Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

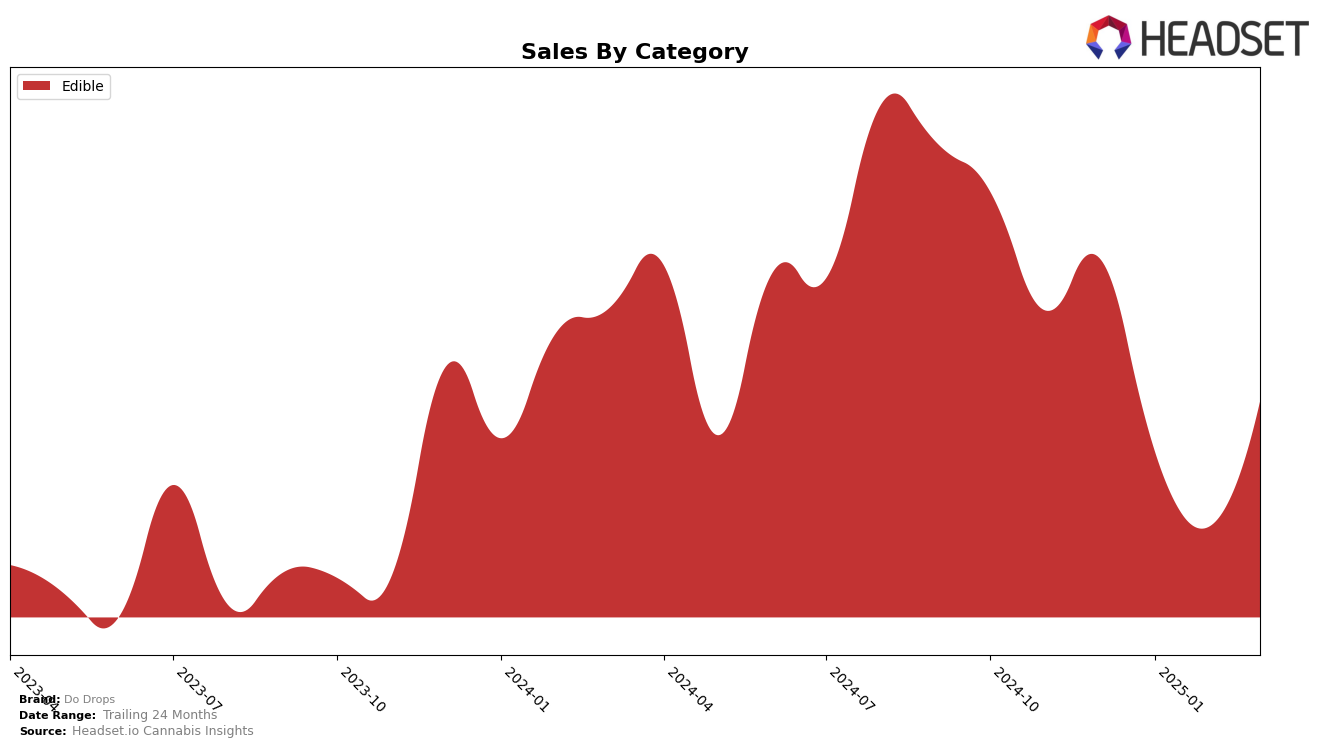

Do Drops has shown varied performance across different states and categories, with notable movements in rankings over the months. In Massachusetts, the brand has not been able to break into the top 30 in the Edible category, maintaining a consistent position just outside the top ranks, with a rank of 45 in both December 2024 and March 2025. This suggests a stable, albeit not leading, presence in the market. On the other hand, in Maryland, Do Drops has performed significantly better, consistently ranking within the top 15 in the Edible category. The brand experienced a slight dip in January and February 2025 but managed to recover to the 13th position by March 2025, indicating a resilient market performance in this state.

Sales trends for Do Drops reveal interesting insights into their market dynamics. While Massachusetts shows a declining trend in sales from December 2024 to March 2025, Maryland presents a more fluctuating pattern. Despite a decrease in sales from December 2024 to February 2025, March 2025 saw a rebound in Maryland, suggesting a potential recovery or successful marketing efforts that month. This contrast in sales trends and rankings between the two states highlights the importance of regional strategies and consumer preferences in the cannabis market. The absence of Do Drops in the top 30 in Massachusetts could be seen as a challenge, while their top 15 presence in Maryland signifies a strong foothold and potential for growth.

Competitive Landscape

In the Maryland edible cannabis market, Do Drops experienced notable fluctuations in its competitive positioning from December 2024 to March 2025. Initially ranked 12th in December, Do Drops saw a decline to 15th place in January and February, before recovering to 13th in March. This pattern suggests a competitive environment where brands are vying closely for market share. Despite the dip in rank, Do Drops managed to increase sales from February to March, indicating a potential rebound in consumer demand. Competitors like Strane and HiColor maintained relatively stable positions, with HiColor consistently outperforming Do Drops in sales. Meanwhile, Dixie Elixirs and AiroPro showed varied performance, with Dixie Elixirs dropping slightly in rank by March. These dynamics highlight the importance for Do Drops to leverage strategic marketing and product differentiation to enhance its market position amidst strong competition.

Notable Products

In March 2025, the top-performing product from Do Drops was the Sleep - CBN/THC 1:1 Slumberberry Gummies 20-Pack, consistently holding the number one spot since December 2024 with sales reaching 3540 units. Pride - Starfruit Gummies 10-Pack maintained its second place from February, showing a steady increase in sales. The Energy - CBD/CBG/THC 2:2:1 Lemon Citrus Gummies 10-Pack secured the third position, recovering from an absence in February. Relief - CBG/THC 4:1 Pineapple Ginger Gummies climbed to fourth place, improving from its third-place debut in February. Relax - CBD/THC 1:1 Peach Gummies 10-Pack remained stable at fifth place, despite a slight drop in sales compared to previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.