Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

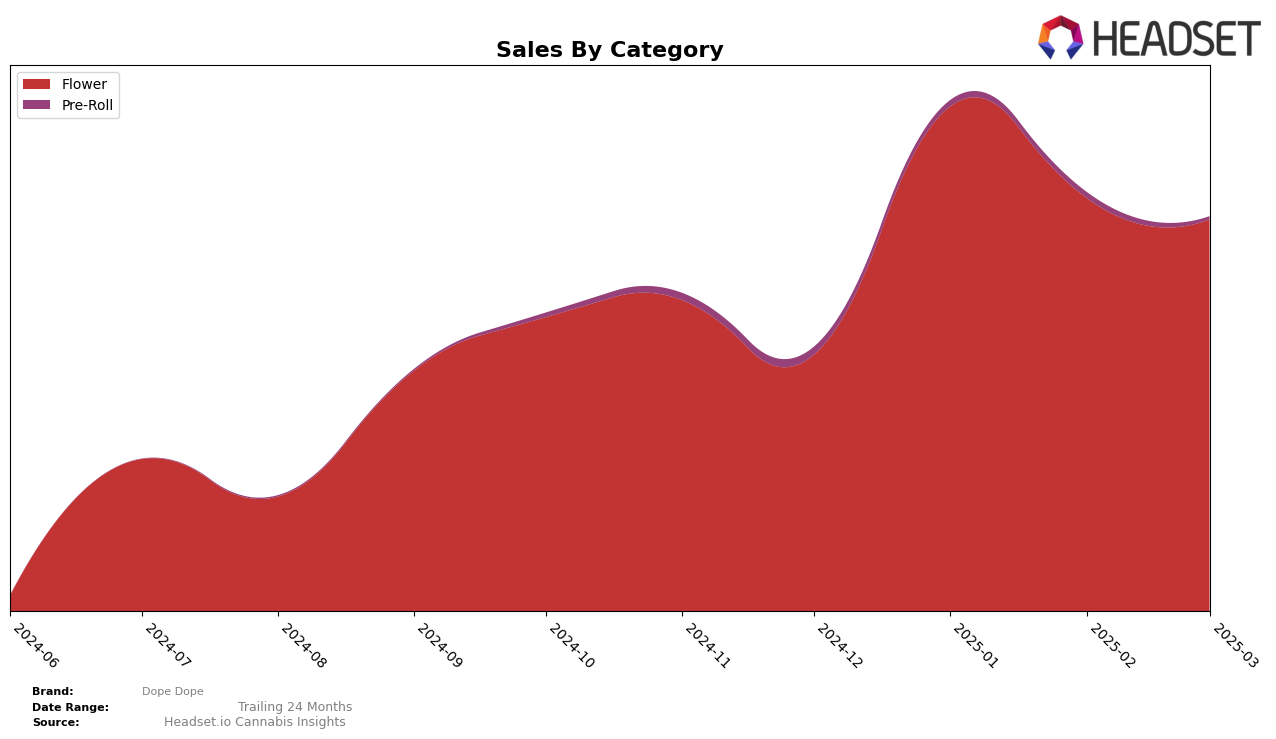

In the Nevada market, Dope Dope has shown a notable upward trajectory in the Flower category. Starting from a rank of 27 in December 2024, the brand climbed to rank 13 by January 2025. This significant leap suggests a strong increase in consumer demand or effective market strategies. Although there was a slight dip to rank 15 in February, the brand managed to improve its position to 14 by March 2025. The initial surge in January could be attributed to seasonal factors or successful promotional campaigns, but further analysis would be necessary to pinpoint the exact causes of this performance.

While Dope Dope's presence in the Nevada Flower category is commendable, the absence of rankings in other categories or states indicates potential areas for growth. The lack of top 30 rankings in other segments might suggest limited product offerings or a need for broader market penetration strategies. Observing how the brand leverages its current momentum in Nevada could provide insights into its future expansion plans. The brand's ability to maintain and improve its standing in the Flower category will be crucial as it seeks to establish a more robust presence across different markets and categories.

Competitive Landscape

In the competitive landscape of the Nevada flower category, Dope Dope has shown a remarkable upward trajectory from December 2024 to March 2025. Initially ranked 27th in December, Dope Dope made a significant leap to 13th place by January 2025, maintaining a strong presence with ranks of 15th and 14th in February and March, respectively. This upward movement in rank is indicative of a robust increase in sales, particularly from December to January, where sales nearly doubled. In contrast, Summa Cannabis experienced fluctuations, dropping out of the top 20 in January before rebounding to 11th place in February. Meanwhile, Grassroots entered the top 20 in January and maintained a steady position around the mid-teens, while Good Green and Firestar displayed more stable rankings with minor shifts. The consistent improvement in Dope Dope's rank and sales performance suggests a growing consumer preference and competitive edge in the Nevada flower market.

Notable Products

In March 2025, Baklava (14g) emerged as the top-performing product for Dope Dope, maintaining its leading position from January 2025 with sales amounting to 824 units. LA Kush Cake (14g) secured the second spot, making a notable entrance into the rankings this month. Orange Daiquiri (7g) climbed to third place, up from an unranked position in previous months, while Runtz (7g) dropped from first place in December 2024 to fourth in March 2025. Grapes and Cream (14g) appeared in the rankings for the first time, closing the top five. This shift in rankings highlights a dynamic change in consumer preferences for Dope Dope's products over the months.

```Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.