Feb-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

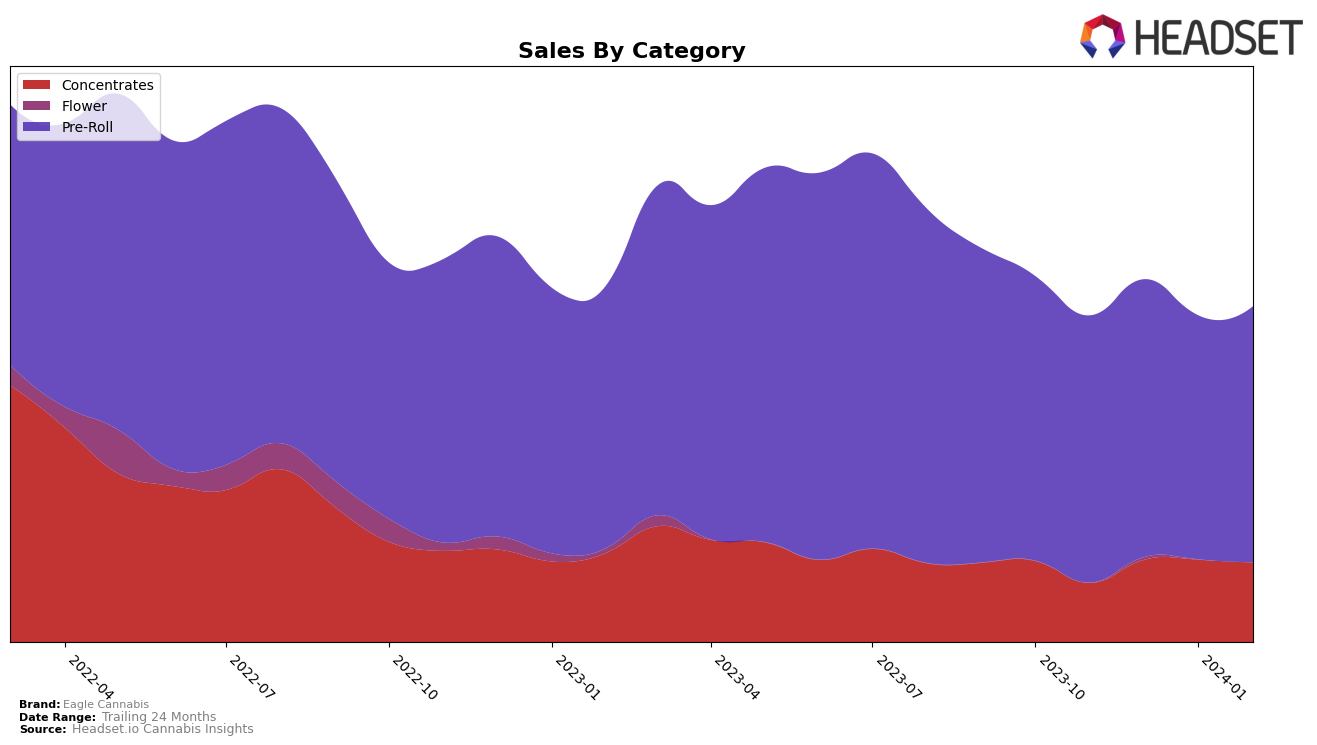

In Washington, Eagle Cannabis has shown a noteworthy progression in the concentrates category, climbing from a rank of 76 in November 2023 to 46 by February 2024. This upward trajectory reflects a consistent improvement in their market positioning, moving closer to the top brands in a highly competitive category. Although the brand did not break into the top 30, the significant jump in rankings over a short period is indicative of growing consumer acceptance and possibly an enhanced distribution network. Sales figures corroborate this positive trend, with a steady increase from November 2023's $26,492 to $35,715 by February 2024, underscoring a solid performance in this segment.

Similarly, Eagle Cannabis's performance in the Pre-Roll category within the same state has demonstrated stability and resilience. Maintaining a position within the top 30 from November 2023 through February 2024, the brand has consistently ranked around the 30th position, peaking at 29th place in January and February 2024. This steadiness in a highly competitive market segment suggests a loyal customer base and effective brand strategies that keep them relevant. Unlike the dramatic shifts seen in the concentrates category, the pre-roll segment shows a more stable but positive outlook for Eagle Cannabis, with sales slightly fluctuating but remaining strong, as evidenced by a sales figure of $114,814 in February 2024. This indicates a reliable demand for their pre-roll products despite the market's competitive nature.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in Washington, Eagle Cannabis has shown a consistent performance amidst fluctuating ranks among its competitors. From November 2023 to February 2024, Eagle Cannabis maintained a position within the top 30 brands, indicating a stable demand for their products. Notably, Treats has seen a significant improvement, moving up from rank 46 in November 2023 to rank 28 by February 2024, surpassing Eagle Cannabis in the latest month. This shift suggests a growing consumer preference for Treats, potentially impacting Eagle Cannabis's market share. Meanwhile, Slab Mechanix also showed notable progress, climbing ten ranks from February 2023 to February 2024. In contrast, Bondi Farms and Seattle Marijuana Company have experienced slight fluctuations but remained relatively stable in their positions. The dynamic changes in rank and the aggressive upward movement of competitors like Treats underscore the competitive pressure on Eagle Cannabis, emphasizing the need for strategic marketing and product innovation to maintain or improve its market position.

Notable Products

In February 2024, Eagle Cannabis saw Granddaddy Purple Pre-Roll 10-Pack (5g) maintain its position as the top-selling product, with impressive sales of 1975 units, continuing its streak from previous months. Following closely, Blue Dream Pre-Roll 10-Pack (5g) secured the second rank, consistently holding its position as well. New entrants in the top products list include Fruity Pebbles Wax (1g) and Ice Cream Cake Wax (1g), which ranked third and fourth respectively, indicating a growing interest in the concentrates category. Pineapple Express Pre-Roll 10-Pack (5g) experienced a slight improvement, moving from the fifth position in January to the fourth in February, showcasing steady demand among pre-roll products. These rankings underscore a stable preference for pre-rolls while highlighting an emerging trend towards concentrates within Eagle Cannabis's product lineup.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.