Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

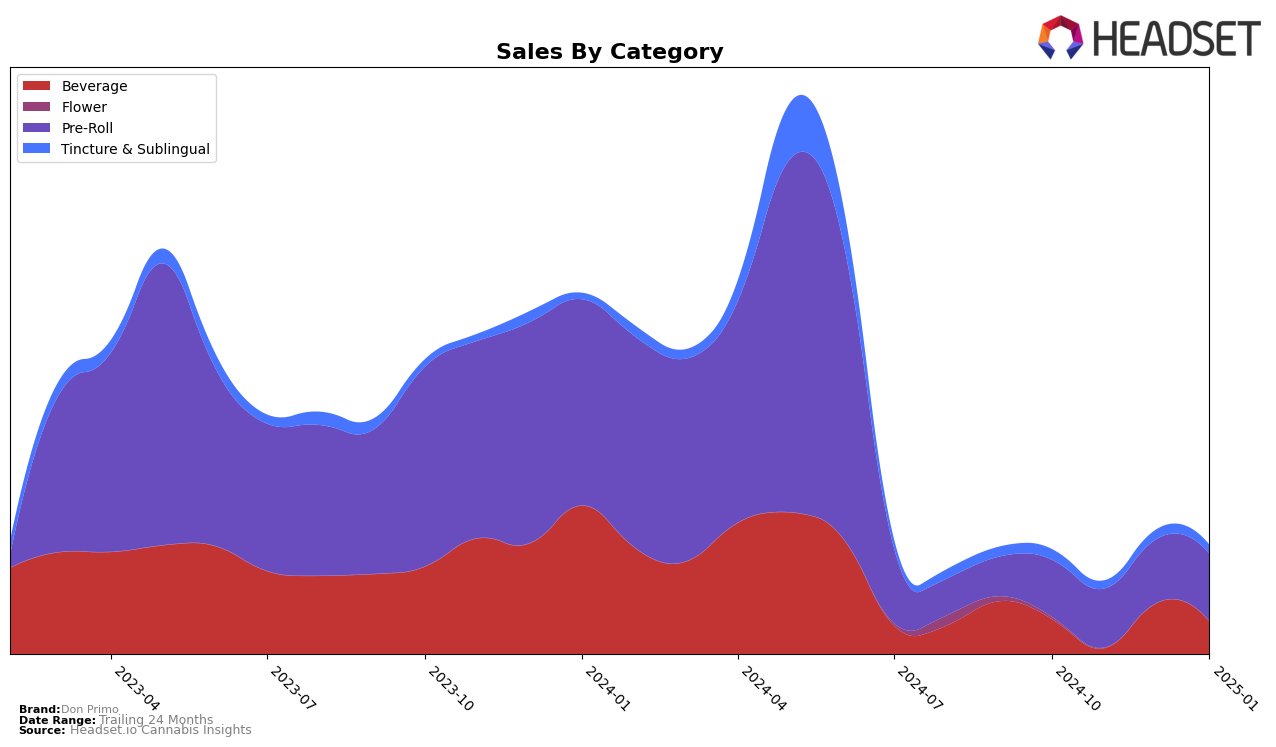

Don Primo has shown a fluctuating performance across different categories and states, particularly in the Beverage category in California. The brand managed to secure the 24th rank in October 2024, dropped out of the top 30 in November, climbed to 21st in December, and returned to 24th in January 2025. This variability suggests a competitive market environment where Don Primo is striving to maintain its position. Notably, the absence from the top 30 in November indicates a potential challenge or shift in consumer preference during that period, which the brand seemed to recover from by the end of the year.

While the specific sales figures for November are not disclosed, the trend suggests a recovery in December with a notable increase in sales, followed by a dip in January. This pattern could imply seasonal factors or promotional efforts that influenced consumer buying behavior. The ability of Don Primo to regain its ranking in December highlights its resilience and potential adaptability in the market. However, the brand's absence from the top 30 in November across other states or categories remains a point of concern and an area worth exploring for further insights into its market dynamics and strategic positioning.

Competitive Landscape

In the competitive landscape of the California cannabis beverage market, Don Primo has experienced fluctuations in its rank and sales over the past few months. In October 2024, Don Primo was ranked 24th, but it dropped out of the top 20 in November, only to climb back to 21st in December before slipping again to 24th in January 2025. This inconsistency in ranking suggests a volatile market presence, potentially influenced by stronger competitors. For instance, Tonik consistently maintained a higher rank, staying within the top 22, with sales figures notably higher than Don Primo's. Meanwhile, Artet showed a promising upward trend in November before disappearing from the top ranks, indicating potential but inconsistent performance. Happy Daze re-entered the rankings in November and January, suggesting a competitive edge during those months. These dynamics highlight the challenges Don Primo faces in maintaining a stable position amidst strong competition, emphasizing the need for strategic marketing and product differentiation to enhance its market share.

Notable Products

In January 2025, the top-performing product for Don Primo was the White Widow Infused Pre-Roll (1.25g) in the Pre-Roll category, maintaining its position as the number one ranked product for four consecutive months with sales of 8808. The Classic Lemonade (100mg) in the Beverage category climbed from fourth place in December 2024 to second place, showcasing a significant increase in demand. Black Cherry Lemonade (100mg THC, 12oz) remained steady in the third position, despite fluctuating sales figures in previous months. Black Widow Infused Pre-Roll (1.25g) saw an improvement, moving from fifth to fourth place, indicating a resurgence in popularity. Meanwhile, Pink Lemonade (100mg) experienced a drop from second to fifth place, reflecting a decline in sales momentum.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.