Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

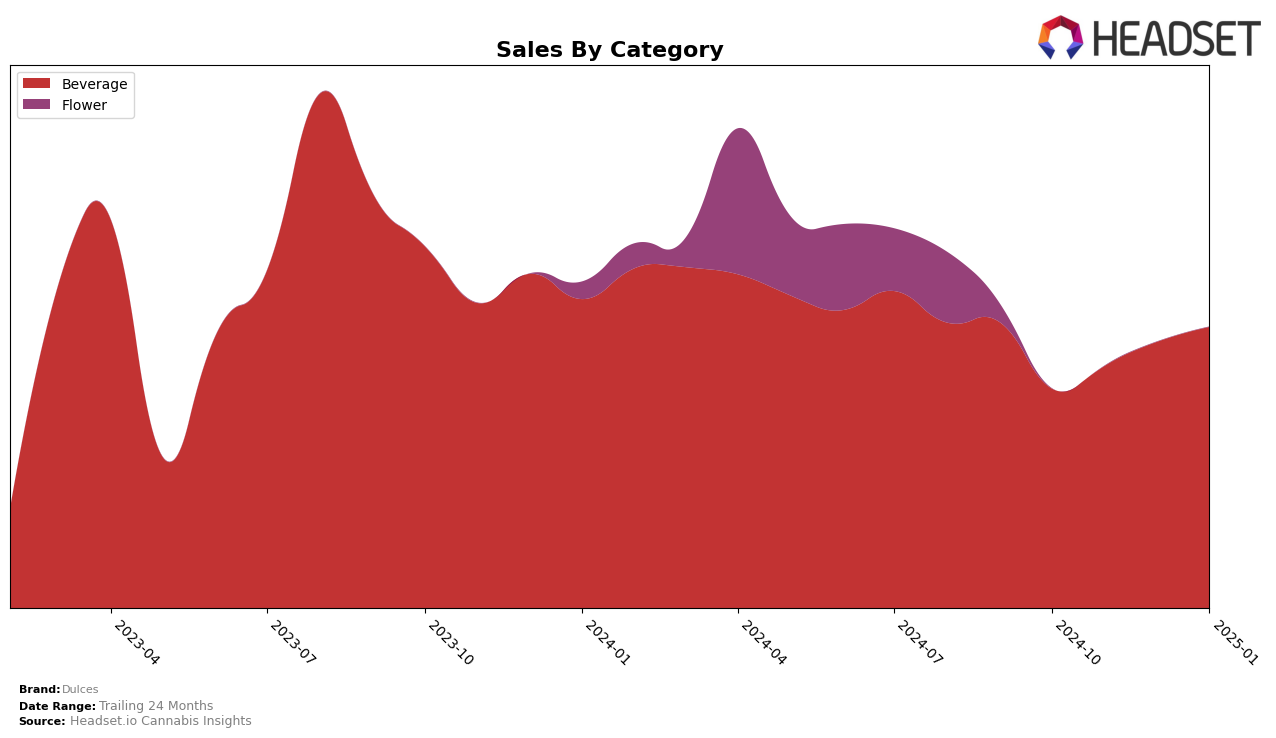

Dulces has shown a steady improvement in the Beverage category in Ontario. Starting from a rank of 22 in October 2024, the brand climbed to 19 by January 2025. This upward trend in their ranking is indicative of growing consumer interest and possibly effective market strategies. Despite not breaking into the top 20 until January, the consistent presence in the rankings suggests a solid market presence in Ontario's competitive beverage segment. The brand's sales figures also reflect this positive trajectory, with an increase from CAD 33,870 in October to CAD 43,395 in January, signaling robust sales growth.

However, it's important to note that Dulces did not appear in the top 30 brands for any other states or categories during this period. This absence could be seen as a missed opportunity or a sign of underperformance in other markets. The focus on Ontario might suggest a strategic concentration of resources, but it also highlights potential areas for expansion or improvement. Understanding the dynamics that led to their success in Ontario could be key to replicating similar results in other regions. The data points to a brand with potential but also underscores the need for a more diversified presence across different markets.

Competitive Landscape

In the competitive landscape of the beverage category in Ontario, Dulces has shown a notable upward trajectory in its rankings over the past few months. Starting from a rank of 22 in October 2024, Dulces improved to 19 by January 2025, indicating a positive trend in market performance. This ascent in rank is particularly significant when compared to competitors like Summit (Canada) and Palmetto, both of which experienced fluctuations and did not consistently maintain a top 20 position throughout the same period. Meanwhile, Vacay and Señorita have managed to sustain relatively stable rankings, with Vacay experiencing a slight dip from 13 to 16 and Señorita maintaining a steady position at 18. The sales growth for Dulces, especially in January 2025, suggests a strengthening market presence, potentially driven by strategic marketing efforts or product innovations that resonate well with consumers. This upward trend positions Dulces as a brand to watch, as it continues to close the gap with higher-ranked competitors.

Notable Products

In January 2025, Dulces' top-performing product was the CBD:THC 1:1 Cherry Shockwave Sparkling Beverage, maintaining its leading position from December 2024 with sales reaching 1986 units. Following closely was the CBD:THC 1:1 Sweet Peach Sparkling Beverage, which held the second spot, demonstrating a notable increase in sales from the previous month. The CBD:THC 1:1 Fruity Berry Beverages remained steady at third place, although its sales slightly decreased compared to December. Meanwhile, the CBD/THC 1:1 Watermelon Sparkling Beverage continued to rank fourth, consistent with its position in the preceding months. Overall, these rankings reflect a stable preference for Dulces' beverage category, with the Cherry Shockwave consistently leading the pack.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.