Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

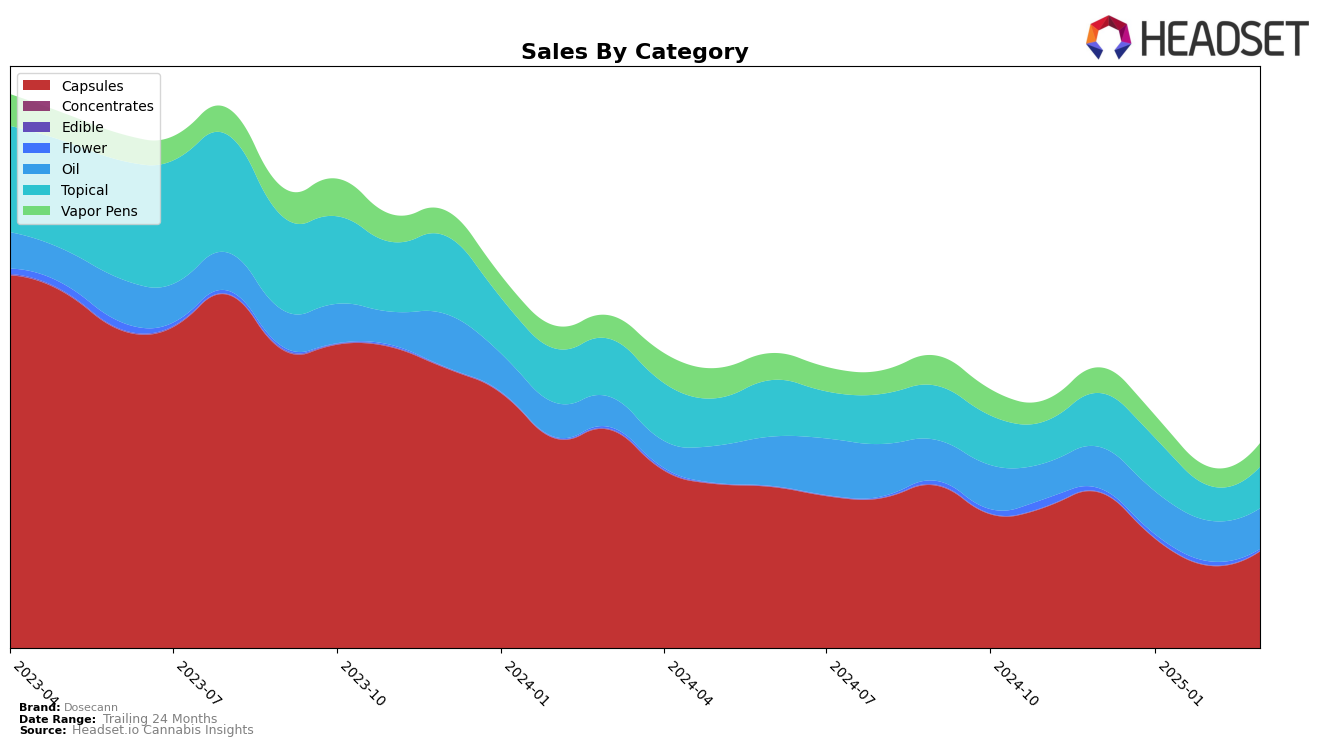

In the competitive landscape of cannabis products, Dosecann has shown varied performance across different categories and provinces. In Alberta, Dosecann maintained a steady presence in the Capsules category, ranking 9th in December 2024 and March 2025, albeit with a dip to 10th place in January and February. Meanwhile, their Oil products consistently held the 8th position throughout the same period, indicating a stable demand. Notably, the sales figures for Oil in Alberta exhibited resilience, with a slight increase in January 2025 compared to December 2024, suggesting a positive reception among consumers.

Across the border in British Columbia, Dosecann's Capsules saw an improvement in March 2025, climbing to 5th place from 7th in February, which might reflect a growing consumer preference. In the Topicals category, Dosecann experienced a minor setback, dropping from 4th to 5th place between January and March 2025. Meanwhile, in Ontario, Dosecann's Capsules showed a rebound in March 2025, moving up to 8th place from 9th in the previous two months. However, the Vapor Pens category presents a challenge, as Dosecann did not break into the top 30, indicating an area for potential growth. In Saskatchewan, Dosecann's Capsules were ranked 4th in December 2024, but the absence of data for subsequent months suggests a decline in visibility or market presence in this category.

Competitive Landscape

In the competitive landscape of the capsules category in Ontario, Dosecann has experienced fluctuations in its market position, reflecting both challenges and opportunities. From December 2024 to March 2025, Dosecann's rank shifted from 7th to 8th, indicating a slight decline in its competitive standing. This change is notable when compared to Indiva, which maintained a steady 6th position throughout the same period, suggesting a more stable market presence. Meanwhile, Decimal showed an upward trajectory, moving from 9th to 7th, potentially capturing market share from Dosecann. Stigma Grow also presents a competitive threat, as it closely follows Dosecann, ending March 2025 at 9th place. Despite these challenges, Dosecann's slight improvement from February to March 2025, moving from 9th to 8th, indicates a potential recovery in sales momentum. This dynamic market environment underscores the importance for Dosecann to leverage advanced data analytics to strategize effectively and regain a stronger foothold in the Ontario capsules market.

Notable Products

In March 2025, the top-performing product from Dosecann was CBD 50 Capsules 30-Pack (1500mg CBD) in the Capsules category, maintaining its first-place rank since December 2024 with sales of 1944 units. CBD Oil (30ml) held steady in second place, consistent with its rank from January and February 2025. The CBD/THC Daily Relief Cream (1200mg CBD, 40mg THC, 60ml) remained in third place as it did in the previous two months, showing a slight recovery in sales from February. CBD Capsules 30-Pack (750mg CBD) reappeared in the rankings at fourth place after not being listed in February. The Indica Blackberry Cream Distillate Disposable Pen (0.3g) consistently held the fifth position since January 2025, indicating stable demand within its category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.