Oct-2023

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

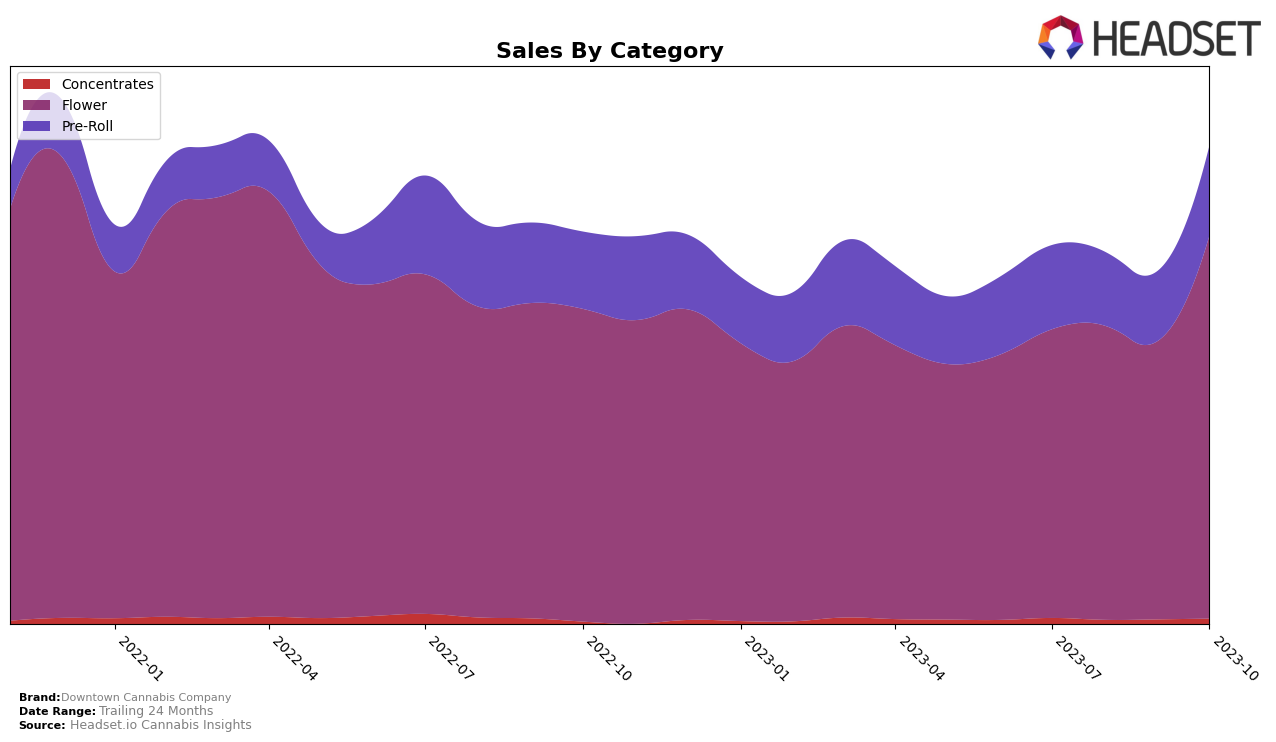

Looking at the performance of the Downtown Cannabis Company in the Washington market, we can see some interesting trends. In the Flower category, the brand has shown a steady improvement in its ranking, moving from the 37th position in July 2023 to the 19th position in October 2023. This upward trajectory in rankings indicates a positive trend in the brand's performance. However, it is worth noting that the brand was not in the top 20 brands in the Flower category until October 2023. This could either be seen as a late bloomer or a potential area for improvement, depending on how you look at it.

On the other hand, the Pre-Roll category presents a slightly different story. Here, Downtown Cannabis Company's ranking fluctuated between 54th and 48th over the same four-month period. While there is a notable improvement from September to October 2023, the brand still did not break into the top 20. This, coupled with a decrease in sales from July to September 2023, suggests that the Pre-Roll category might be a more challenging market for the brand in Washington. However, the increase in sales in October 2023 shows potential for growth and recovery.

Competitive Landscape

In the Flower category within Washington state, Downtown Cannabis Company has shown a significant upward trend, breaking into the top 20 brands in October 2023. This progress is particularly notable when compared to competitors such as Agro Couture and Mt Baker Homegrown, who despite having higher ranks in earlier months, were surpassed by Downtown Cannabis Company by October. In contrast, brands like Cowlitz Gold and Falcanna have consistently maintained higher ranks and sales, indicating a more established presence in the market. However, the rapid rise of Downtown Cannabis Company suggests a positive growth trajectory and potential to challenge these leading brands in the future.

Notable Products

In October 2023, Downtown Cannabis Company's top product was the Hassel Hoth Pre-Roll (1g), which maintained its number one rank from previous months. This product achieved impressive sales figures, reaching up to 4007 units. The second highest performing product was the Hassel Hoth (3.5g) from the Flower category, also holding its position from previous months with sales of 2546 units. The Comatoast Pre-Roll (1g) ranked third, climbing from its fourth position in July 2023, while the McFly Pre-Roll (1g) slipped one place to fourth compared to July 2023. Lastly, the Hassel Hoth (1g) retained its fifth rank since August 2023.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.