Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

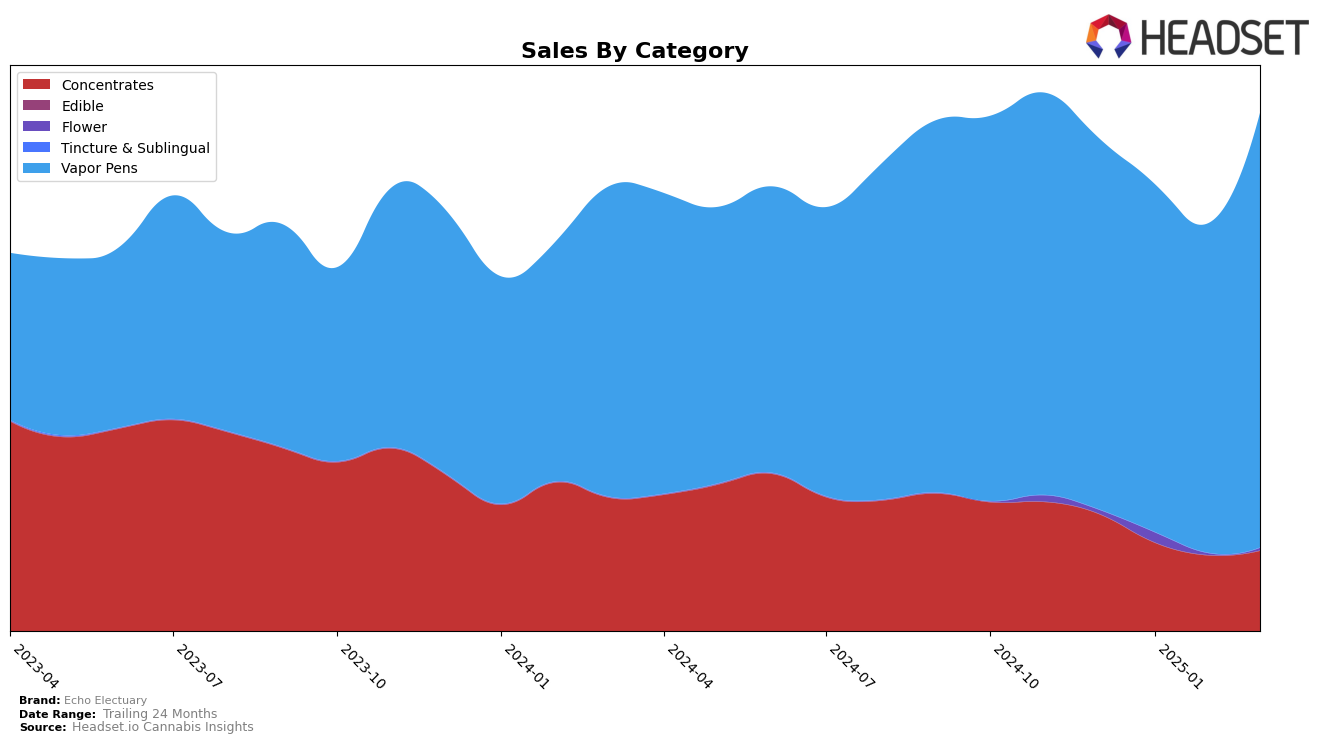

Echo Electuary's performance in the Oregon market reveals intriguing dynamics across different product categories. In the Concentrates category, the brand has experienced a gradual decline in rankings, moving from 9th place in December 2024 to 17th place by March 2025. This downward trend is accompanied by a notable decrease in sales, with a drop from $171,715 to $117,759 over the same period. Such a decline could indicate increasing competition or shifting consumer preferences within the Concentrates segment. It's worth noting that Echo Electuary managed to maintain its presence within the top 20, suggesting some level of resilience despite the challenges.

Conversely, the Vapor Pens category in Oregon tells a different story for Echo Electuary. Here, the brand has shown an upward trajectory, improving its ranking from 12th place in December 2024 to 10th place by March 2025. Additionally, this positive movement is reflected in a significant increase in sales, particularly notable in March 2025. Such performance suggests that Echo Electuary is effectively capitalizing on consumer demand in the Vapor Pens category, possibly through strategic product offerings or marketing initiatives. While the brand's performance varies across categories, its ability to adapt and capture market share in Vapor Pens is a promising sign for its future in the Oregon market.

Competitive Landscape

In the competitive landscape of vapor pens in Oregon, Echo Electuary has shown a notable upward trajectory in its rankings, moving from 12th place in December 2024 to an impressive 10th place by March 2025. This positive shift in rank reflects a strategic gain in market presence, especially when compared to competitors such as Oregrown and Rogue Gold, which have experienced more fluctuating ranks during the same period. While Oregrown maintained a relatively stable position, Rogue Gold saw a significant drop in rank in January and February before recovering in March. Meanwhile, Farmer's Friend Extracts and Higher Cultures consistently outperformed Echo Electuary in sales, indicating a potential area for growth. Echo Electuary's sales figures have shown a positive trend, particularly in March 2025, suggesting that their market strategies may be starting to pay off, positioning them well against their competitors in the Oregon vapor pen market.

Notable Products

In March 2025, Echo Electuary's top-performing product was the Georgia GMO Live Nectar XL Cartridge (1g) in the Vapor Pens category, achieving the number one rank with sales of 927 units. Following closely was the Matanuska Thunder F*ck Live Resin XL Cartridge (1g), which secured the second position. Blue Dream Live Nectar XL Cartridge (1g) came in third place, maintaining a strong presence in the Vapor Pens category. Tally Mon Live Nectar XL Cartridge (1g) and Airheadz Live Nectar Cartridge (1g) rounded out the top five, ranking fourth and fifth, respectively. Compared to previous months, these products have consistently improved in rankings, indicating a growing consumer preference for Echo Electuary's vapor pen offerings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.