Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

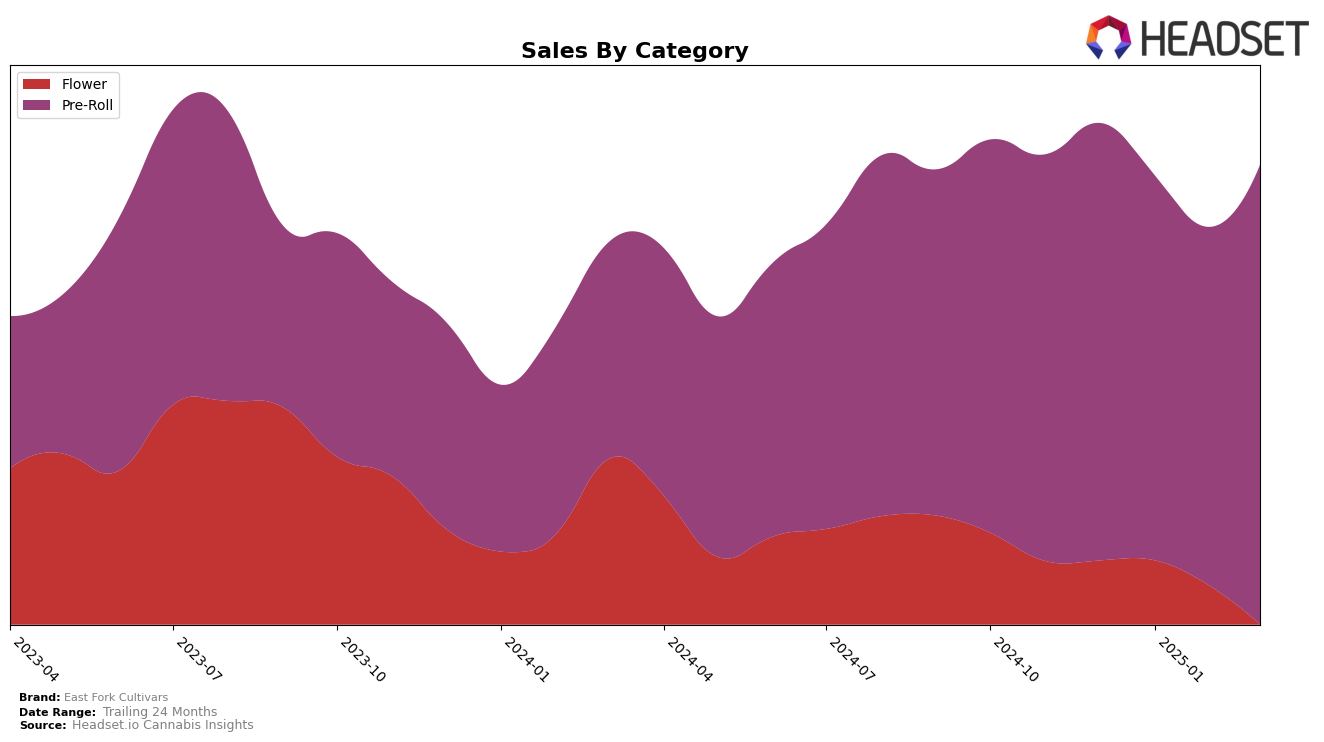

East Fork Cultivars has shown a fluctuating performance in the Oregon market, particularly within the Pre-Roll category. Starting in December 2024, the brand held the 30th position, but dropped out of the top 30 in January 2025. However, they made a recovery by February and March, regaining the 29th spot. This indicates a resilience in their market presence despite a temporary setback. The sales figures reflect this volatility, with a dip in January but a notable increase by March, suggesting a potential recovery or strategic adjustment that paid off.

The absence of East Fork Cultivars in the top 30 during January could be seen as a challenge, possibly highlighting increased competition or market dynamics that temporarily affected their standing. Nonetheless, their ability to bounce back into the rankings by February and maintain their position in March is a positive sign of their brand strength and consumer appeal. The data suggests that while there are hurdles, East Fork Cultivars is capable of navigating these challenges and re-establishing their presence in the competitive pre-roll segment in Oregon. This performance trajectory offers insights into both the competitive landscape and the brand's strategic responses.

Competitive Landscape

In the competitive landscape of Oregon's pre-roll category, East Fork Cultivars has demonstrated a steady presence, maintaining a rank within the top 30 from December 2024 to March 2025. Despite facing competition from brands like SugarTop Buddery, which consistently outperformed East Fork Cultivars with higher sales figures, East Fork managed to improve its rank from 33rd in January to 29th by February and March. This suggests a positive trend in consumer preference or strategic marketing efforts. Meanwhile, Oregrown showed fluctuations, peaking at 26th in February but dropping to 33rd by March, indicating potential volatility that East Fork Cultivars could capitalize on. Additionally, Grown Rogue and National Cannabis Co. did not make it into the top 20 during this period, highlighting an opportunity for East Fork Cultivars to further solidify its market position by leveraging its consistent ranking and exploring strategies to increase sales and climb the ranks.

Notable Products

In March 2025, the top-performing product from East Fork Cultivars was Pineapple Kush Pre-Roll (0.5g), which climbed to the number one rank with sales of 1305 units. Create - Jelly Delight Pre-Roll (0.5g) maintained its position as the second-best seller for the second consecutive month. Takilma Kush Pre-Roll (0.5g) saw a notable improvement, moving up to the third position from being unranked in February. Balance - Kush Petals Pre-Roll (0.5g) experienced a drop, falling to fourth place from the top spot in February. The CBD Pear Blossom Pre-Roll (0.5g) entered the rankings for the first time in March, securing the fourth position alongside Balance - Kush Petals Pre-Roll (0.5g).

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.