. This marks a significant breakthrough for Disco Fsh, especially when compared to established competitors like Jonny Chronic, which saw a decline from 8th to 13th place over the same period. Meanwhile, DEBUNK maintained a relatively stable position, fluctuating between 7th and 9th place. Adults Only showed an upward trend, climbing from 18th to 11th, while Trippy Sips remained consistent around the 12th to 14th ranks. This competitive shift suggests that Disco Fsh's market entry strategy may be effectively capturing consumer interest, potentially impacting the sales dynamics among existing brands.

Notable Products

In March 2025, Slaughtermelon Distillate Cartridge (1g) emerged as the top-performing product for Disco Fsh, achieving the number one rank with sales of 2049 units. Following closely, Tangerina Cantina Co2 Cartridge (1g) and Kiwi Island Crush CO2 Cartridge (1g) secured the second and third positions, respectively. Notably, Gucci - Juicy Fruit & Sour Green Apple Distillate Dual Chamber Disposable 2-Pack (1.2g), which held the top rank from December 2024 through February 2025, dropped to fourth place. Meanwhile, Orange Crush & Blue Ice Raspberry Distillate Dual Chamber Disposable 2-Pack (1.2g) slipped from its previous high ranks to fifth position. This shift in rankings indicates a significant change in consumer preference towards single cartridge products over dual chamber disposables.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.