Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

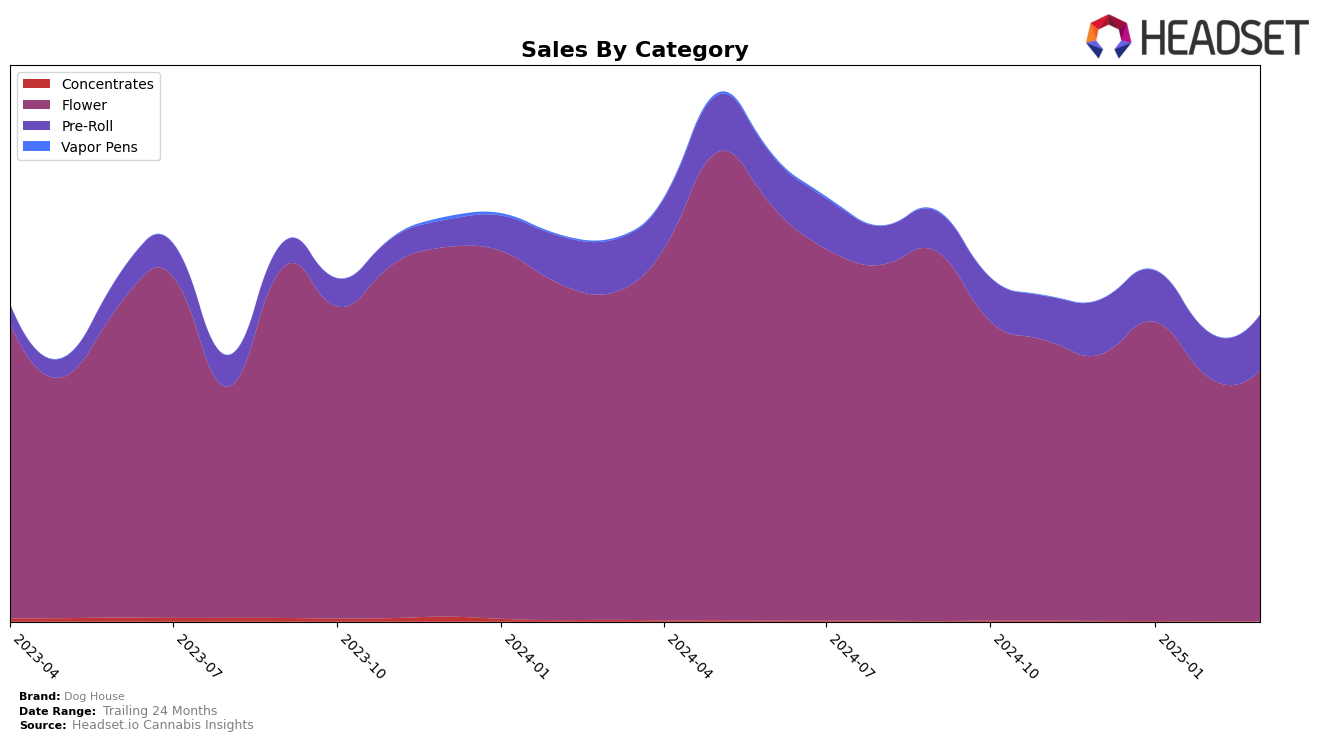

In the state of Michigan, Dog House has shown a mixed performance across its product categories. In the Flower category, the brand experienced a decline in its ranking from 16th in December 2024 to 23rd by March 2025, indicating a potential area of concern. This downward trend in rankings is accompanied by a decrease in sales from $1,465,893 in December 2024 to $1,267,267 in March 2025. Conversely, the Pre-Roll category shows a more positive trajectory, with Dog House improving its ranking from 70th to 58th over the same period. This upward movement suggests a growing consumer interest or improved market strategies in this category, despite not being in the top 30 brands.

In contrast, Oregon presents a more favorable picture for Dog House, especially in the Flower category where it managed to climb from 29th to 17th position by March 2025. This significant improvement is reflected in the sales figures, with a notable increase from $209,315 in December 2024 to $316,000 in March 2025. Meanwhile, in the Pre-Roll category, Dog House has maintained a relatively stable presence, staying within the top 20, although experiencing a slight dip in February before recovering to the 12th position by March. In Washington, however, Dog House's presence in the Flower category remains less prominent, as it did not break into the top 30, maintaining rankings in the 70s range, which could indicate a need for strategic adjustments to enhance market penetration.

Competitive Landscape

In the competitive landscape of the Flower category in Michigan, Dog House has experienced some fluctuations in its market position over the first quarter of 2025. Starting at rank 16 in December 2024, Dog House improved its rank to 13 in January 2025, indicating a positive reception and increased sales momentum. However, by March 2025, Dog House's rank slipped to 23, suggesting a decline in sales or increased competition. Notably, Galactic maintained a strong presence, consistently ranking higher than Dog House, although it too saw a decline from rank 10 in December to 21 in March. Meanwhile, Dubs & Dimes showed resilience, maintaining a close competitive edge with Dog House, ending March at rank 22. Glacier Cannabis and Emerald Mountain Labs (MI) were less consistent, with ranks fluctuating and often trailing behind Dog House, except for Emerald Mountain Labs, which surged to rank 24 in March. These dynamics indicate a competitive market where Dog House must strategize to regain and maintain its earlier momentum.

Notable Products

In March 2025, Gas Face Pre-Roll (1g) reclaimed its top position as the leading product for Dog House, with sales reaching 4084 units. Pink Lady Pre-Roll (1g) closely followed, maintaining its strong performance by rising to the second position from third place in February. Sex Tape (Bulk) made a significant entry into the rankings, securing the third spot with notable sales figures. Bomb Sauce (3.5g), previously ranked second in February, slipped to fourth place. Blue Runtz Pre-Roll (1g), which was the top performer in February, fell to fifth, indicating a shift in consumer preference towards other pre-roll products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.