Jun-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

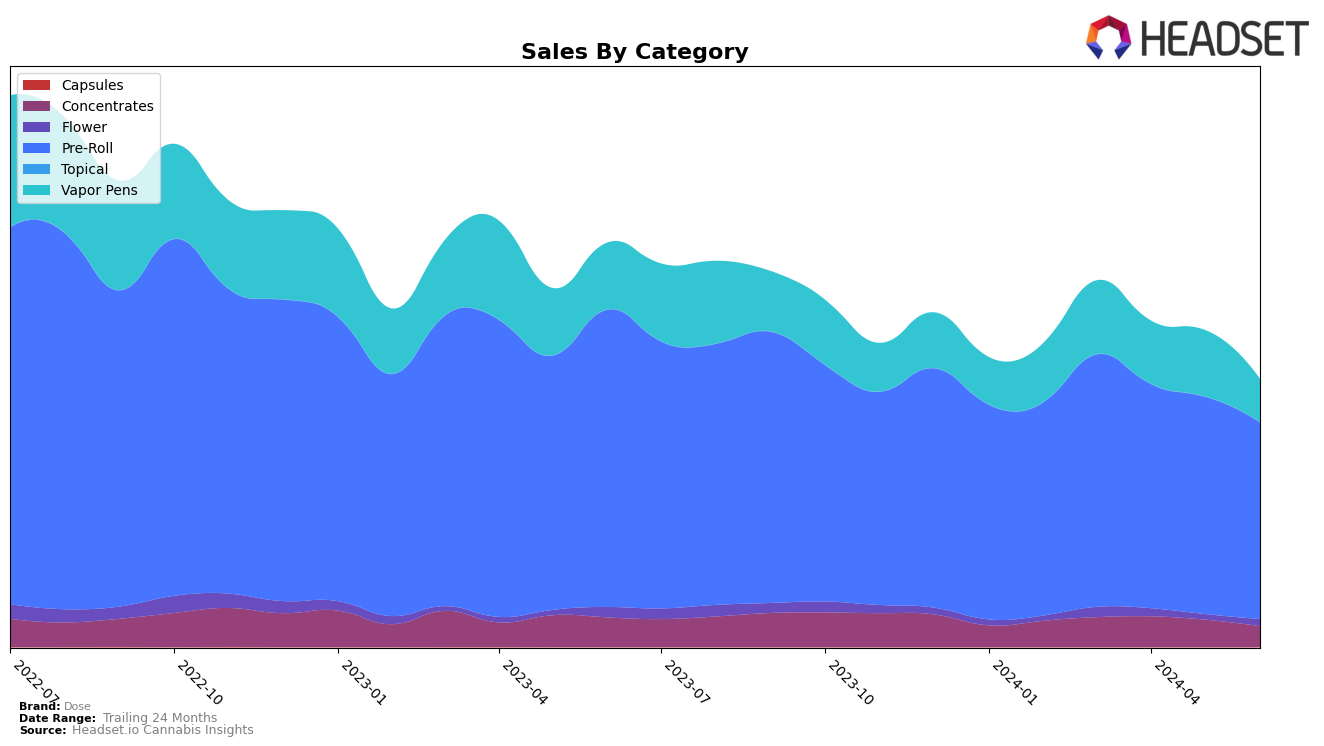

In Washington, Dose has shown varied performance across different categories. In the Concentrates category, Dose did not make it into the top 30 brands for the months of March through June, indicating a weaker performance in this segment. Despite a slight improvement in April, where they moved up to 65th place, the overall trend has been downward, ending at 76th place in June. This suggests that Dose might need to reconsider its strategy for Concentrates in Washington. On the other hand, the Pre-Roll category has been relatively stable for Dose, maintaining a position within the top 30 brands. Although there was a gradual decline from 18th place in March to 22nd place in June, Dose still holds a strong position in this category, which could be a key area for continued focus and improvement.

The Vapor Pens category presents a mixed bag for Dose in Washington. Starting at 72nd place in March, there was a slight dip in April to 76th place, followed by a brief recovery to 72nd place in May. However, June saw a significant drop to 88th place, indicating challenges in maintaining a competitive edge in this category. The sales figures reflect this volatility, with a notable decrease from 68,001 in March to 39,701 in June. This trend suggests that Dose may need to innovate or adjust its marketing strategies to regain traction in the Vapor Pens market. Overall, while Dose has some strongholds, particularly in the Pre-Roll category, there are clear areas for improvement to enhance their market presence in Washington.

Competitive Landscape

In the competitive landscape of the Washington pre-roll category, Dose has experienced notable fluctuations in its rank and sales over the past few months. From March to June 2024, Dose's rank shifted from 18th to 22nd, indicating a downward trend. This decline in rank is mirrored by a decrease in sales, from $232,944 in March to $181,565 in June. In contrast, Green Haven has shown resilience, maintaining a relatively stable position around the 20th rank, with sales rebounding to $204,573 in June after a dip in May. Meanwhile, Equinox Gardens has seen a positive trajectory, climbing from 30th to 21st place, accompanied by a steady increase in sales, reaching $201,151 in June. Brands like Fire Bros. and Bacon Buds have also shown upward movement in ranks, suggesting a competitive pressure that Dose needs to address to regain its standing in the market.

Notable Products

In June 2024, Dose's top-performing product was Jack Herer Infused Pre-Roll (1g) in the Pre-Roll category, which achieved the highest sales figure of 1781 units. Orange Soda Infused Pre-Roll (1g) climbed to the second position with notable sales of 1591 units, showing a significant increase from its fifth position in May. Blueberry Donut Infused Pre-Roll (1g) secured the third spot, followed by Strawnana Infused Pre-Roll (1g) in fourth place. King Louis XIII Infused Pre-Roll (1g) dropped slightly to fifth place, despite a steady increase in sales over the months from April to June. Overall, the rankings saw some shifts, particularly with Orange Soda Infused Pre-Roll (1g) making a remarkable leap from fifth to second place within a month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.