Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

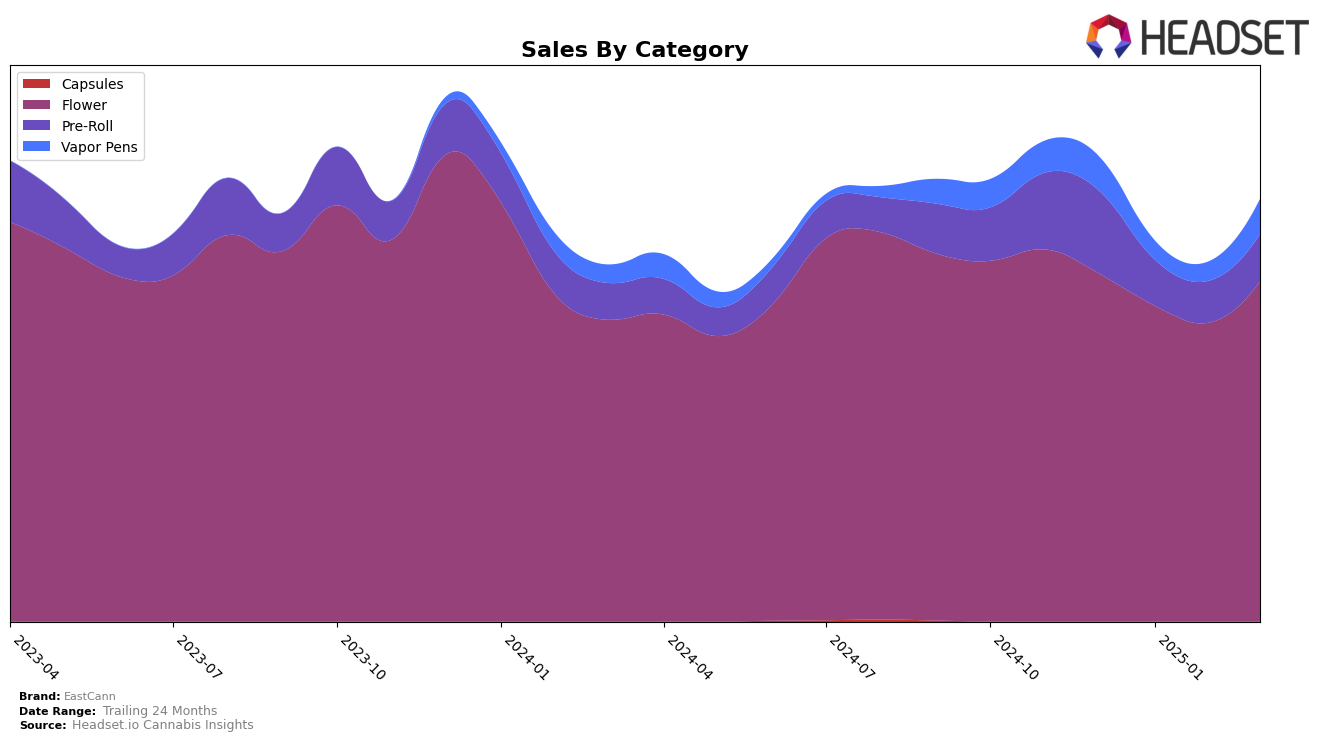

EastCann's performance in the Ontario market has shown notable fluctuations across different categories. In the Flower category, EastCann made a significant leap from being ranked 38th in February 2025 to breaking into the top 30 by March 2025, securing the 29th position. This upward movement corresponds with a substantial increase in sales, indicating a positive reception in the market. However, their presence in the Vapor Pens category has been less consistent. Although they improved from 85th in February to 70th in March, they have not yet managed to enter the top 30, suggesting there is still room for growth and improvement in this segment.

In Saskatchewan, EastCann has experienced a dynamic performance in the Flower category, with rankings varying significantly from 6th in January 2025 to 18th by March. This decline in rank might raise questions about competitive pressures or changes in consumer preferences. Meanwhile, in the Pre-Roll category, EastCann was ranked 30th in December 2024 and 36th in January 2025 but did not maintain a top 30 position in the following months. This absence from the top rankings suggests challenges in maintaining a competitive edge in this category, highlighting potential areas for strategic focus.

Competitive Landscape

In the competitive landscape of the Flower category in Ontario, EastCann has shown a notable improvement in its market position from December 2024 to March 2025. Starting at rank 39 in December, EastCann climbed to rank 29 by March, indicating a positive shift in its competitive standing. This upward trend is particularly significant when compared to competitors such as Tenzo, which also improved its rank from 44 to 28, and Dime Bag (Canada), which moved from 49 to 33. Despite these improvements, EastCann's sales trajectory shows a recovery in March 2025, aligning closely with BLKMKT, which maintained a steady rank but experienced a decline in sales over the same period. The strategic positioning of EastCann in the Ontario Flower market suggests a potential for growth, especially as it closes the gap with brands like Muskoka Grown, which has shown less volatility in rank but fluctuating sales figures.

Notable Products

In March 2025, Velvet Z (1g) maintained its top position as EastCann's best-selling product, continuing its streak from December 2024. Chopper's Pick (28g) held steady at the second spot for the third consecutive month, showing a notable increase in sales to 1334 units. Gastro Pop (3.5g) climbed back to the third position after slipping to fifth in February, reflecting a resurgence in popularity. Mango Sour Cured Resin Cartridge (1g) re-entered the rankings at fourth place, with sales reaching 1070 units. Platinum Mints Pre-Roll 10-Pack (5g) rounded out the top five, dropping one spot from its February rank but still maintaining a strong presence in the market.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.