Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

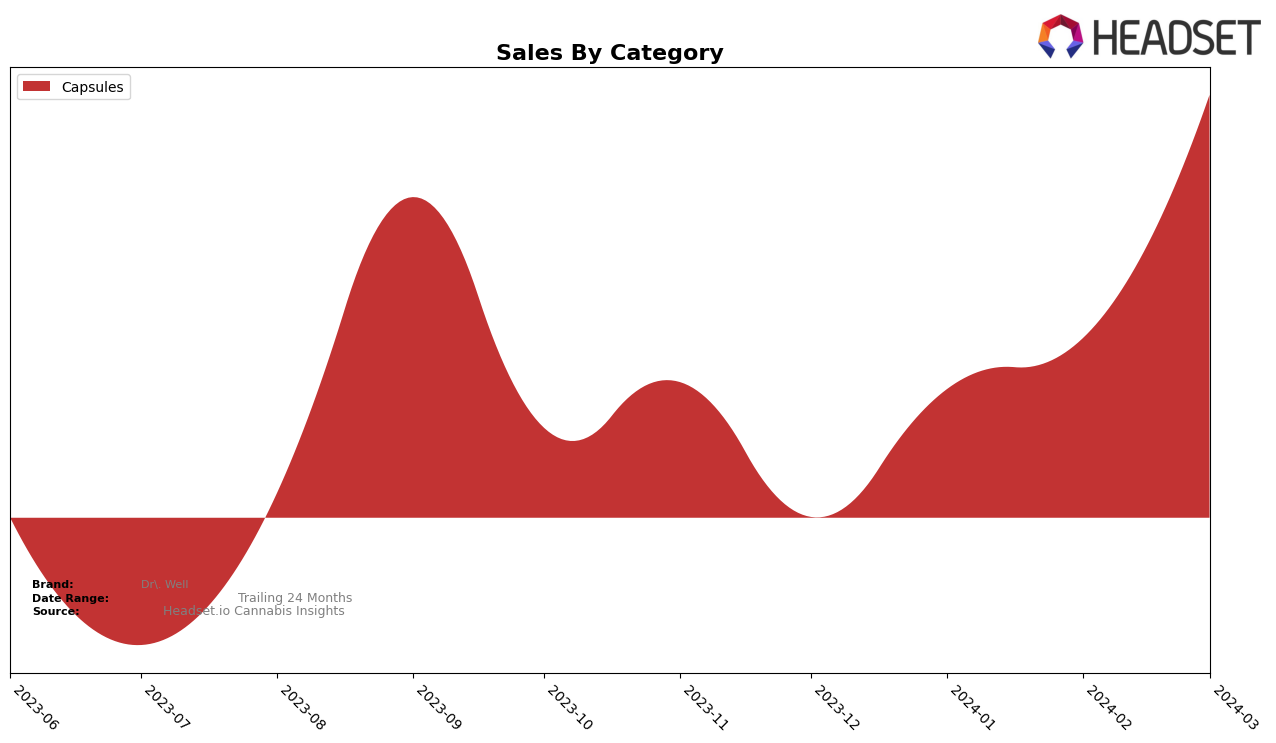

In the competitive cannabis market of Ontario, Dr. Well has shown a notable presence in the Capsules category, demonstrating a positive trajectory in rankings over the first quarter of 2024. Starting the year outside of the top 30 brands in December 2023, Dr. Well made a significant leap into the rankings in January at 31st place, followed by a gradual climb to 30th in February, and impressively up to 25th by March. This upward movement is underscored by a substantial increase in sales, from 417 units in January to 1200 units in March, indicating a growing consumer interest and market penetration in Ontario's cannabis scene. The absence from the top 30 in December could be seen as a setback, but the rapid recovery and progress in the subsequent months highlight the brand's resilience and potential for growth.

While the data provided focuses exclusively on the Ontario market, the performance of Dr. Well in the Capsules category offers valuable insights into the brand's market dynamics and consumer acceptance. The significant sales jump from January to March suggests effective marketing strategies, product quality, or both, as driving factors behind the brand's improved market position. This performance might also reflect broader trends in consumer preferences within the Ontario cannabis market, possibly indicating a rising interest in capsule-based cannabis products. However, without comparative data from other states or provinces, it's challenging to gauge the brand's overall performance across different markets. Nonetheless, Dr. Well's trajectory in Ontario is a case study in how brands can recover from a slow start to the year and capitalize on emerging market opportunities.

Competitive Landscape

In the competitive landscape of the capsule category within Ontario's cannabis market, Dr. Well has shown a notable upward trajectory in its rankings over the recent months. Starting from not being in the top 20 in December 2023, Dr. Well has climbed significantly to rank 25th by March 2024. This growth is particularly impressive when compared to its competitors. For instance, WholeHemp and Ollopa have experienced fluctuations but remained within the 21st to 24th rank range, indicating a more stable but less dynamic performance. Meanwhile, brands like Kinloch Wellness and Pure Laine have seen a decline or stagnation in their rankings, landing at 27th and 26th respectively by March 2024. Dr. Well's significant rank improvement, despite starting from a lower base, suggests a growing consumer interest and potential challenges for its competitors, especially if this upward trend continues.

Notable Products

In March 2024, the top-performing product for Dr. Well was the CBD Turmeric Ginger Capsules 30-Pack (750mg CBD) within the Capsules category, maintaining its number one rank consistently from December 2023 through March 2024. This product saw a significant increase in sales, reaching 59 units sold in March. Notably, this represents the highest sales figure for a single product in the dataset for that month. The consistent ranking as the top product across four consecutive months highlights its strong market presence and consumer preference. This performance indicates a stable demand for wellness-focused cannabis products, particularly those combining CBD with health-oriented ingredients like turmeric and ginger.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.