Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

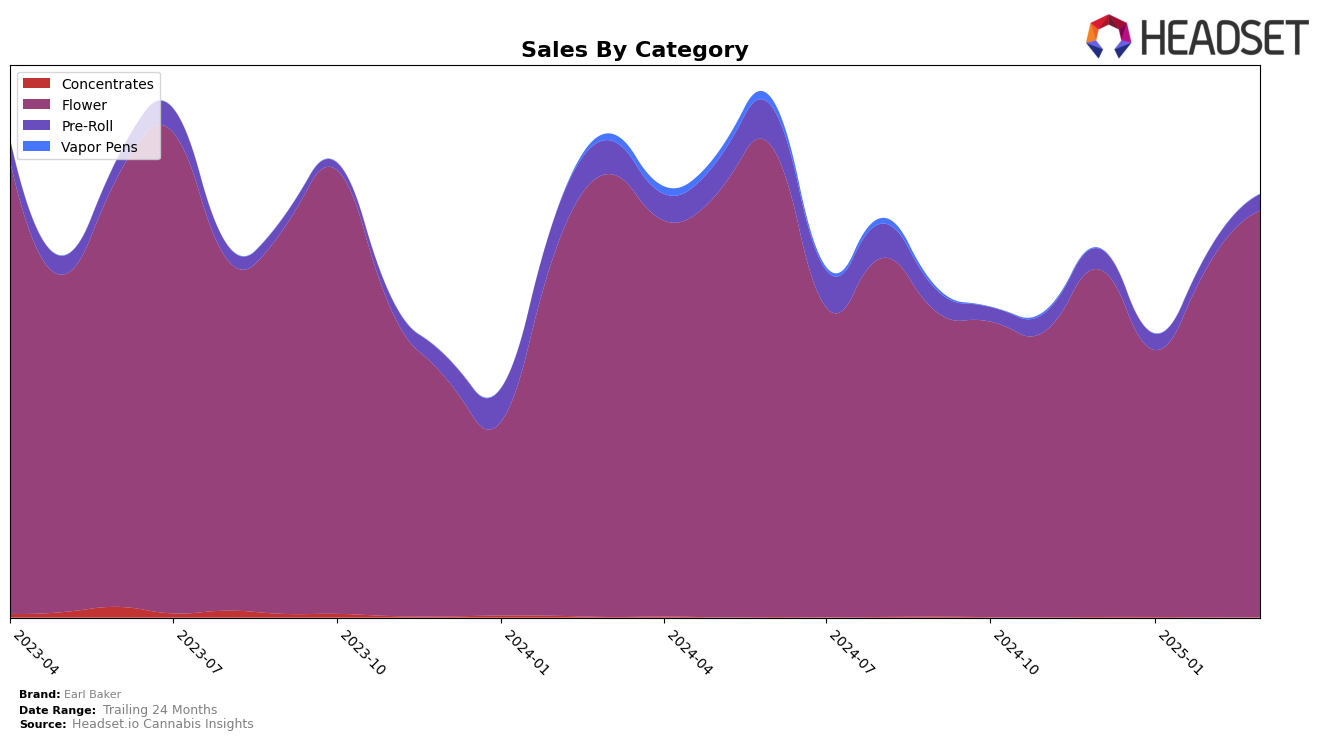

In the Oregon market, Earl Baker has shown a notable performance in the Flower category. Starting December 2024, the brand was ranked 24th, which saw a slight dip in January 2025 to 27th. However, by February and March 2025, Earl Baker made a significant comeback, climbing to 18th and then 19th position, respectively. This upward trend suggests a strong recovery and growing consumer interest in their Flower products, with March sales reaching a notable $307,832. The performance in this category indicates a strategic focus that is paying off, as they managed to re-enter and maintain a position within the top 20 brands in this competitive market segment.

Conversely, in the Pre-Roll category, Earl Baker has struggled to gain a foothold in Oregon. Throughout the observed months, the brand consistently ranked outside the top 30, with rankings of 82nd, 90th, 95th, and 88th from December 2024 to March 2025. This indicates a challenging market presence in this category, reflecting either a lack of consumer preference or competitive pressure from other brands. Despite these challenges, there was a slight improvement in March 2025, as the brand moved up to 88th from 95th in February, suggesting potential for growth if strategic adjustments are made. The contrasting performance across categories highlights the brand's varying market dynamics and the need for targeted strategies to enhance its position in the Pre-Roll segment.

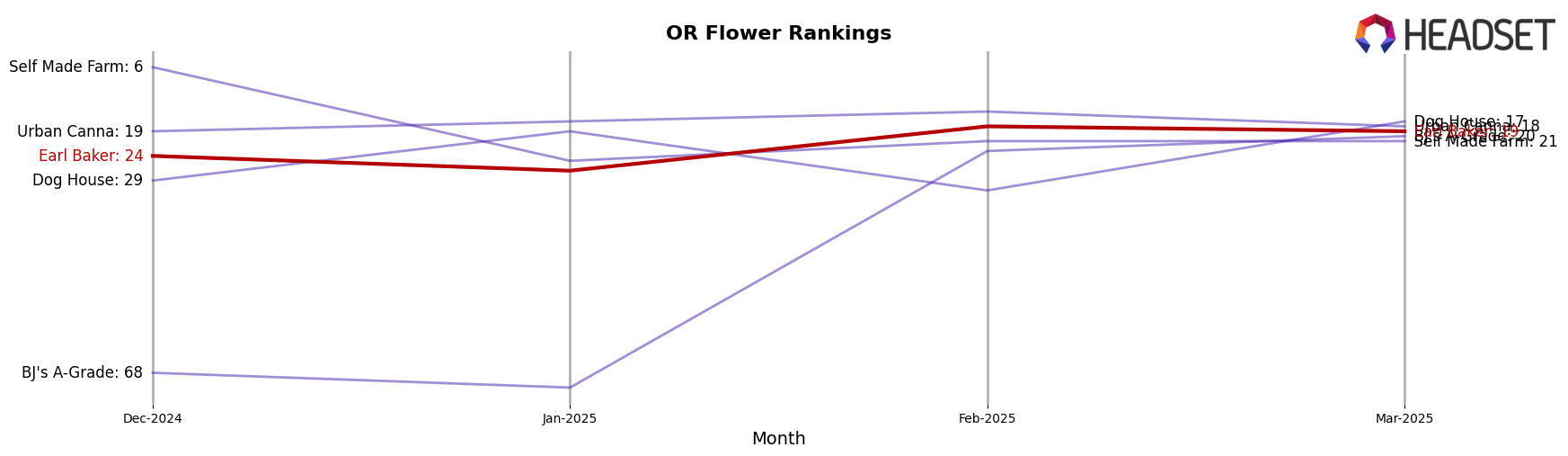

Competitive Landscape

In the competitive landscape of the Oregon flower category, Earl Baker has demonstrated a promising upward trajectory in recent months. After starting at rank 24 in December 2024, Earl Baker improved its position to rank 18 by February 2025, maintaining a strong presence at rank 19 in March. This positive trend in rank is mirrored by a steady increase in sales, suggesting growing consumer preference and market penetration. Notably, Self Made Farm experienced a significant drop from rank 6 in December to rank 21 by March, indicating potential market share opportunities for Earl Baker. Meanwhile, Urban Canna has remained a consistent competitor, hovering around the top 20, which highlights the competitive pressure in maintaining rank. Earl Baker's strategic improvements in rank and sales amidst fluctuating performances by competitors like Dog House and BJ's A-Grade underscore its potential for continued growth and market leadership in Oregon's flower category.

Notable Products

In March 2025, the top-performing product for Earl Baker was Dante's Inferno (Bulk) in the Flower category, securing the first rank with sales figures reaching 1823. Icee Blizzard (Bulk) followed closely as the second top product, having dropped from its first position in February 2025. Stankonya (Bulk) maintained its third position from the previous month, showing consistent performance. Gouda Gas (Bulk) debuted in the rankings at fourth place, while Ice Cream Man (Bulk) rounded out the top five. Notably, the rankings for Icee Blizzard (Bulk) and Stankonya (Bulk) shifted slightly, indicating a competitive sales environment.

```Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.