Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

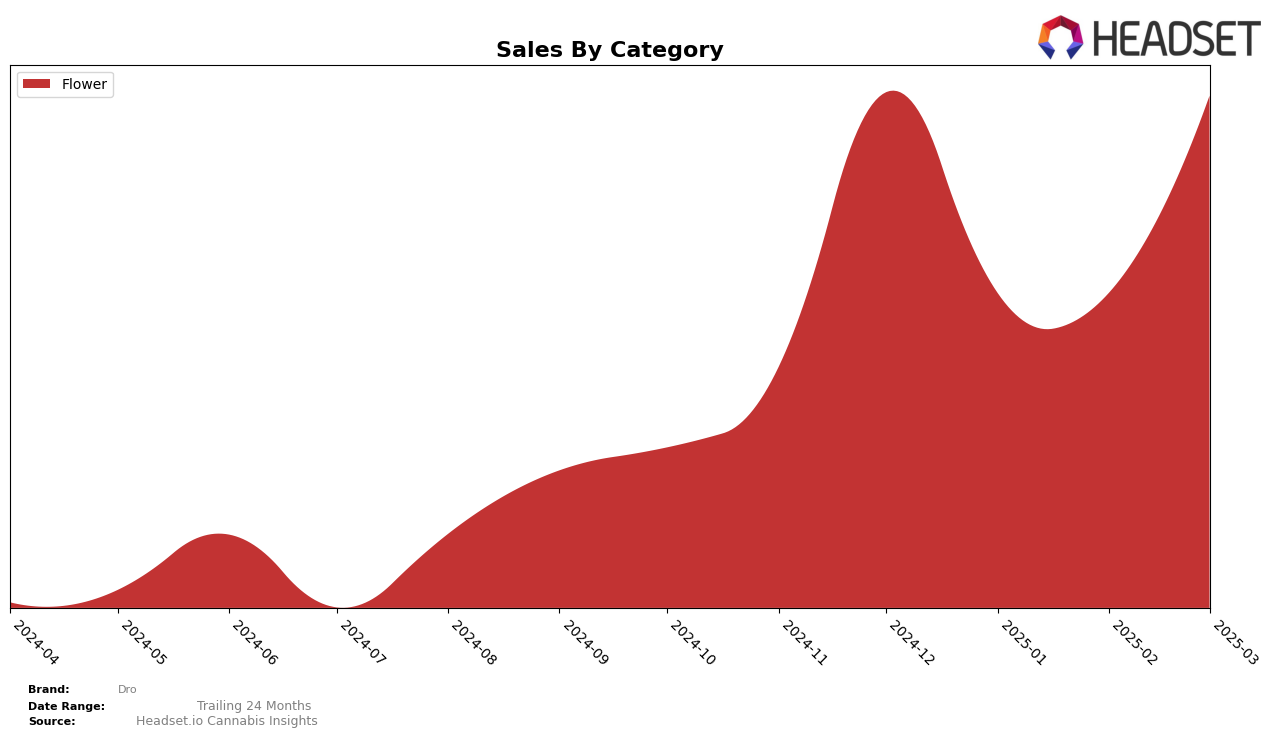

In the state of Colorado, Dro has demonstrated notable fluctuations in the Flower category rankings over the past few months. In December 2024, Dro was ranked 8th, showcasing a strong presence in the market. However, the brand experienced a decline in January 2025, dropping to 17th place. This dip was temporary as Dro climbed back to 14th in February and achieved an impressive 7th place by March 2025. This upward trend in March suggests a successful strategy or market adaptation that has allowed Dro to regain its competitive edge in Colorado's Flower category.

While the sales figures for Dro in Colorado reveal some volatility, the overall trajectory indicates a recovery and growth pattern. The brand's sales dipped in January 2025, corresponding with the lower rank at that time, but rebounded significantly by March 2025, nearly matching the sales figures from December 2024. This recovery in sales and rankings highlights Dro's resilience and capability to navigate the competitive landscape in Colorado. The absence of rankings in other states or categories suggests that Dro may not be in the top 30 brands elsewhere, which could indicate areas for potential growth or market entry strategies in the future.

Competitive Landscape

In the competitive landscape of the Colorado flower market, Dro experienced a notable fluctuation in its ranking and sales performance from December 2024 to March 2025. Dro's rank dropped significantly from 8th in December 2024 to 17th in January 2025, indicating a challenging start to the new year. However, the brand showed resilience by climbing back to 14th in February and achieving a commendable 7th place by March 2025. This recovery suggests a positive trend and potential for growth. In contrast, Green Dot Labs maintained a relatively stable position, starting and ending the period at 5th place, despite a dip to 8th in January and February. Meanwhile, 710 Labs showed a similar upward trajectory to Dro, improving from 12th in January to 6th in March. Silver Lake and TREES experienced more volatility, with Silver Lake dropping from 6th to 8th and TREES peaking at 5th in January before falling to 9th by March. These dynamics highlight the competitive pressures and opportunities within the Colorado flower market, where Dro's ability to rebound could signal strategic adjustments or market shifts favorable to its offerings.

Notable Products

In March 2025, the top-performing product from Dro was Blanco (7g) in the Flower category, securing the number one rank with sales reaching 1812 units. Grape Cream Cake (7g) made a significant debut, climbing to the second position, while Sherbanger #22 (7g) followed closely in third place. Permanent OZ (7g) and Bernscotti (7g) held the fourth and fifth ranks, respectively. Notably, Blanco (7g) improved from its second position in February to claim the top spot in March. This shift in rankings reflects a dynamic change in consumer preferences within Dro's Flower category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.