Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

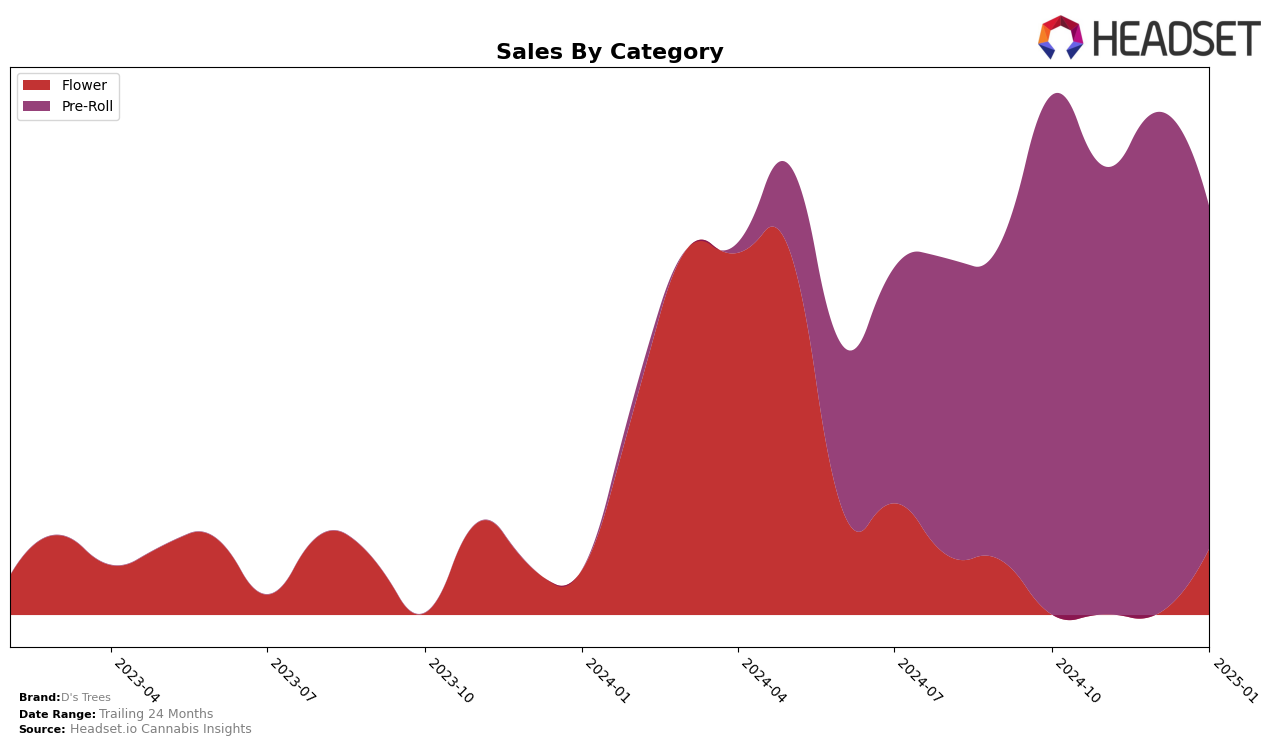

D's Trees has shown varied performance across different categories and states. In the Colorado market, the brand did not make it into the top 30 for the Flower category from October 2024 through January 2025, indicating a potential area for growth or increased competition in this segment. However, the Pre-Roll category tells a more positive story, with D's Trees consistently ranking within the top 30 during the same period. The brand improved its position from 30th in October 2024 to 23rd by December 2024, before slightly dropping to 25th in January 2025. This suggests a strong presence in the Pre-Roll category, although the slight dip in January could be an area to watch.

Sales figures for D's Trees in the Pre-Roll category also reflect some interesting trends. While there was a noticeable decrease in sales from November 2024 to January 2025, the brand still maintained a competitive rank, which indicates resilience despite the sales drop. The sales for Pre-Rolls in November were notably high, reaching a peak before declining in the following months. This fluctuation in sales could be attributed to seasonal trends or shifts in consumer preferences. Overall, while D's Trees shows strength in the Pre-Roll category in Colorado, there is room for expansion and improvement in the Flower category, where the brand has yet to break into the top ranks.

Competitive Landscape

In the competitive landscape of the Colorado pre-roll market, D's Trees has shown a consistent presence, maintaining a rank within the top 30 brands from October 2024 to January 2025. Despite a slight fluctuation, D's Trees improved its rank from 30th in October to 23rd in December, before settling at 25th in January. This trajectory suggests a stable yet competitive positioning. Notably, TWAX demonstrated a remarkable upward trend, moving from 78th to 24th, surpassing D's Trees by January, which could indicate a shift in consumer preference or marketing effectiveness. Meanwhile, Magic City and Fuego Farms (CO) experienced declines, with Magic City dropping from 22nd to 27th, and Fuego Farms falling out of the top 20 by January. These dynamics highlight the competitive pressures D's Trees faces, emphasizing the importance of strategic marketing and product differentiation to maintain and improve its market position.

Notable Products

In January 2025, Tropicana Cherry Popcorn (1g) from D's Trees took the top spot in sales, achieving a notable figure of 2944 units sold. Following closely was Peach Maraschino Pre-Roll (1g), which secured the second position. Strawberry Diesel Pre-Roll (1g) experienced a drop from its previous second-place rank in December 2024 to third in January 2025, with 2010 units sold. Hella Jelly Pre-Roll (1g) maintained a consistent fourth-place ranking from December 2024 to January 2025. Black Cherry Gelato Pre-Roll (1g), which was previously unranked for November and December, achieved a fifth-place ranking in January 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.