Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

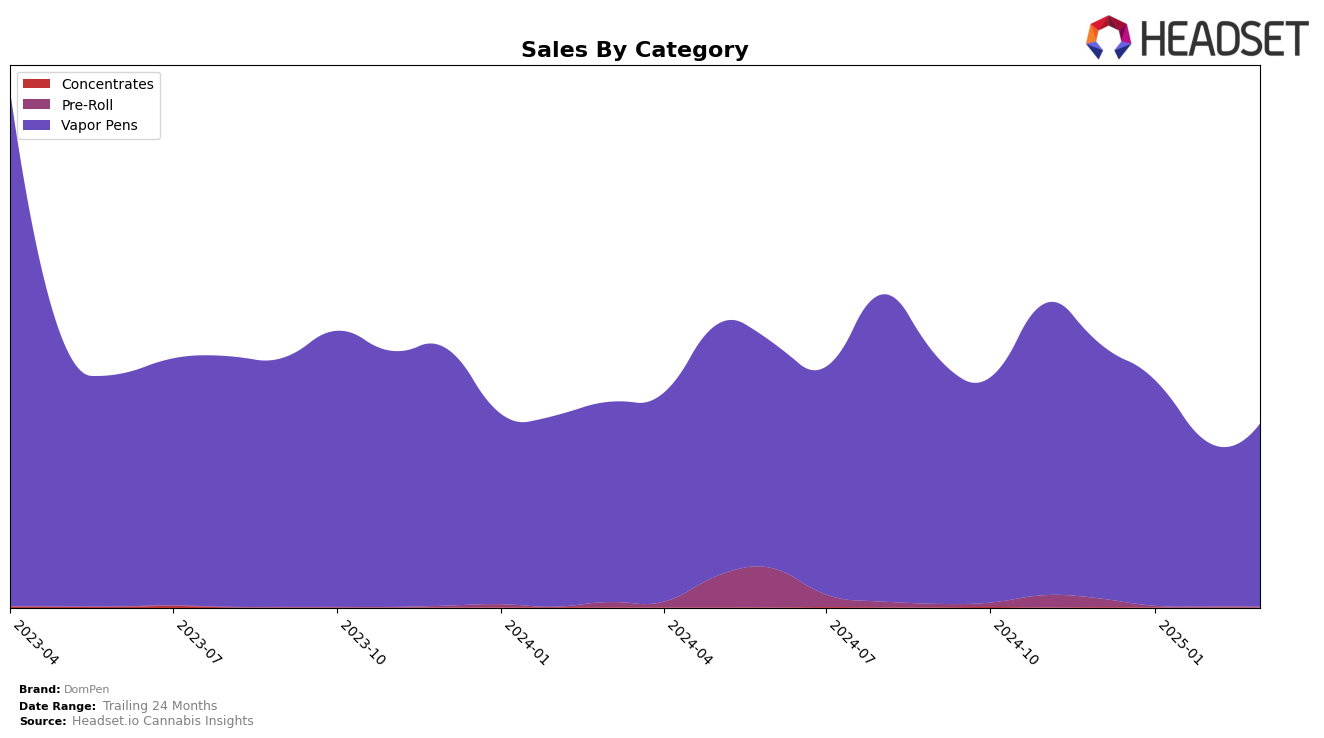

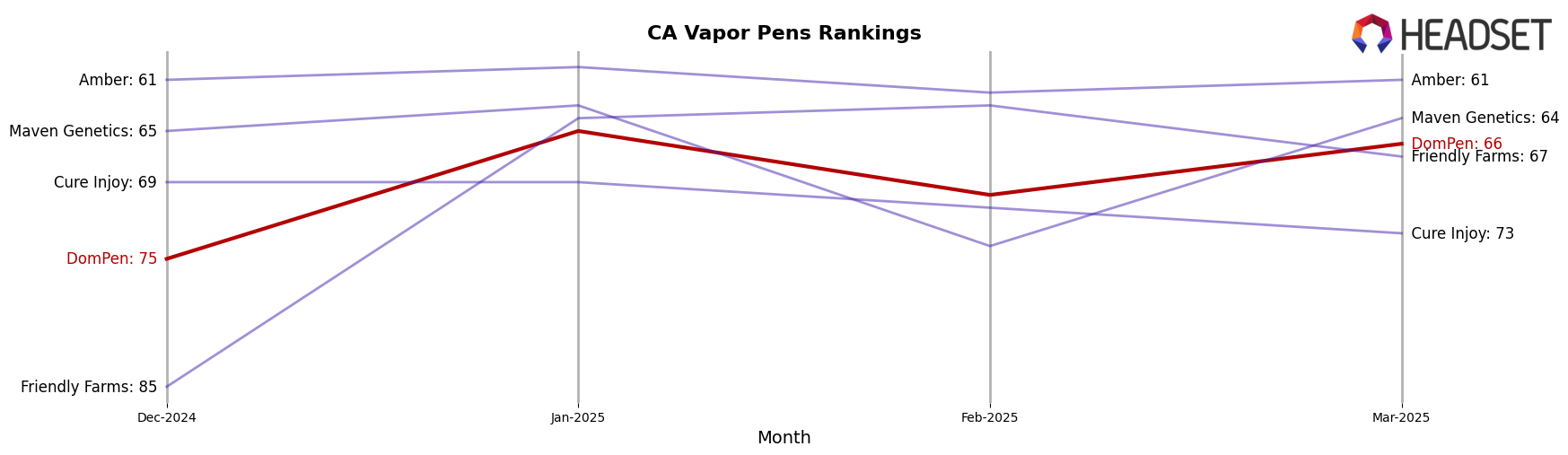

DomPen's performance in the vapor pen category has seen varied results across different states and provinces. In California, DomPen has shown resilience, maintaining a steady presence in the rankings. Although it did not break into the top 30, its rank improved from 75th in December 2024 to 66th by March 2025, reflecting a positive trend despite fluctuations in sales. In contrast, New York has witnessed a decline in DomPen's presence, with its ranking slipping from 51st in December 2024 to 64th in March 2025. This indicates a challenging market environment or increased competition in the region.

Meanwhile, DomPen's entry into Saskatchewan has been noteworthy. Despite not being ranked in January and February 2025, the brand made a significant leap to 30th place by March 2025. This suggests a successful market penetration strategy or an increased consumer interest in the region. In Ohio, DomPen has maintained a consistent ranking, staying around the 50th position throughout the months, which could indicate stable demand but also potential room for growth. However, in Michigan, DomPen's absence from the top 30 rankings in early 2025 suggests challenges in gaining a foothold in this competitive market.

Competitive Landscape

In the competitive landscape of vapor pens in California, DomPen has shown a consistent presence, although it faces stiff competition from several notable brands. Over the months from December 2024 to March 2025, DomPen's rank has fluctuated slightly, moving from 75th to 66th. This indicates a slight improvement, yet it remains behind competitors such as Amber, which consistently ranks higher, maintaining a stable position around the 60th mark. Meanwhile, Friendly Farms has shown significant volatility, with a notable surge in January 2025, surpassing DomPen. Similarly, Maven Genetics has also outperformed DomPen, except for a dip in February 2025. Cure Injoy, although missing from the top 20 in February, has shown resilience by reappearing in March. These dynamics suggest that while DomPen is holding its ground, it faces strong competition from brands that are either maintaining or improving their market positions, indicating a need for strategic adjustments to enhance its competitive edge in the California vapor pen market.

Notable Products

In March 2025, DomPen's top-performing product was the Midnight Berry Live Resin Disposable (1g) in the Vapor Pens category, maintaining its consistent first-place ranking from previous months with sales of 799 units. The Pineapple Coast Live Resin Disposable (1g) climbed back to the second position, up from fourth in February, showing strong performance with notable sales figures. Lemon Cherry Gelato Live Resin Disposable (1g) held steady in third place, despite a slight decrease in sales. New entrants, California Citrus Distillate Disposable (1g) and CBD/THC 4:1 Honey Citrus Live Resin Disposable (1g), debuted in fourth and fifth positions, respectively, indicating a positive reception in the market. This shift in rankings highlights a dynamic change in consumer preferences within DomPen's Vapor Pens offerings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.