Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

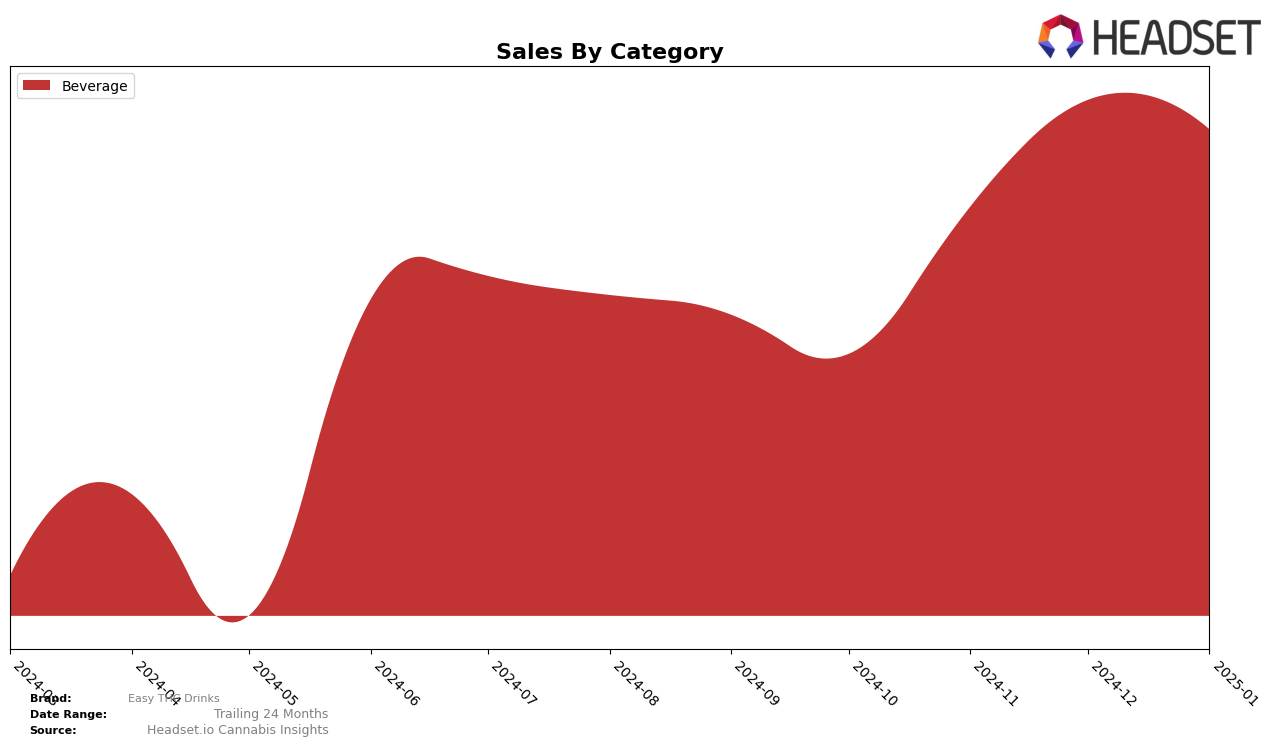

Easy THC Drinks has shown notable performance in the Beverage category within the state of Massachusetts. In October 2024, the brand was not among the top 30, but by November, it had climbed to the 17th position, maintaining this rank through December and January. This consistency suggests a strong foothold in the Massachusetts market, indicating successful brand strategies or consumer acceptance. The brand's sales in Massachusetts increased from November to December, although there was a slight dip in January. Such trends may reflect seasonal purchasing behaviors or competitive pressures.

The absence of rankings in other states or provinces suggests Easy THC Drinks has yet to break into the top 30 in those regions, which may represent untapped potential or challenges in market penetration. The brand's focused success in Massachusetts could serve as a strategic blueprint for expansion into other markets. Understanding the factors contributing to their Massachusetts success could be critical for replicating this performance elsewhere. The brand's current trajectory in Massachusetts highlights its potential for growth and the importance of targeted market strategies.

Competitive Landscape

In the Massachusetts beverage category, Easy THC Drinks has shown a consistent presence in the rankings from November 2024 to January 2025, maintaining the 17th position. This stability in rank, despite not being in the top 20 in October 2024, suggests a steady market presence. However, competitors such as Keef Cola, which re-entered the rankings at 8th place in January 2025, and Journeyman, appearing at 12th in November 2024, indicate a competitive landscape. Sip has shown slight fluctuations but remains ahead of Easy THC Drinks, consistently ranking between 13th and 14th. Meanwhile, Good Feels Inc holds the 16th position, just one spot above Easy THC Drinks. Despite these challenges, Easy THC Drinks has managed to increase its sales from November to December 2024, although it experienced a slight dip in January 2025. This competitive analysis highlights the need for strategic marketing efforts to improve rank and sales amidst strong competition in the Massachusetts market.

Notable Products

In January 2025, the top-performing product from Easy THC Drinks was Grapefruit Bubbly Water (5mg THC, 12oz), maintaining its number one rank from the previous months with sales reaching 1053 units. Lime Bubbly Water (5mg THC, 12oz) held steady in the second position, showing consistent performance across the last few months. Lemon Bubbly Water (5mg THC, 12oz) remained in the third spot, continuing its upward sales trend since October 2024. Notably, Pineapple Seltzer (5mg THC, 355ml, 12oz) was not ranked in January 2025, indicating a potential discontinuation or lack of sales data. The Beverage category from Easy THC Drinks consistently dominated the rankings, with no shifts among the top three products from December 2024 to January 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.