Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

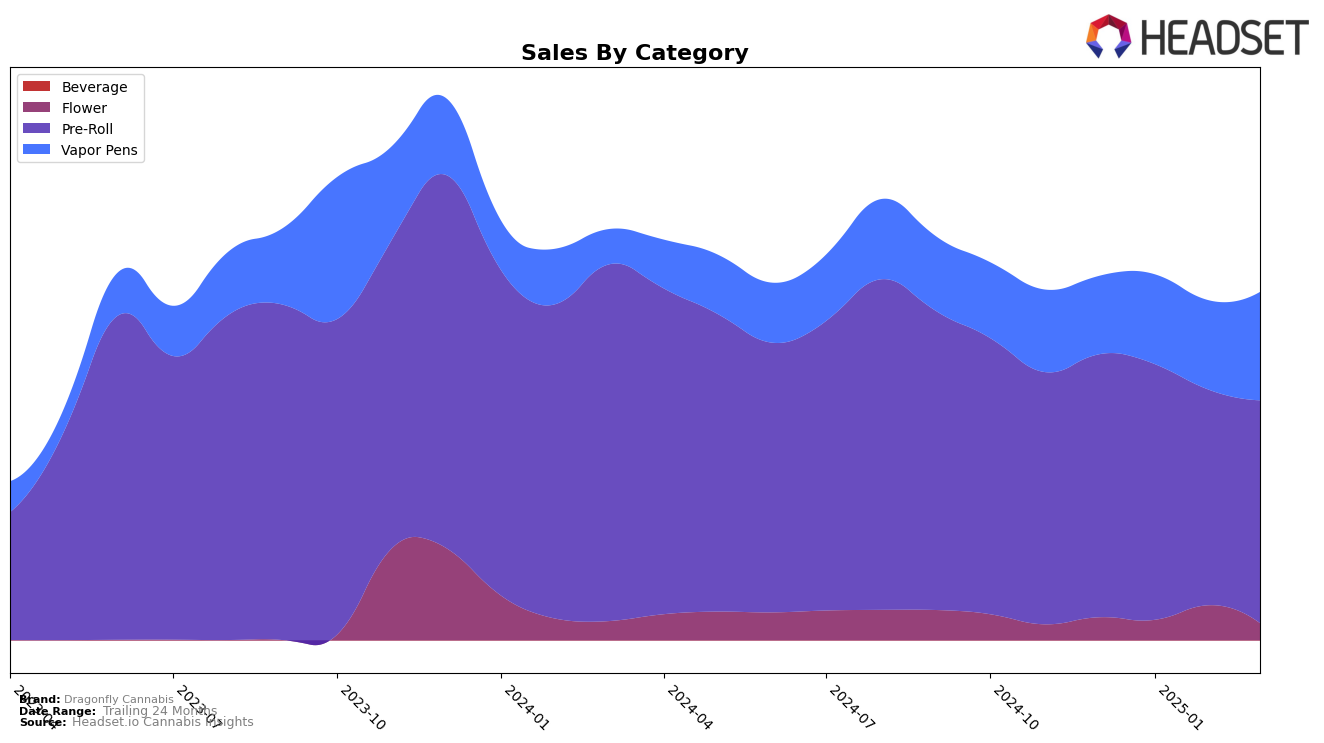

Dragonfly Cannabis has shown varied performance across different product categories and states. In Michigan, the brand has maintained a strong presence in the Pre-Roll category, consistently holding the 4th position from December 2024 through March 2025. This stability suggests a solid consumer base and effective product positioning within this category. However, in the Flower category, Dragonfly Cannabis has not been able to break into the top 30 brands, indicating potential challenges in market penetration or competition. This could be an area for the brand to explore further to enhance its market share and visibility.

The Vapor Pens category in Michigan has seen a notable upward trajectory for Dragonfly Cannabis. Starting from the 19th rank in December 2024, the brand has climbed to the 11th position by March 2025. This upward movement reflects a positive consumer response and possibly effective marketing strategies or product improvements. The absence from the top 30 in the Flower category, however, highlights a disparity in the brand's performance across different segments, suggesting a need for strategic focus to balance its portfolio and capitalize on growth opportunities in underperforming categories.

Competitive Landscape

In the competitive landscape of the Michigan pre-roll category, Dragonfly Cannabis consistently maintained its position at rank 4 from December 2024 through March 2025. Despite a steady rank, Dragonfly Cannabis faced a decline in sales over this period, which could be a concern as competitors like Mitten Extracts showed a remarkable improvement, jumping from rank 43 in January 2025 to rank 6 by March 2025, accompanied by a significant increase in sales. Meanwhile, Goodlyfe Farms and Cali-Blaze consistently held higher ranks at 3 and 2, respectively, with Cali-Blaze experiencing a notable sales surge in March 2025. The consistent performance of Dragonfly Cannabis in terms of rank, despite the sales dip, suggests a strong brand presence, but the growing competition and fluctuating sales figures indicate a potential need for strategic adjustments to maintain and enhance market share.

Notable Products

In March 2025, Dragonfly Cannabis saw Biscotti Pippen Pre-Roll (1g) leading the sales as the top-performing product, maintaining its first-place position with impressive sales of $66,750. Apples & Bananas Pre-Roll (1g) slipped to second place from its previous top rank in February, indicating a slight decline in its dominance. Blue Dream Haze Pre-Roll (1g) secured the third spot, marking its debut in the top rankings for the year. Afternoon Tea Pre-Roll (1g) remained steady at fourth place, showing consistent performance over the past two months. Chem 91 Pre-Roll (1g) reappeared in the rankings, climbing to fifth place after not being ranked in January and February.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.