Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

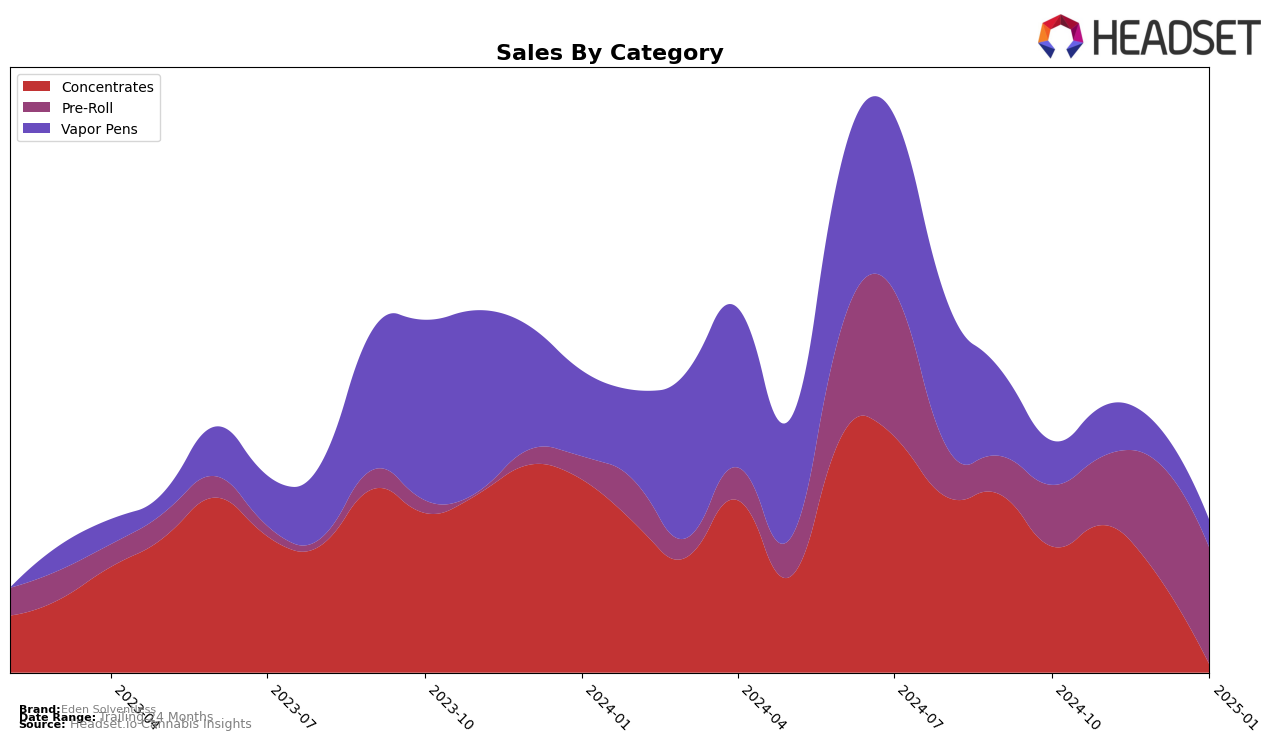

Eden Solventless has shown varied performance across different product categories in Maryland. In the Concentrates category, the brand maintained a steady presence in the top 20 rankings from October to December 2024, but dropped out of the top 30 by January 2025. This suggests a potential decline in market share or increased competition. On the other hand, the Pre-Roll category indicates a positive trend, with Eden Solventless improving its rank from 39th in October 2024 to 34th by January 2025, which could imply growing consumer preference or successful marketing strategies. Vapor Pens, however, did not manage to break into the top 30 in any of the months, highlighting a potential area for improvement or a more competitive landscape in this category.

The sales data further underscores these trends, with notable fluctuations in the Concentrates category, where sales peaked in November 2024 before declining sharply by December 2024. This could indicate seasonal demand variations or the impact of new product launches by competitors. Pre-Rolls, conversely, experienced a consistent increase in sales from October 2024 to January 2025, aligning with their improved ranking. This upward trajectory might suggest successful consumer engagement strategies or product innovations. Vapor Pens, despite a slight uptick in sales in November 2024, did not maintain a strong market presence, emphasizing the need for strategic focus to capture a larger share in this category.

Competitive Landscape

In the Maryland pre-roll category, Eden Solventless has demonstrated a consistent upward trajectory in its rankings and sales over the past few months. Starting from a rank of 39 in October 2024, Eden Solventless improved to the 34th position by January 2025, indicating a positive trend in market presence. This upward movement is particularly notable when compared to competitors like Kings & Queens, which experienced fluctuating rankings, dropping from 29th to 36th over the same period. Meanwhile, Khalifa Kush saw a decline from 22nd to 30th, suggesting potential challenges in maintaining its market share. Although Beezle Extracts and MORE Cannabis were not consistently in the top 20, Eden Solventless's steady rise in sales, particularly in December 2024 and January 2025, highlights its growing appeal among consumers. This trend positions Eden Solventless as a brand to watch, with potential for further ascension in the competitive landscape.

Notable Products

In January 2025, Eden Solventless's top-performing product was Strawberry Candy Bubble Hash Infused Pre-Roll (1g), which climbed to the number one rank with sales of 383 units, showing a significant increase from its third-place position in December. Filthy Animal Bubble Hash Infused Pre-Roll (1g) slipped from the first position in December to second place in January, indicating a decrease in sales momentum. Fruity Gum Bubble Hash Infused Pre-Roll (1g) made its debut in the rankings at third place, while Space Burger Bubble Hash Infused Pre-Roll (1g) followed closely in fourth. Tropical Sweets Bubble Hash Infused Pre-Roll (1g) maintained its fifth-place ranking from October, reflecting consistent sales performance. Overall, the Pre-Roll category shows dynamic shifts in product popularity, with notable gains for Strawberry Candy.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.