Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

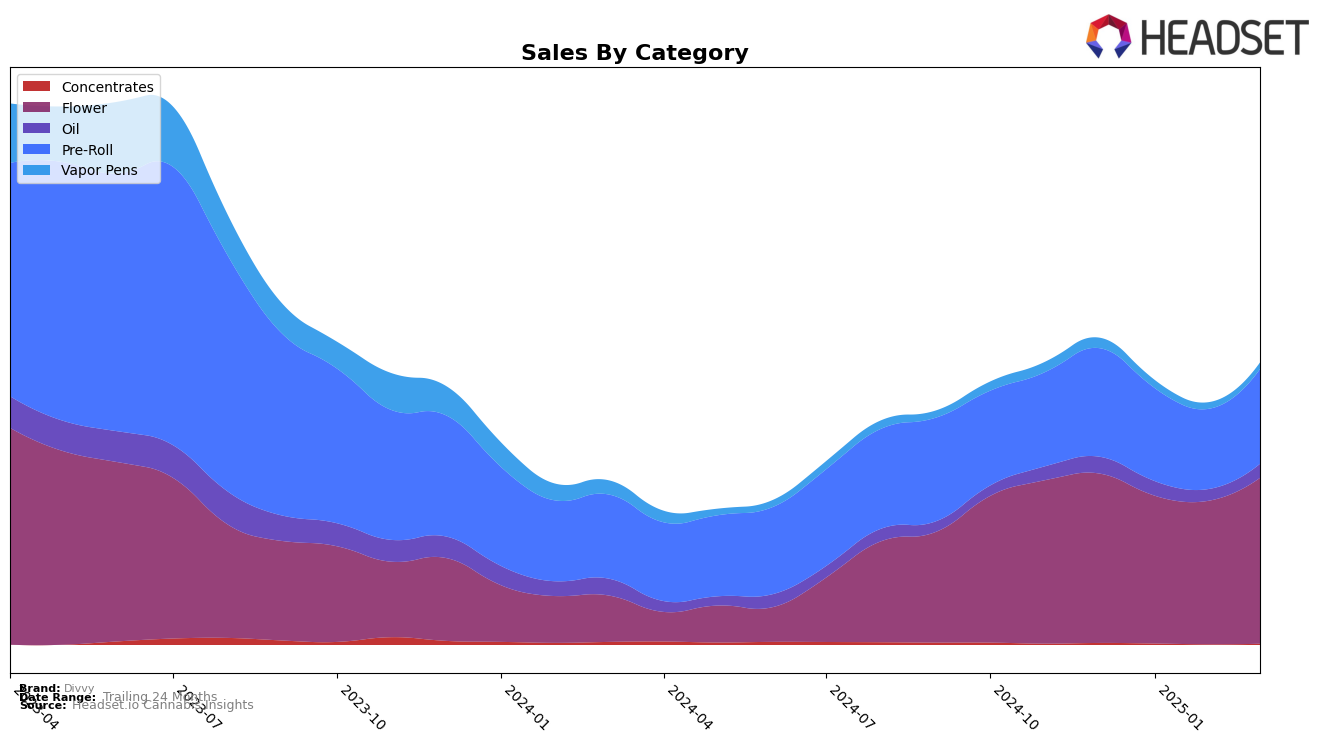

Divvy has demonstrated notable performance across various categories and provinces, with significant movements particularly in the Alberta market. In the Flower category, Divvy saw a remarkable rise from 29th place in December 2024 to 14th in January 2025, maintaining a strong position through March. This upward trend in Alberta is complemented by stable rankings in the Oil category, where Divvy consistently held a top 10 position. However, the Pre-Roll category in Alberta shows room for improvement, with rankings fluctuating outside the top 50 and reaching as high as 64th in March. The performance in British Columbia for Pre-Rolls was less stable, with Divvy missing the top 30 in February, indicating potential challenges in market penetration or competition.

In Ontario, Divvy's Flower category maintained a steady improvement, moving from 26th to 23rd place by March 2025. This consistency suggests a strong foothold in the Ontario market, despite the overall sales figures showing a slight decline from December to January. The Pre-Roll category in Ontario also reflected a positive trajectory, with Divvy climbing from 26th to 24th place by March. However, the Vapor Pens category remained a challenge, with Divvy unable to break into the top 70 consistently, indicating potential areas for strategic focus. Meanwhile, in Saskatchewan, Divvy's Flower category experienced a notable comeback, jumping to 12th place in March after a dip in February, hinting at a recovery or successful market strategy implementation.

Competitive Landscape

In the competitive landscape of the Flower category in Ontario, Divvy has shown a steady improvement in its ranking, moving from 26th in December 2024 to 23rd by March 2025. This upward trend indicates a positive reception and growing market presence, despite a dip in sales from December to January. In comparison, Tribal has experienced a decline in rank, dropping from 19th to 21st over the same period, which could signal an opportunity for Divvy to capture some of Tribal's market share. Meanwhile, Holy Mountain has maintained a relatively stable position around the 22nd rank, suggesting a consistent performance that Divvy might aim to surpass. VOLO has seen fluctuating ranks, ending at 24th in March, just behind Divvy, which underscores the competitive nature of this market segment. As Divvy continues to climb the ranks, it positions itself as a formidable player against these competitors, potentially leveraging its momentum to further enhance its market share.

Notable Products

In March 2025, the top-performing product from Divvy was the CBD Black Widow Pre-Roll 12-Pack, which climbed to the number one position with sales reaching 6282. Following closely was Blueberry, a Flower category product, which held the second rank, maintaining its strong performance from previous months. The Pineapple Nuken Pre-Roll 12-Pack consistently held the third position, showing stable demand. Roll Up Sativa Pre-Roll saw a drop to fourth place after leading in January 2025. Sour Kush, a new entrant in the rankings, secured the fifth position, indicating a growing interest in this Flower category product.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.