Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

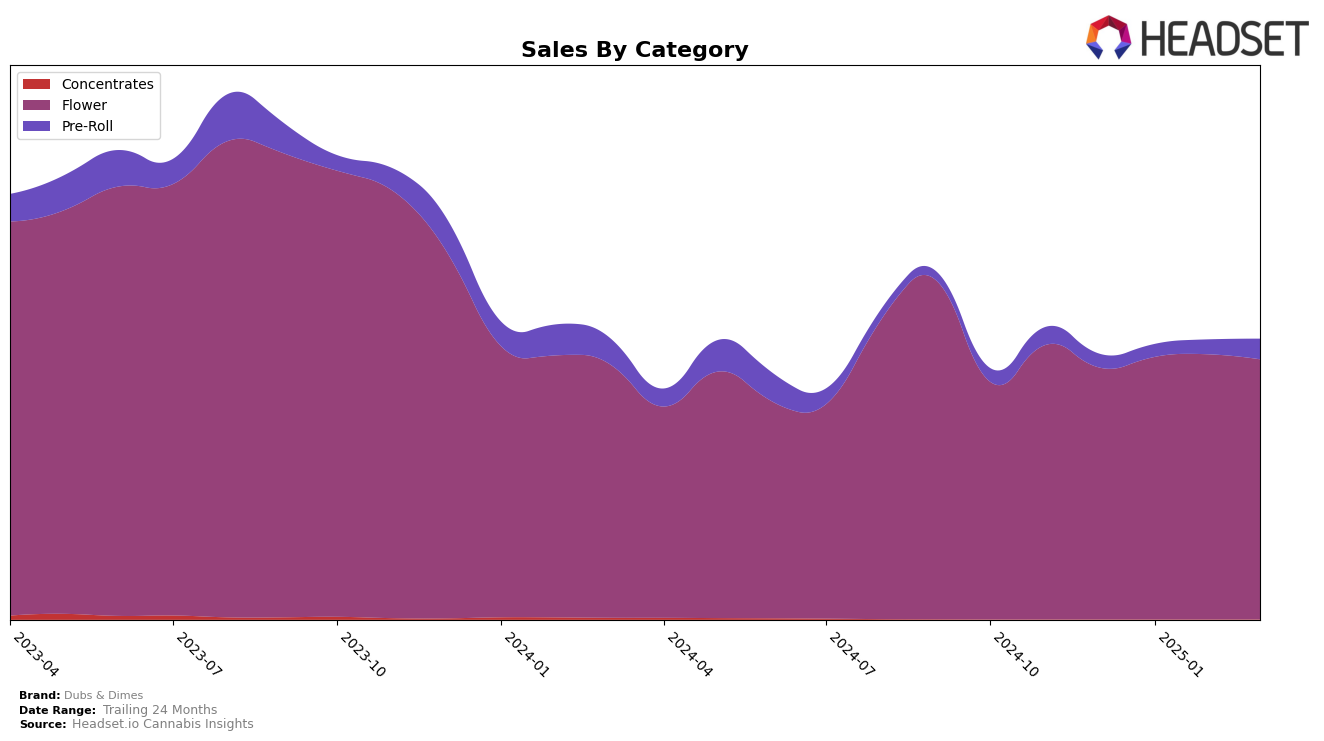

In the Michigan market, Dubs & Dimes has shown varied performance across different product categories. In the Flower category, the brand maintained a steady presence in the top 30, with a slight dip from 18th position in February 2025 to 22nd in March 2025. This suggests a relatively stable market position, although the drop in ranking may indicate increased competition or a shift in consumer preferences. On the other hand, the Pre-Roll category tells a different story, where Dubs & Dimes improved their ranking significantly, moving from 92nd in December 2024 to 71st by March 2025. This upward trend highlights a growing acceptance or demand for their Pre-Roll products, which could be a strategic area for further exploration.

It's noteworthy that Dubs & Dimes did not appear in the top 30 for the Pre-Roll category in December 2024, which might have been concerning at the time. However, their subsequent rise in the rankings over the next few months demonstrates a positive trajectory. The brand's ability to climb the ranks in this category suggests effective marketing strategies or product improvements that resonated with consumers. Meanwhile, the slight decline in the Flower category ranking could be an area to watch, as maintaining a competitive edge is crucial in the dynamic cannabis market. Overall, these movements across categories in Michigan provide insight into the brand's performance and potential areas of focus for sustained growth.

Competitive Landscape

In the competitive landscape of the Michigan flower category, Dubs & Dimes has experienced a dynamic shift in its market positioning over the past few months. Starting from December 2024, Dubs & Dimes held the 21st rank, showing a slight improvement to the 18th position in January and February 2025, before dropping to 22nd in March. This fluctuation indicates a competitive struggle to maintain a top 20 position, especially against brands like Dog House and Glorious Cannabis Co., which have also seen varying ranks but managed to stay within the top 20. Notably, Galactic consistently outperformed Dubs & Dimes, despite a similar downward trend in March. Meanwhile, Emerald Mountain Labs (MI) made a significant leap from being outside the top 20 in December and January to securing the 24th rank in March, showcasing a potential rising competitor. These shifts suggest a highly competitive environment where Dubs & Dimes needs strategic initiatives to enhance its market share and stabilize its ranking amidst fluctuating sales trends.

Notable Products

In March 2025, the top-performing product for Dubs & Dimes was Classic - Don Knotts (3.5g) from the Flower category, securing the number one rank with sales of 6552 units. Following closely was Apple Fritter (Bulk), also in the Flower category, which maintained its position at rank two with significant sales figures. Connoisseur - Biscotti Pippen (3.5g) held the third position, showing consistent performance in the Flower category. Classic - Bob Hope Pre-Roll (1g) and Classic - Canal Street Runtz Pre-Roll (1g) both performed strongly in the Pre-Roll category, with the latter maintaining its fourth position from February 2025. Notably, Classic - Canal Street Runtz Pre-Roll (1g) saw a rise in sales from 3852 in February to 5044 in March 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.