Apr-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

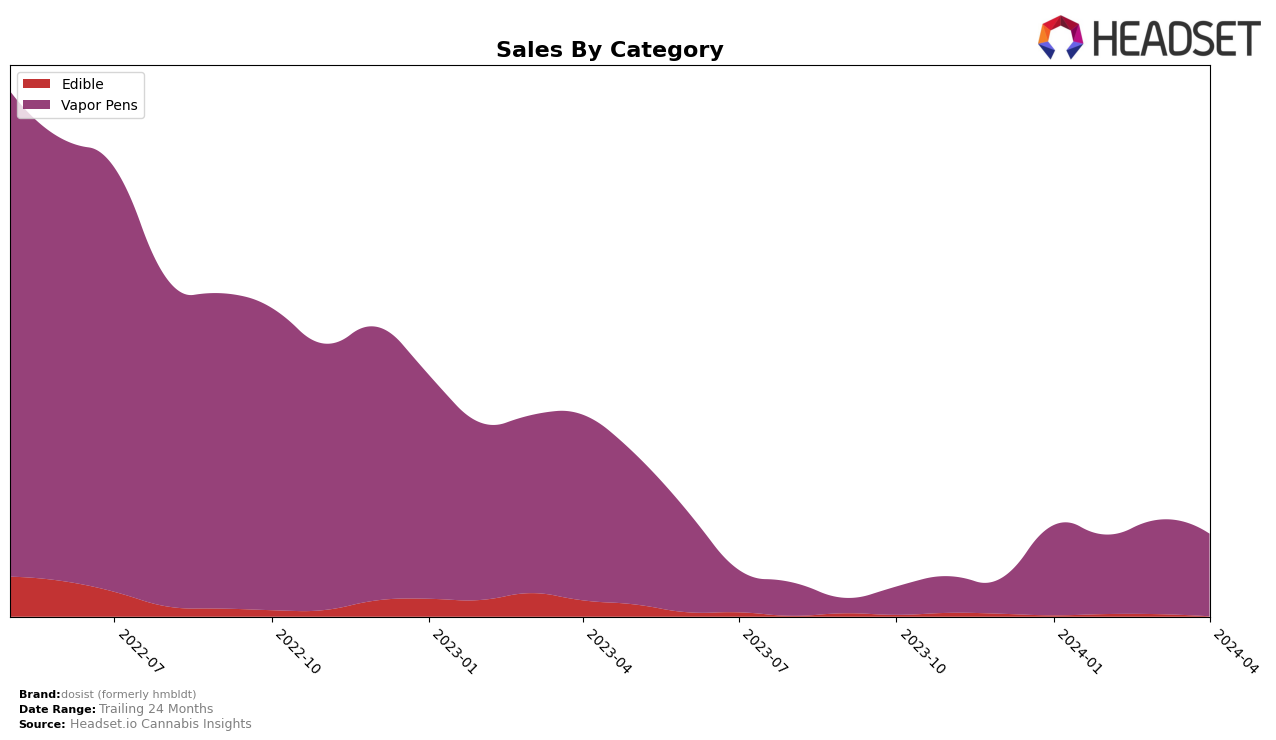

In the competitive landscape of the New York New York cannabis market, dosist (formerly hmbldt) has shown a consistent presence in the Vapor Pens category, managing to stay within the top 30 brands from January to April 2024. Starting the year at rank 27 in January and experiencing slight fluctuations in ranking, dosist eventually landed at rank 30 by April. While the brand's ability to maintain a spot in the top 30 signals a stable demand for their vapor pens, the downward trend towards the lower end of the ranking raises questions about competitive pressures and market dynamics. The sales figures, peaking in March with $62,616 before slightly declining in April, indicate a peak in consumer interest during the spring, yet the brand's position at the edge of the top 30 suggests challenges in sustaining or growing its market share amidst stiff competition.

Despite the challenges, dosist's performance in New York's Vapor Pens category showcases important insights into consumer preferences and market trends. The brand's consistent ranking within the top 30, despite a competitive market environment, underscores a loyal customer base and a steady demand for their products. The slight decline in rank over the observed months, however, highlights the importance of strategic initiatives aimed at product differentiation and marketing to bolster the brand's visibility and appeal. Without revealing specific sales numbers beyond March, it's clear that dosist needs to leverage its existing market presence and possibly innovate or expand its product offerings to climb the rankings and capture a larger market share in the evolving New York cannabis market.

Competitive Landscape

In the competitive landscape of the Vapor Pens category in New York, dosist (formerly hmbldt) has experienced a slight decline in rank over the first four months of 2024, moving from not being in the top 20 in January to further sliding down the ranks, indicating a challenging period for the brand amidst stiff competition. Notably, OMO - Open Minded Organics showed a significant presence earlier in the year but saw a decline to 31st by April, suggesting volatility in consumer preferences or possible distribution challenges. In contrast, Kingsroad maintained a more stable position, slightly improving its rank and potentially indicating a steady demand for their offerings. DomPen, despite not being ranked in the earlier months, surged to 34th place by April, showcasing a remarkable entry that could signify a growing interest in their products. Meanwhile, Flower by Edie Parker has been relatively consistent, maintaining a position in the lower ranks but showing some improvement by April. This competitive analysis underscores the dynamic nature of the Vapor Pens market in New York, with dosist facing challenges to regain its footing among a mix of fluctuating and emerging competitors.

Notable Products

In April 2024, dosist (formerly hmbldt) saw its "Bliss - CBD/THC 1:9 100 Live Resin Disposable (0.25g)" maintain its top position in the Vapor Pens category, with sales reaching 443 units. Following closely, "Calm - CBD/THC 6:1 100 Oil Dose Pen (0.25g)" secured the second rank, showing consistent performance from the previous month. The third spot was held by "Sleep - CBD/THC 1:8 100 Live Resin Disposable (0.25g)", which also retained its position from March to April. "Relief - CBD/THC 1:2 100 Live Resin Dose Pen (0.25g)" remained in fourth place, underscoring a stable demand for dosist's products. Notably, "Arouse - CBD/THC 1:2 Strawberry Mint Gummies 10-Pack (50mg CBD, 100mg THC)" entered the rankings at fifth place in April, a new addition to the top products list, indicating a diversification in consumer preferences within the brand's offerings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.