Oct-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

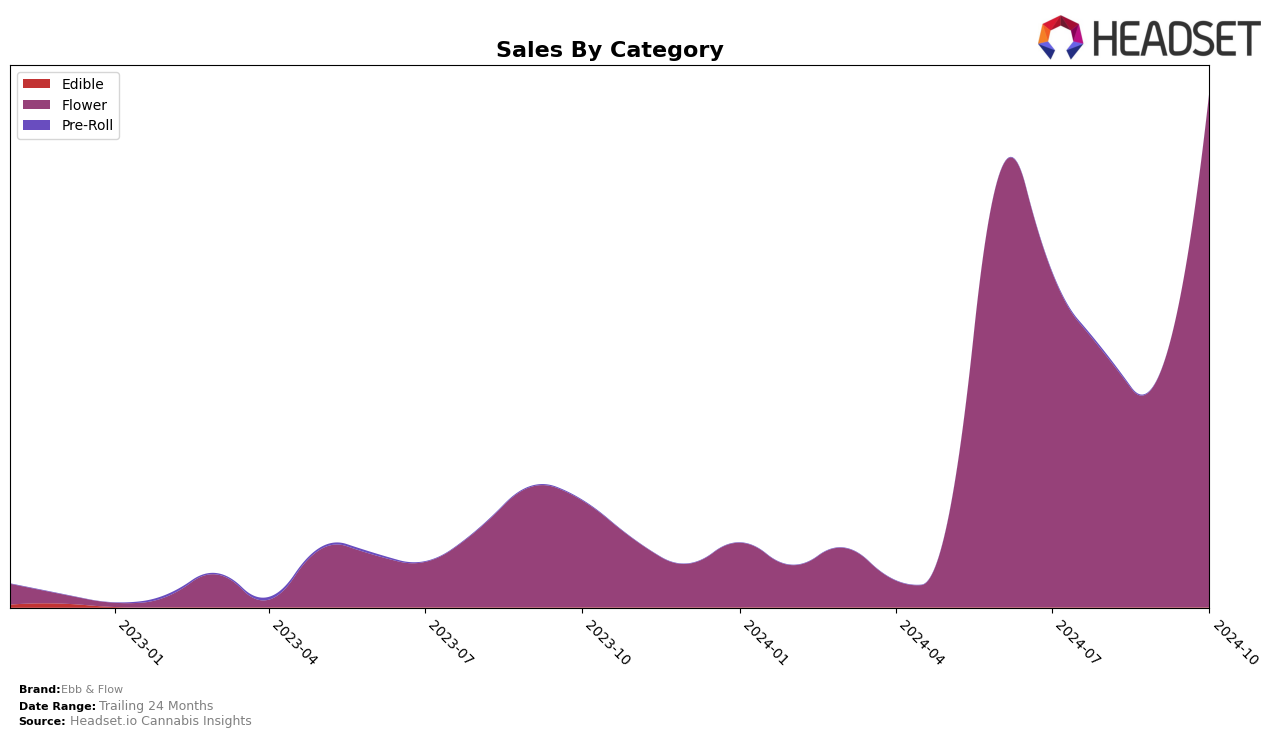

Ebb & Flow has shown notable performance improvements in the Oregon market, especially in the Flower category. After not ranking in the top 30 brands throughout July to September 2024, Ebb & Flow made a significant leap to 28th place in October. This upward movement is indicative of a strategic shift or market response that has positively impacted their sales trajectory. The increase in rank suggests a potential increase in consumer demand or effective marketing strategies that have resonated well with the Oregon audience.

Despite the challenges in maintaining a top 30 position during the summer months, Ebb & Flow's resurgence in October is a promising sign for the brand's future prospects in Oregon. The brand's ability to climb the rankings after a period of absence from the top 30 highlights their potential for growth and adaptability in a competitive market. While the specific strategies leading to this improvement remain undisclosed, the brand's performance in October could serve as a foundation for further expansion and stability in the Flower category.

Competitive Landscape

In the competitive landscape of the Oregon flower market, Ebb & Flow has experienced significant fluctuations in its ranking over the past few months, reflecting a dynamic and competitive environment. In July 2024, Ebb & Flow held a relatively strong position at 42nd place, but saw a decline in August and September, dropping to 59th and 58th respectively. However, by October, Ebb & Flow made a remarkable recovery, climbing back up to 28th place. This rebound is indicative of a strategic adjustment or market response that effectively boosted their sales, which peaked at a notable level in October. In contrast, Cultivated Industries showed a consistent upward trajectory, moving from 85th in July to 30th by October, suggesting a steady increase in consumer preference or market penetration. Meanwhile, Excolo maintained a strong presence, particularly in August and September, ranking 27th and 25th, before slightly dropping to 26th in October. TH3 Farms and Bald Peak also demonstrated competitive performances, with TH3 Farms experiencing a dip in August but recovering by October, and Bald Peak showing a steady climb to 27th place. These shifts highlight the competitive pressures and opportunities within the Oregon flower market, emphasizing the need for Ebb & Flow to continuously innovate and adapt to maintain and improve its market position.

Notable Products

In October 2024, the top-performing product for Ebb & Flow was Stargate (Bulk) from the Flower category, securing the number one rank with a significant sales figure of 2740. Member Berries (Bulk), also in the Flower category, maintained its second-place position from September into October, indicating consistent demand with a sales figure of 2504. Strawberry Gary (1g) debuted in the rankings at third place, highlighting its growing popularity. Han Solo in Plantinum (Bulk) and Wonder Dawg (1g) entered the rankings for the first time, taking the fourth and fifth spots respectively. Notably, Stargate (Bulk) made a remarkable jump from third place in July to the top spot by October, showcasing its increasing consumer preference over the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.