Apr-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

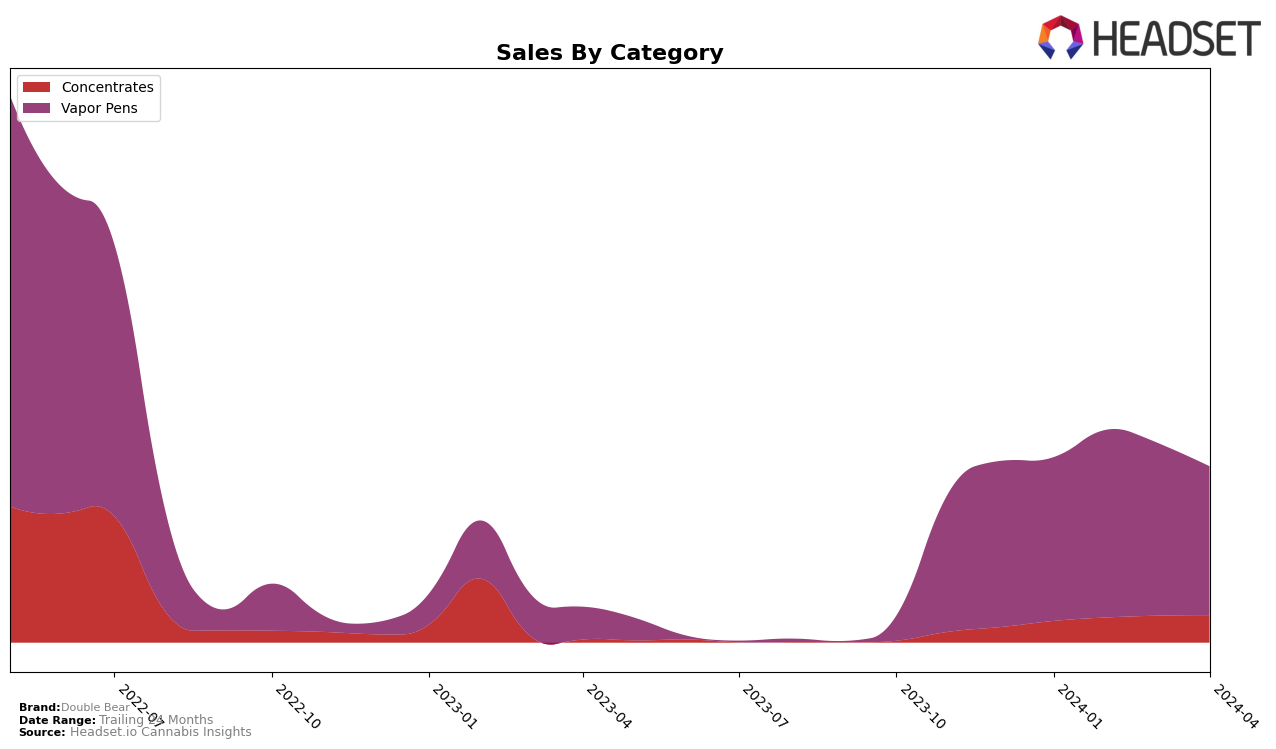

In Colorado, Double Bear has shown a notable performance across different cannabis categories, particularly in Concentrates and Vapor Pens. For Concentrates, the brand has demonstrated a consistent upward movement in rankings from January 2024, starting at 46th and climbing to 36th by April 2024. This positive trajectory indicates a growing market presence and consumer preference within the state. However, in the Vapor Pens category, Double Bear's performance has been somewhat fluctuating. The brand improved its ranking from 31st in January to 28th in February, showcasing a potential for significant market capture. Yet, it experienced a slight dip in March, falling to 32nd, before stabilizing back to 30th in April. This volatility suggests a competitive market environment for vapor pens in Colorado, where Double Bear is fighting hard to maintain and improve its standing.

While the brand's sales figures in February 2024 for Concentrates ($44,108) hint at increasing consumer demand, the detailed sales trends across the months further support this. The steady increase in sales, alongside the improvement in rankings, underscores Double Bear's effective strategies in engaging its target market within the Concentrates category. On the other hand, the sales trajectory for Vapor Pens, despite being higher, indicates a challenge in sustaining growth amidst fierce competition. The initial sales spike in February followed by a decrease suggests that while Double Bear has the capability to attract consumers, retaining them or continuing to grow in the face of new entrants or competitive actions requires more strategic efforts. These dynamics across categories highlight Double Bear's potential and challenges in Colorado's cannabis market, with room for strategic maneuvers to bolster its market position further.

Competitive Landscape

In the competitive landscape of the Vapor Pens category in Colorado, Double Bear has experienced fluctuations in its market position, indicating a dynamic competition among brands. Starting at a rank of 31 in January 2024, Double Bear saw a slight improvement in February, moving up to 28, before experiencing a dip in March to rank 32, and finally settling at rank 30 in April. This trajectory suggests a challenging environment, with Double Bear navigating through ups and downs in its competitive standing. Notably, its competitors have shown varied performances; Mile High Xtractions (MHX) displayed a strong presence, peaking at rank 22 in March before dropping to 28 in April, indicating a significant competitive threat with higher sales volumes. Conversely, Amber and Pyramid Pens have shown less fluctuation but remained in close ranks to Double Bear, with Pyramid Pens maintaining a slight lead in sales and rank in most months. Binske, despite not being in the top 20, showed an upward trend, ending at rank 31 in April, closely trailing Double Bear. This competitive analysis underscores the importance of strategic positioning and innovation for Double Bear to enhance its market share and rank amidst a fiercely competitive Vapor Pens market in Colorado.

Notable Products

In April 2024, Double Bear's top-performing product was the 9 Pound Hammer Mystic Oil Cartridge (1g) in the Vapor Pens category, securing the first rank with sales figures reaching 1412 units. Following closely, the Banana Runtz Mystic Oil Cartridge (1g) took the second spot, marking a notable shift from its previous top position in February. The King Louis XIII Mystic Oil Cartridge (1g) landed in third place, maintaining a consistent performance from the prior month. Interestingly, the Trainwreck Mystic Oil Cartridge (1g) held its ground at fourth place, despite fluctuating ranks in earlier months. The 9 Pound Hammer Mystic Oil Cartridge (0.5g) rounded out the top five, showcasing a significant drop from its initial second-place rank in January.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.