Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

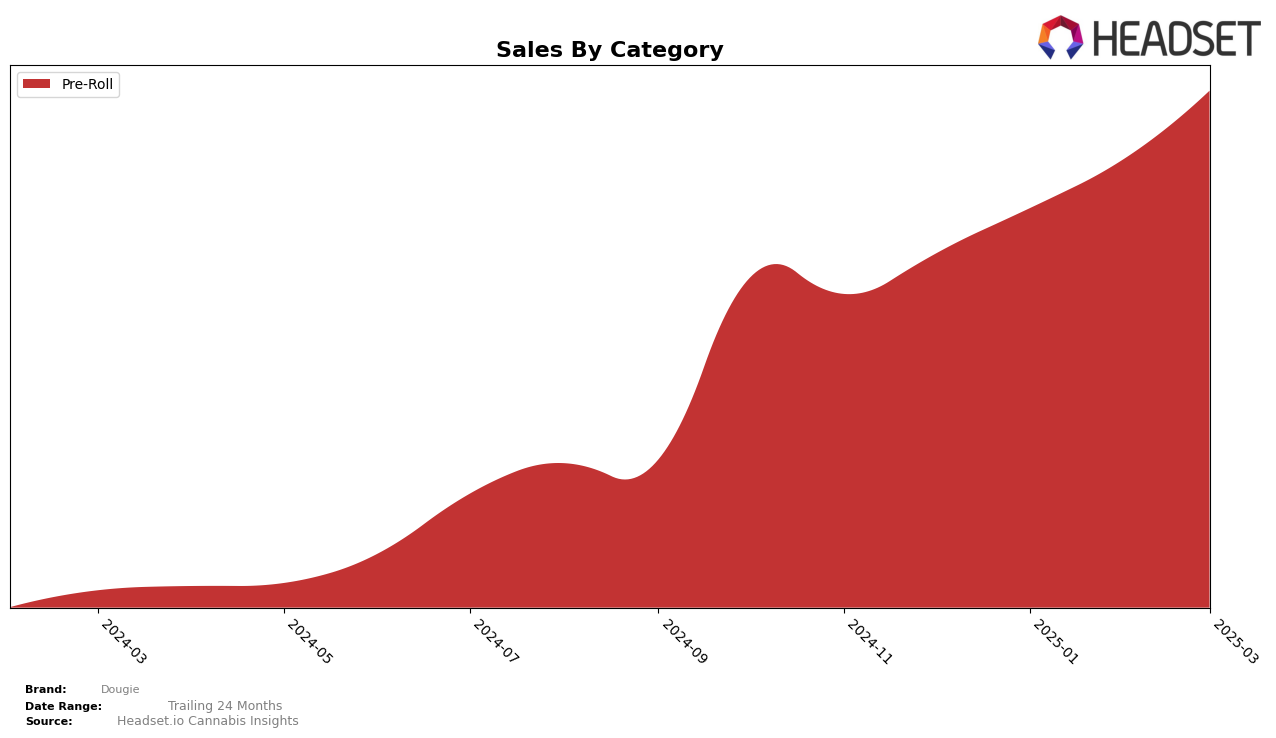

In the Oregon market, Dougie has demonstrated a consistent upward trajectory in the Pre-Roll category. Starting from a rank just outside the top 30 in December 2024, the brand has steadily climbed to secure the 24th position by March 2025. This improvement is underscored by a notable increase in sales, with March 2025 figures reflecting a significant rise from the December 2024 baseline. Such progress indicates a growing consumer preference for Dougie's offerings in this category, suggesting effective market strategies or product enhancements that appeal to the local consumer base.

However, the absence of Dougie in the top 30 rankings in other states or categories indicates room for growth and expansion. This absence could be perceived as a missed opportunity in capturing a wider market share or diversifying their product reach. The focus on the Oregon market's Pre-Roll category, while successful, highlights the potential for Dougie to leverage its brand strength and explore similar success in other markets. Understanding the dynamics that led to their success in Oregon could provide valuable insights for replicating this growth in new regions or categories.

Competitive Landscape

In the competitive landscape of the Oregon pre-roll market, Dougie has shown a promising upward trajectory in terms of rank and sales over the past few months. Starting from a rank of 31 in December 2024, Dougie improved to 24 by March 2025, indicating a consistent climb in the market. This improvement is mirrored in its sales figures, which have seen a significant increase, suggesting a growing consumer preference for Dougie's offerings. In comparison, Altered Alchemy and Emerald Extracts also experienced upward rank movements, but Dougie's sales growth outpaced theirs, particularly in March 2025. Meanwhile, Smokes / The Grow and Piff Stixs have shown fluctuations in their rankings, with Piff Stixs dropping from 17 to 22, which may indicate potential vulnerabilities that Dougie could capitalize on. Overall, Dougie's consistent rank improvement and sales growth position it as a rising contender in the Oregon pre-roll market, suggesting a positive trend that could be further leveraged with strategic marketing efforts.

Notable Products

In March 2025, the top-performing product from Dougie was the Golden Goat Infused Pre-Roll (1g), which climbed to the number one spot with sales reaching 1528 units. The Durban Poison Infused Blunt (1g) secured the second position, marking its debut in the rankings. Mendo Bendo Infused Blunt (1g), which was previously ranked second in February, dropped to the third position. Curve Ball Infused Blunt (1g) saw a decline from second to fourth place. Mars OG Infused Pre-Roll (1g) maintained its fifth position, showing consistency over the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.