Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

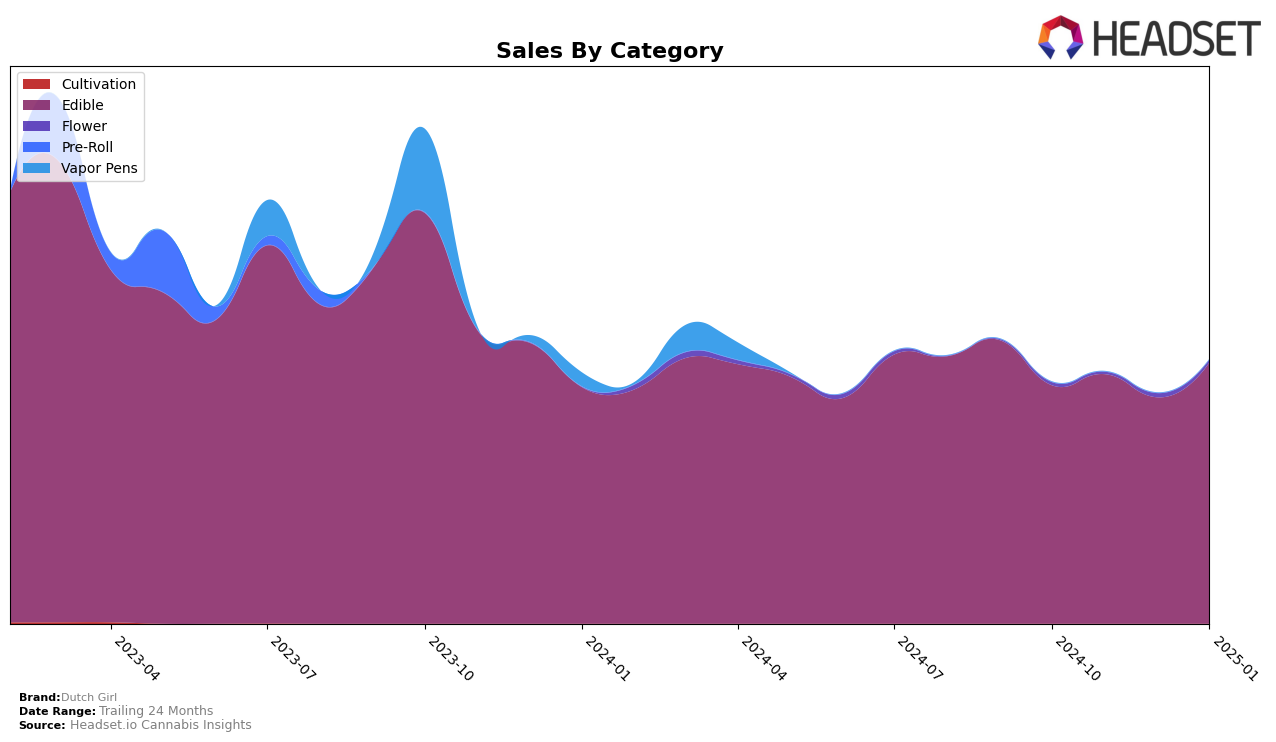

In the state of Colorado, Dutch Girl has shown a modest upward trend in the Edible category. Starting from October 2024, Dutch Girl was just outside the top 30, ranked at 32nd, but managed to break into the top 30 by January 2025, climbing to the 29th position. This movement indicates a positive reception and growing popularity among consumers in the state. The sales figures correspond to this improvement, with a noticeable increase from October to January, suggesting that Dutch Girl's strategies in Colorado might be effectively resonating with the market.

While Dutch Girl's performance in Colorado is noteworthy, it is important to consider their absence from the top 30 rankings in other states and categories, which could highlight areas for potential growth or needed strategic adjustments. The lack of presence in these rankings might be seen as a challenge for the brand, emphasizing the competitive nature of the cannabis market across different regions. Understanding these dynamics could provide valuable insights into how Dutch Girl might tailor its approach to different markets to enhance its performance further.

Competitive Landscape

In the competitive landscape of the edible cannabis market in Colorado, Dutch Girl has shown a steady improvement in its rankings from October 2024 to January 2025. Initially ranked 32nd in October, Dutch Girl climbed to 29th by January 2025, indicating a positive trend in its market position. This upward movement is noteworthy, especially when compared to brands like Devour, which experienced a significant drop from 21st to 30th in the same period. Meanwhile, Binske maintained a relatively stable position, hovering around the 27th to 30th ranks, which suggests a consistent but not significantly growing presence. On the other hand, Nove Luxury Chocolate saw a decline from 17th to 31st, reflecting a potential loss in market share. Despite these shifts, Dutch Girl's consistent sales growth, culminating in a notable increase in January, positions it as a brand on the rise, potentially appealing to consumers seeking reliable and improving options in the edible category.

Notable Products

In January 2025, the top-performing product from Dutch Girl was the CBD/CBN/THC/CBG 1:1:1:1 Moonberry Stroopwafel Cookie 10-Pack, maintaining its number one rank consistently since October 2024 with a sales figure of 974 units. The Indica Caramel Stroopwafels 10-Pack held steady at the second position throughout the months, although its sales have gradually declined to 266 units by January. The Original Stroopwafel debuted in the rankings, securing the third spot with 260 units sold. Strawberry Stroop Waffle Cookie, although slipping to fourth place, maintained a close sales count at 255 units. Notably, the Strawberry Stroopwafel re-entered the rankings in January at fifth place, showing a marked increase in sales to 181 units.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.