Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

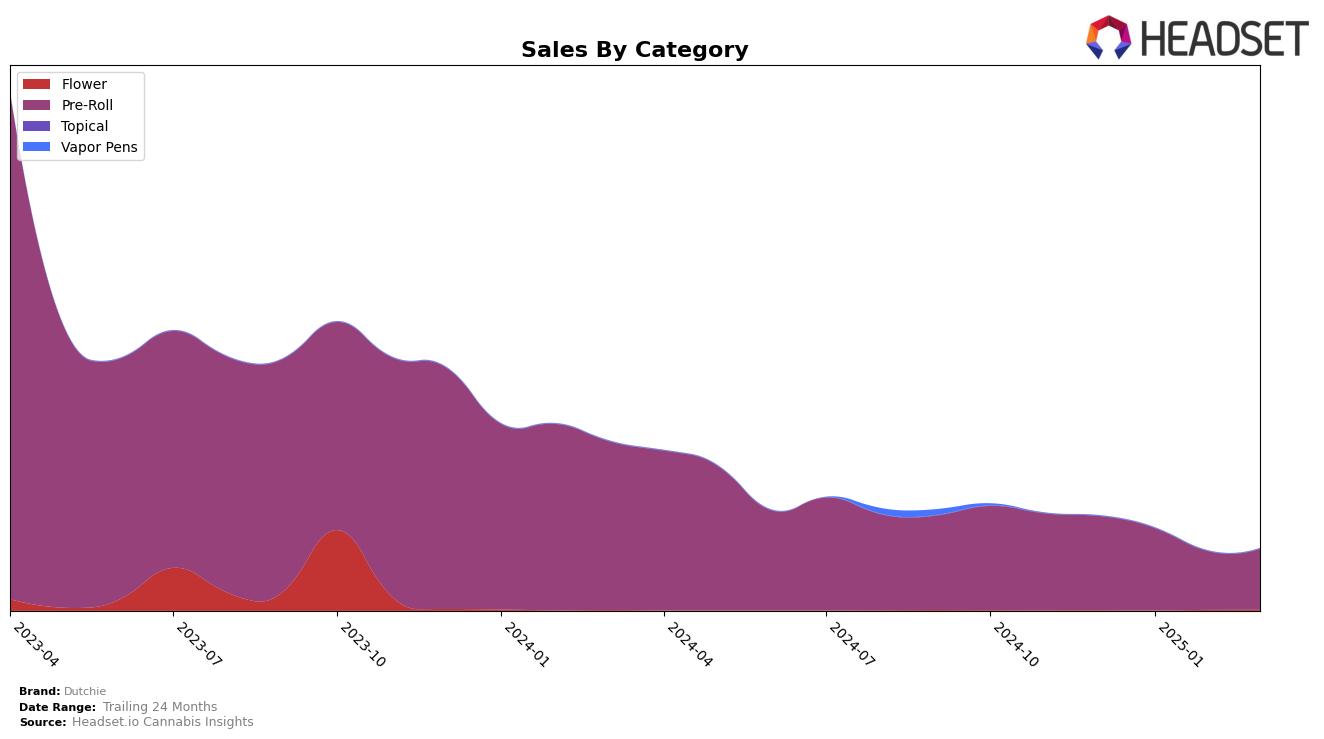

In the Arizona market, Dutchie's performance in the Pre-Roll category has seen some fluctuations over the months from December 2024 to March 2025. Starting with a rank of 14 in both December and January, the brand experienced a decline in February, falling to the 24th position. However, March showed a slight recovery as Dutchie moved up to the 23rd position. This indicates a potential struggle in maintaining a strong foothold in the competitive Pre-Roll category in Arizona, especially considering that they were not in the top 20 for two consecutive months. Despite these ranking shifts, Dutchie managed to maintain a presence in the top 30, which could be seen as a positive sign of resilience in a challenging market.

While the ranking fluctuations suggest some volatility, the sales figures provide additional context to Dutchie's performance. The sales in December 2024 were recorded at $174,841, but there was a noticeable decline in January and February, with sales dropping to $152,773 and further to $107,887. March saw a slight increase to $113,035, which aligns with the minor improvement in rankings. This trend indicates that while Dutchie is facing challenges, there is a potential for recovery as seen in the March data. The brand's ability to bounce back slightly in rankings and sales could hint at strategic adjustments or market responses that might be explored further to understand its performance dynamics in Arizona.

Competitive Landscape

In the competitive landscape of the pre-roll category in Arizona, Dutchie experienced notable fluctuations in its market position from December 2024 to March 2025. Initially ranked 14th in December and January, Dutchie saw a decline to 24th in February before slightly recovering to 23rd in March. This dip in rank coincided with a decrease in sales from December to February, though there was a modest rebound in March. In contrast, Connected Cannabis Co. demonstrated a strong upward trajectory, improving from 27th in December to 15th in February, before settling at 20th in March, indicating a robust increase in sales during this period. Meanwhile, Mohave Cannabis Co. maintained a relatively stable presence, hovering around the 20th rank, while Alien Labs re-entered the top 20 in February and March after not ranking in January. The competitive dynamics suggest that while Dutchie faced challenges in maintaining its rank, competitors like Connected Cannabis Co. capitalized on market opportunities, potentially impacting Dutchie's market share and necessitating strategic adjustments to regain its competitive edge.

Notable Products

In March 2025, Dutchie's top-performing product was Blue Dream Pre-Roll 6-Pack (3g) in the Pre-Roll category, maintaining its number one rank from January 2025, despite a drop in sales to 400 units. GG4 Pre-Roll 6-Pack (3g) rose to the second position, with sales reaching 387 units, showing improvement from its third-place ranking in January. Blue Dream Pre-Roll 2-Pack (1g) climbed to third place from fifth in February, indicating a growing preference for this product. Gorilla Watermelon Pre-Roll 6-Pack (3g) entered the rankings in fourth place, marking its first appearance in the top five. Lastly, GMO Cookies Pre-Roll 2-Pack (1g) secured the fifth position, rounding out the list of top products for the month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.