Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

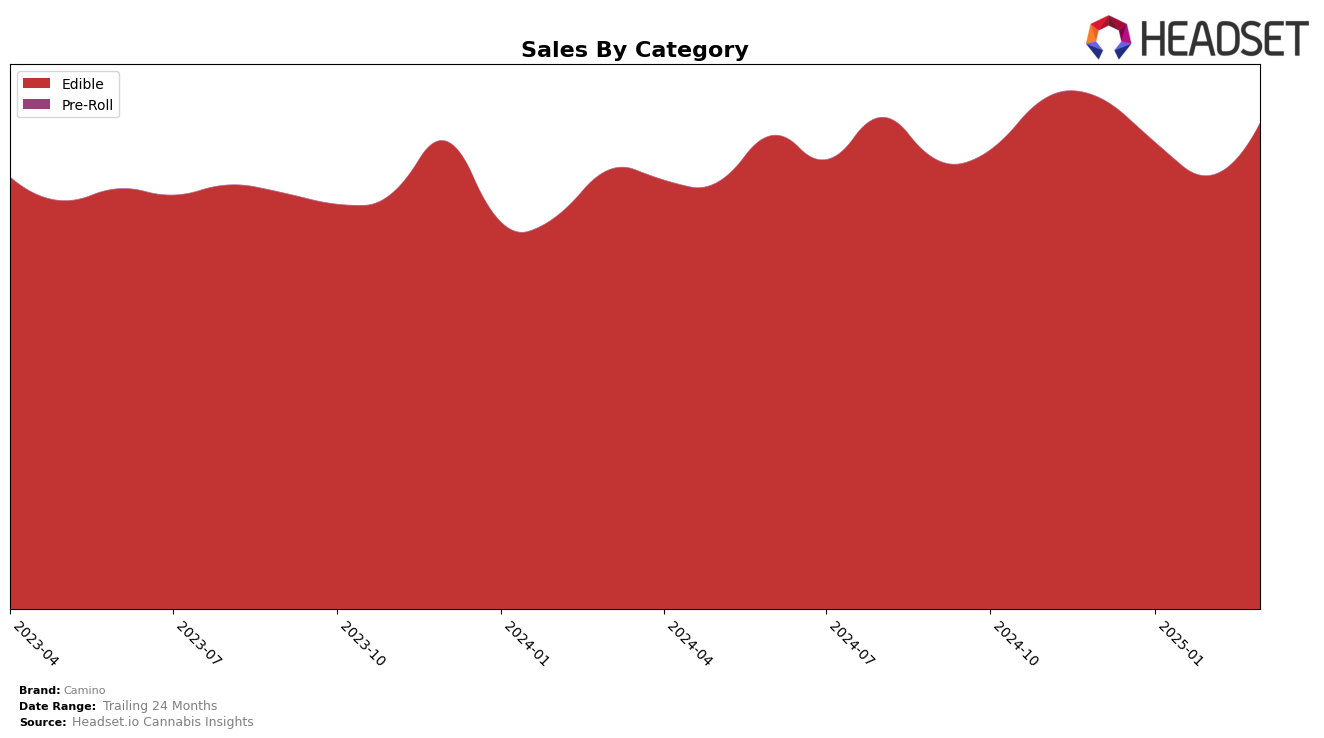

Camino has demonstrated consistent performance in the California edible market, maintaining a strong hold on the number two spot from December 2024 through March 2025. This stability is noteworthy given the competitive nature of the California market. In Massachusetts, Camino has retained the top position in the edible category, although there has been a noticeable decline in sales from December to March. Meanwhile, in Illinois, the brand experienced some fluctuations, dipping to the tenth position in February before rebounding to seventh in March, indicating a potential area for improvement or strategic focus.

In Ohio, Camino has shown positive momentum, climbing from the eighth position in December to fourth by March, suggesting a strengthening brand presence. However, in Missouri, Camino's absence from the rankings post-December could be a point of concern, as it indicates they were not among the top 30 brands in the edible category. Meanwhile, New York has seen Camino holding steady at the second rank, with sales showing a slight uptick in March. The performance in Nevada reflects a positive trend, with the brand moving up one spot to fourth place by March, indicating a solidifying market position.

Competitive Landscape

In the competitive landscape of the California edible cannabis market, Camino consistently holds the second rank from December 2024 through March 2025. Despite a slight dip in sales from December to February, Camino's position remains stable, indicating strong brand loyalty or effective marketing strategies. Wyld maintains its lead as the top-ranked brand, with sales figures consistently higher than Camino's, suggesting a robust market presence. Meanwhile, Kanha / Sunderstorm and Lost Farm hold the third and fourth positions respectively, with sales significantly lower than Camino's, highlighting Camino's competitive edge in the market. The stability in rankings suggests that while Camino faces strong competition, it continues to perform well, maintaining its position as a leading choice for consumers in the California edibles category.

Notable Products

In March 2025, the THC/CBN 5:1 Midnight Blueberry Sleep Gummies 20-Pack maintained its top position as the best-selling product for Camino, with sales reaching 113,249. The Sour Watermelon Lemonade Gummies 20-Pack consistently held the second rank, while the CBD/THC/CBN 1:1:1 Deep Sleep Sour Blackberry Dream Gummies 10-Pack remained in third place. Notably, the Wild Berry Chill Gummies 20-Pack maintained its fourth position, showing a steady performance since January 2025. The THC/CBN 10:3 Sours Blackberry Dream Sleep Gummies 10-Pack, which was introduced into the rankings in February, secured the fifth position in March, indicating a positive reception from consumers.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.