Oct-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

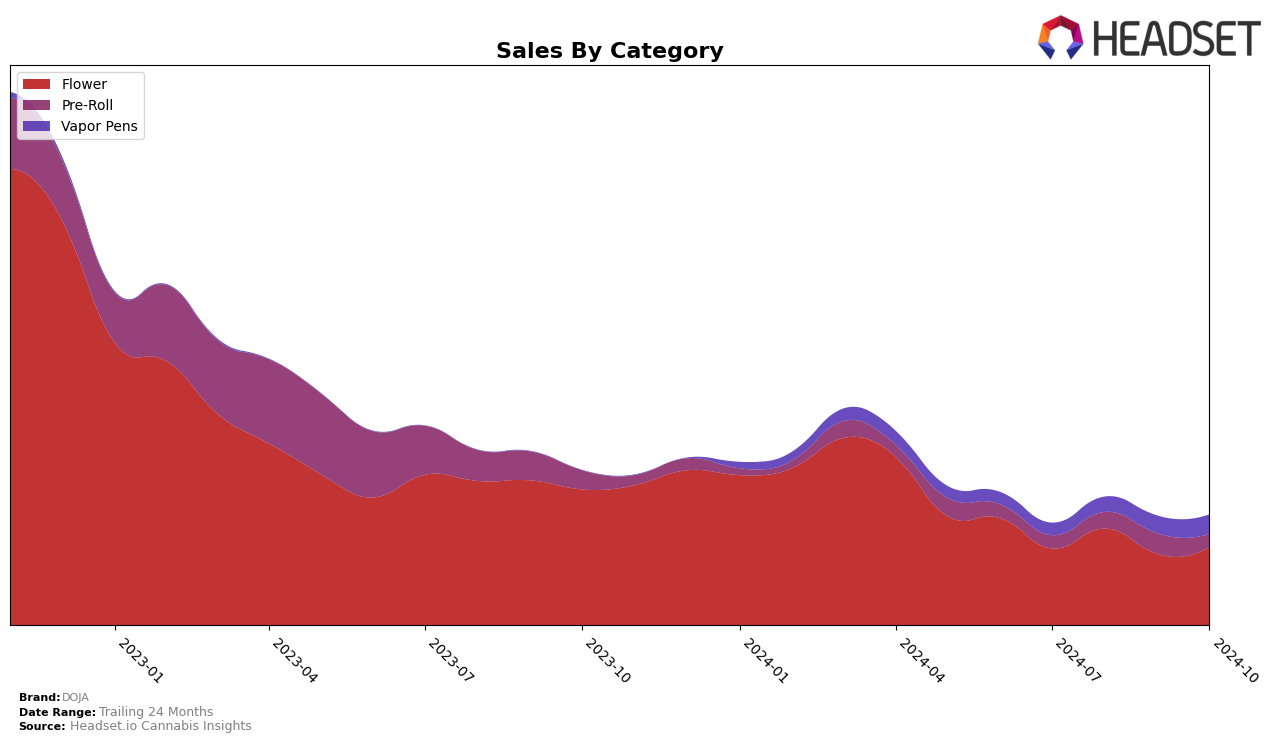

DOJA has shown varied performance across different states and categories in recent months. In Arizona, the brand's presence in the Flower category has been consistent, albeit outside the top 30, maintaining a rank around the low 70s. Despite not breaking into the top tier, there was a slight uptick in sales from August to October, indicating potential for growth. In British Columbia, DOJA's position in the Flower category has fluctuated significantly, dropping from 35th in July to 57th in September before recovering to 50th by October. This volatility suggests challenges in maintaining a steady market position, though the recovery in October is a positive sign. Meanwhile, their Pre-Roll category in British Columbia has not entered the top 30, highlighting an area for potential improvement.

In Saskatchewan, DOJA has demonstrated stronger performance in the Flower category, consistently ranking within the top 30, though experiencing minor fluctuations. This stable ranking, combined with a healthy sales trajectory, suggests a solid foothold in this market. However, the Pre-Roll category presents a mixed picture, with the brand absent from the top 30 in August, but making a notable re-entry by September. In Washington, DOJA's performance in the Vapor Pens category has shown promising improvement, climbing from 98th to 85th over the months. This upward trend in a competitive category like Vapor Pens indicates a positive reception and growing consumer interest in the brand's offerings.

Competitive Landscape

In the competitive landscape of the Flower category in British Columbia, DOJA has experienced notable fluctuations in its market position over the past few months. Despite a dip in sales from July to September, DOJA's October sales showed a recovery, although it remains outside the top 20 brands for this period. In contrast, QWEST has shown a consistent upward trend, surpassing DOJA in both rank and sales by October. Meanwhile, Pistol and Paris maintained a stronger position in the earlier months but saw a decline by October, suggesting potential volatility. BC Green has demonstrated resilience with stable sales, closely rivaling DOJA's performance. Lastly, Potluck has shown a mixed performance, with sales peaking in September before dropping in October, indicating a competitive but fluctuating market environment. These dynamics highlight the competitive pressures DOJA faces and the importance of strategic positioning to regain and sustain its market rank.

Notable Products

In October 2024, Ultra Sour (3.5g) emerged as the top-performing product for DOJA, achieving the number one rank with sales reaching 1933 units. Dream (3.5g) climbed to the second position, showing a significant increase from its previous fourth place in September, with sales rising to 1640 units. Raspberry Sorbet Cured Resin Disposable (1g) maintained its steady performance, holding the third rank consistently from August through October. Okanagan Grown - Ultra Sour Pre-Roll 3-Pack (1.5g) experienced a drop in ranking, moving from the top position in September to fourth in October. Lastly, Tropical Guava Cured Resin Disposable (1g) entered the rankings at fifth place, marking its debut in the top five.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.