Jul-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

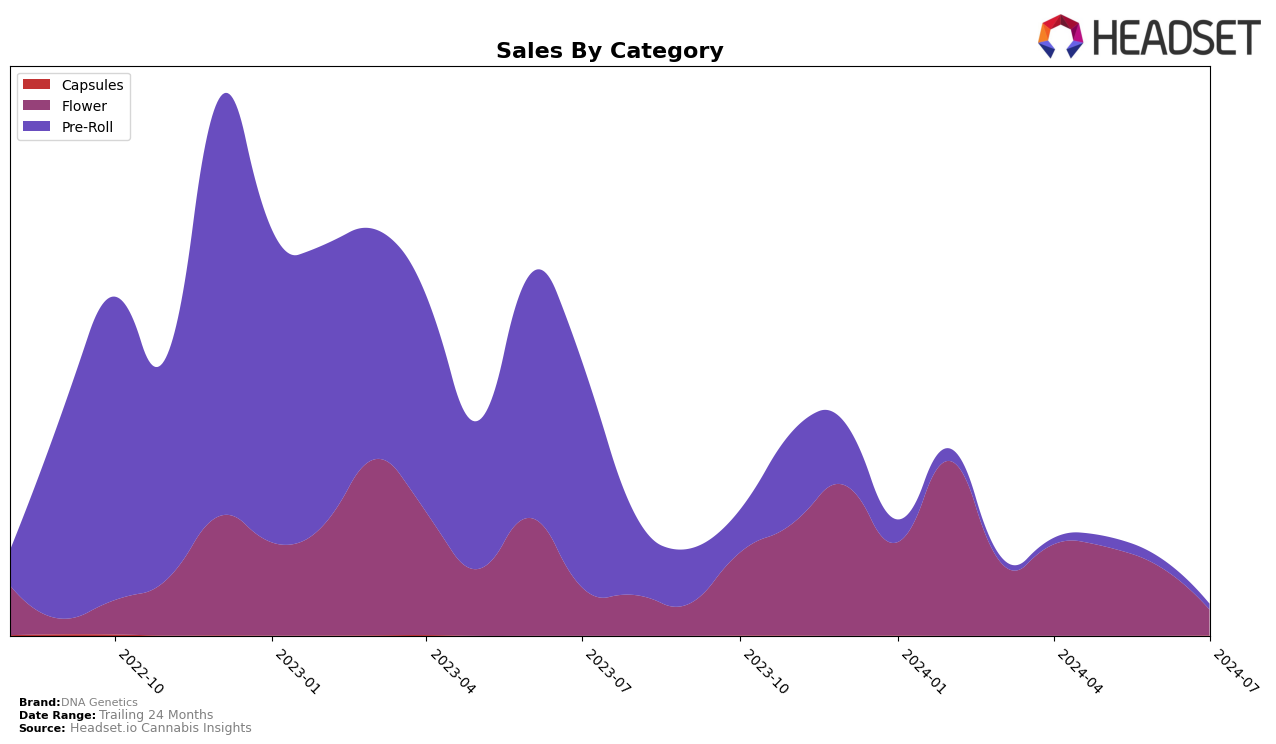

DNA Genetics has shown varied performance across different states and categories over recent months. In Nevada, the brand's ranking in the Flower category has been relatively stable, remaining at 88th place for both June and July 2024. However, it is important to note that DNA Genetics did not make it into the top 30 brands in Nevada during these months, which could indicate potential challenges in market penetration or consumer preference within this specific state. Despite this, the brand's sales figures in Nevada have seen a slight decline from $25,118 in April 2024 to $20,248 in June 2024, suggesting a need for strategic adjustments to regain momentum.

Across other states, DNA Genetics' performance has not been highlighted in the top 30 rankings, which could be seen as a point of concern or an area of opportunity for growth. The absence of rankings in multiple states may reflect either a highly competitive market or a need for enhanced brand visibility and distribution strategies. Keeping an eye on the brand's movements in these markets will be crucial for understanding its overall market trajectory and potential areas for improvement. For a more detailed analysis of DNA Genetics' performance, further examination of individual state data and category-specific trends would be necessary.

Competitive Landscape

In the highly competitive Nevada flower category, DNA Genetics has experienced fluctuating rankings that reflect a challenging market landscape. Over the period from April to July 2024, DNA Genetics consistently ranked in the lower tiers, with positions of 91, 88, and 88, respectively, before dropping out of the top 20 in July. This contrasts sharply with competitors like Harmony Extracts, which saw a notable improvement from 82 to 67 before also falling out of the top 20, and Verano, which showed a significant upward trend, moving from unranked to 27 by June. The standout performer, however, is &Shine, which maintained a strong presence, ranking 16th in May. These dynamics suggest that while DNA Genetics maintains a steady but lower-tier presence, the brand faces stiff competition from rapidly ascending brands and established players, potentially impacting its market share and sales growth in the long term.

Notable Products

In July 2024, DNA Genetics saw its top-performing product, Challah Bread (3.5g) in the Flower category, rise to the number one spot with notable sales of 129 units. Four Prophets (3.5g), also in the Flower category, secured the second position, showing a significant improvement from previous months. Clementine Pre-Roll (1g) in the Pre-Roll category ranked third, despite a decline in sales from its previous months. Kosher Kush Diamonds & Terp Sauce Infused Pre-Roll 2-Pack (1.4g) moved up to fourth place. Clementine (3.5g), which had consistently ranked first in the preceding months, dropped to fifth place in July 2024.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.