Oct-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

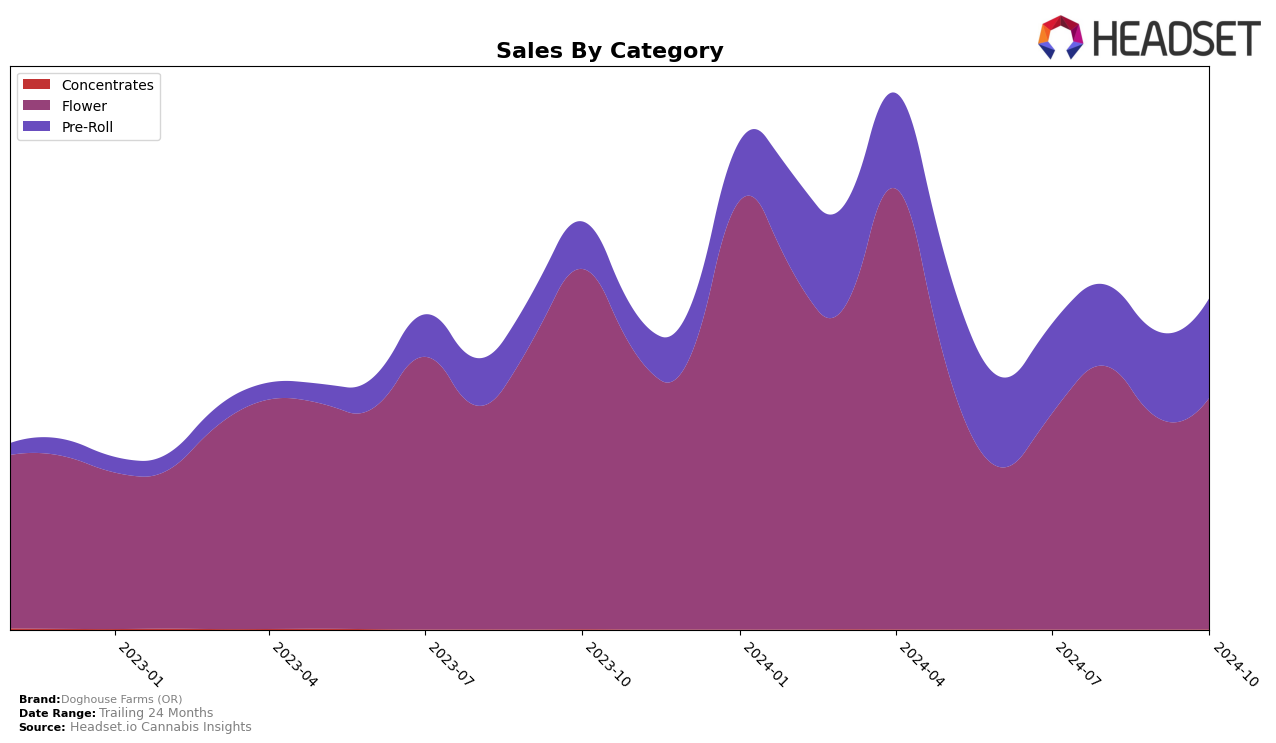

Doghouse Farms (OR) has shown a consistent presence in the Oregon market, particularly in the Flower category. Over the past few months, their ranking has fluctuated slightly, starting at 7th place in July 2024 and moving to 9th place by October 2024. Despite this slight dip in ranking, their sales figures reveal a resilient performance with a notable peak in August. This suggests that while there was a temporary slip in their market position, Doghouse Farms (OR) has managed to maintain a strong foothold in the competitive Flower category in Oregon.

In the Pre-Roll category, Doghouse Farms (OR) has demonstrated an upward trajectory in Oregon. Starting in 17th place in July, they climbed to 12th place by October 2024. This improvement in ranking, coupled with a steady increase in sales from August to October, indicates a growing consumer interest and acceptance in their Pre-Roll offerings. The brand's ability to move up the ranks in this category reflects a strategic focus on enhancing their product appeal and possibly capitalizing on market trends. However, it's important to note that they have not yet broken into the top 10, which remains a future milestone for the brand.

Competitive Landscape

In the competitive landscape of the Oregon flower market, Doghouse Farms (OR) has experienced a slight fluctuation in its ranking from July to October 2024, moving from 7th to 9th place. This shift indicates a dynamic market environment where competitors like Eugreen Farms and Self Made Farm have shown notable upward trends. Eugreen Farms consistently maintained a strong position, ranking 6th in July and improving to 7th by October, while Self Made Farm climbed from 17th to 8th, showcasing a significant increase in market presence and sales. Meanwhile, Oregon Roots exhibited a recovery from a dip in August, regaining its position to rank 11th in October. These movements highlight the competitive pressures Doghouse Farms (OR) faces, emphasizing the need for strategic adjustments to maintain and enhance its market share in the Oregon flower category.

Notable Products

In October 2024, the top-performing product for Doghouse Farms (OR) was Noxious (Bulk) in the Flower category, maintaining its first-place rank from July and September, with a notable sales figure of 30,577. Strawberry Pancakes (Bulk), also in the Flower category, emerged as the second-best seller, marking its debut in the rankings this month. Gelmo (Bulk), another Flower product, took the third spot, also appearing for the first time in the top rankings. Bomb Sauce (Bulk) returned to the fourth position, consistent with its July ranking. Quickies - Noxious Pre-Roll 5-Pack (2.5g) secured the fifth position, showing a strong entry in the Pre-Roll category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.