Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

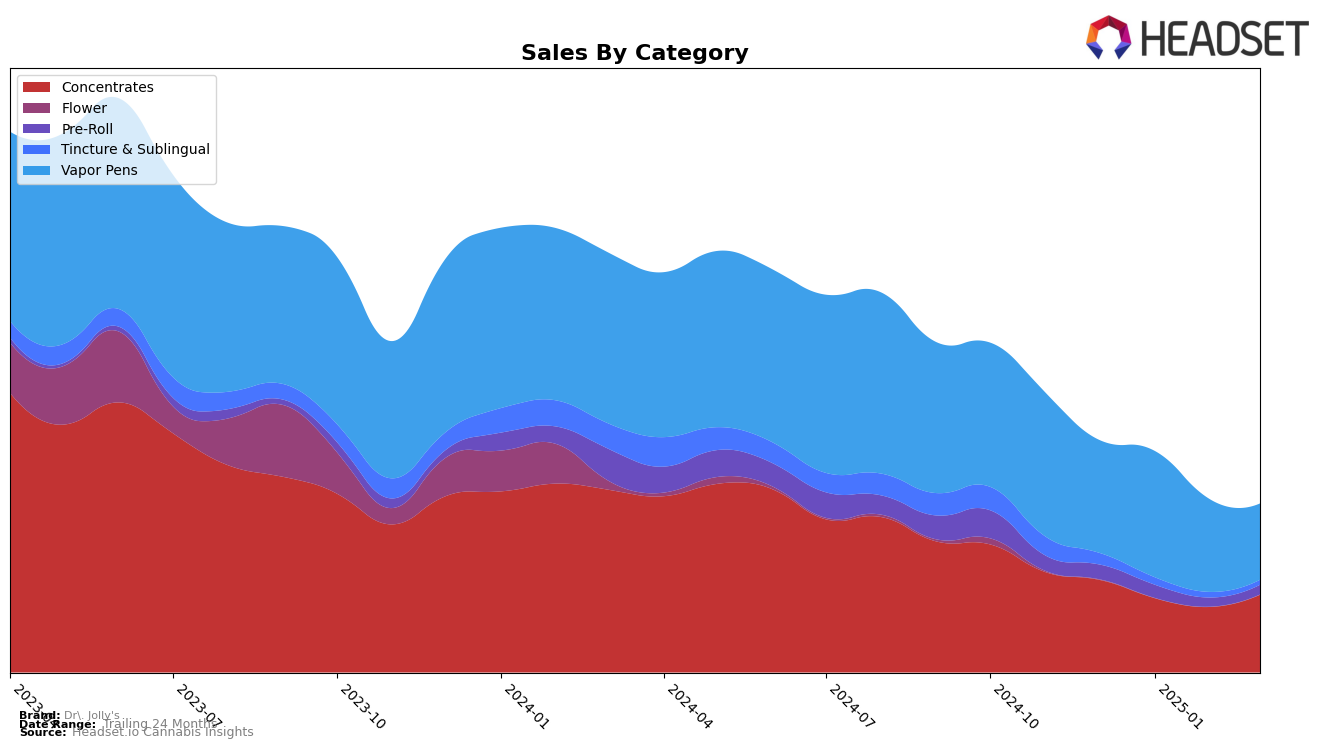

Dr. Jolly's has shown varied performance across different product categories in Oregon. In the Concentrates category, the brand maintained a steady presence within the top 20 throughout the first quarter of 2025, although it experienced a drop from 11th in December 2024 to 18th in February 2025 before rebounding slightly to 15th in March. This suggests a dynamic market where Dr. Jolly's is striving to maintain its competitive edge. Meanwhile, the Vapor Pens category also saw fluctuations, with the brand starting at 30th in December, rising to 27th in January, but ultimately slipping to 34th by March. This indicates a challenging landscape for Vapor Pens, where maintaining a stable ranking is proving difficult.

In contrast, Dr. Jolly's performance in the Pre-Roll category in Oregon has been less prominent, consistently ranking outside the top 30, with rankings hovering around the 70s. This suggests that Pre-Rolls may not be a strong focus for the brand in this state. Additionally, the Tincture & Sublingual category saw Dr. Jolly's ranked 11th in December 2024 and 13th in January 2025, but the absence of a ranking in February and March indicates a potential withdrawal from the top 30, which could be a point of concern or a strategic pivot. Overall, these movements highlight the brand's strengths and areas for potential growth within the competitive cannabis market of Oregon.

Competitive Landscape

In the Oregon concentrates market, Dr. Jolly's experienced fluctuating rankings from December 2024 to March 2025, starting at 11th place, dropping to 18th in February, and recovering slightly to 15th in March. This volatility in rank coincides with a downward trend in sales, which saw a notable decrease from December to February before a slight rebound in March. Competitors such as Echo Electuary and Focus North also displayed similar fluctuations, with Echo Electuary dropping from 9th to 17th and Focus North experiencing a dip to 17th before climbing back to 13th. Meanwhile, Private Stash maintained a relatively stable position, peaking at 11th in January. The competitive landscape suggests that while Dr. Jolly's faces challenges in maintaining its rank, there is potential for recovery and growth, especially as other brands also navigate similar market dynamics.

Notable Products

In March 2025, Dr. Jolly's top-performing product was the Modified Mojito Diamond J Infused Pre-Roll, which maintained its number one rank from January with sales of 594 units. The Purple Pakistani Kush Live Resin Distillate Cartridge dropped to third place from its previous top position in February, indicating a slight decline in sales momentum. The CBD/CBG/CBN/THC 1:1:1:1 House Blend FECO emerged as a strong contender, securing the second rank with notable sales, a new entry in the top rankings. Both Raz Gas Sugar Wax and Sapphire Surprise Sugar Wax shared the fourth position, showing consistent performance within the concentrates category. Overall, March saw a shift in rankings with new entries and changes in sales dynamics among the top products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.