Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

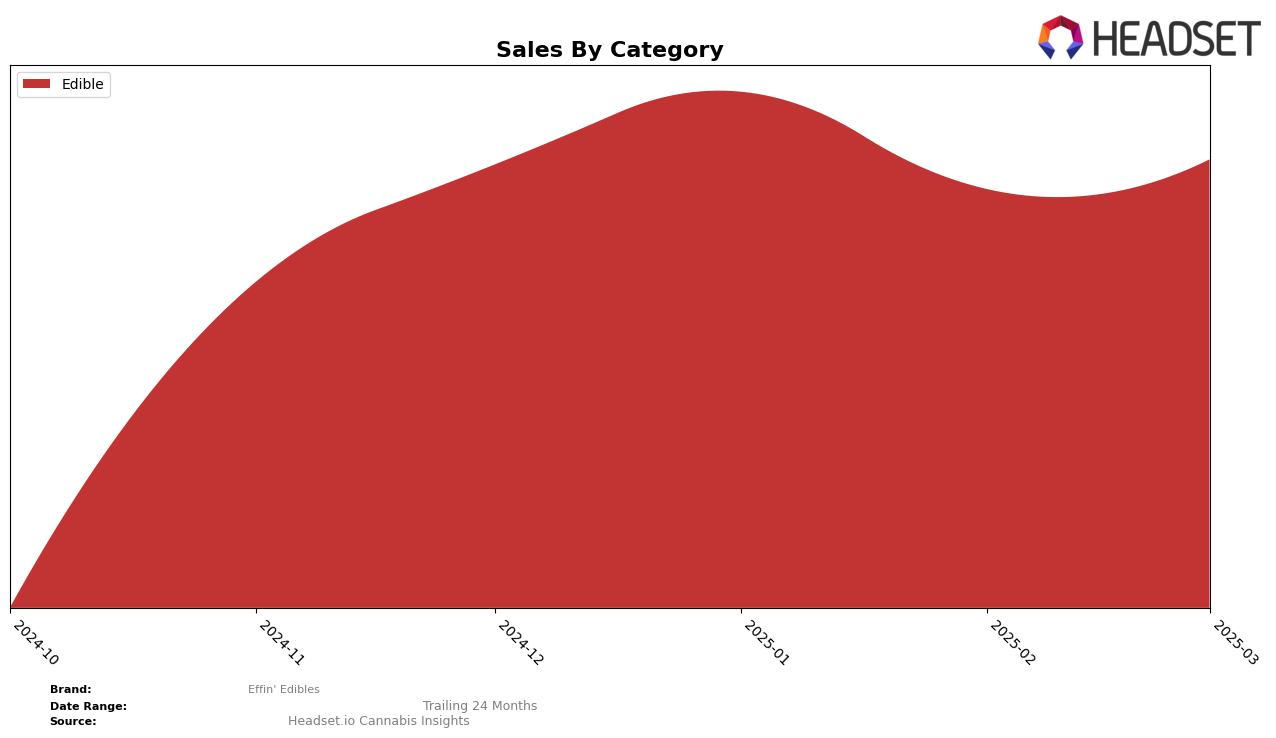

Effin' Edibles has shown varied performance across different states in the past few months. In Illinois, the brand has maintained a steady presence in the top 30 edible brands, fluctuating between the 22nd and 25th positions from December 2024 to March 2025. Despite this consistent ranking, there was a noticeable dip in sales in January and February, with a recovery in March to slightly above December's figures. This suggests that while the brand's market position remains stable, sales volumes have been somewhat volatile, indicating potential seasonal or competitive influences that might be worth exploring further.

In Massachusetts, Effin' Edibles has consistently ranked within the top 30, with positions varying from 19th to 22nd. The brand's sales peaked in January 2025 but saw a decline in the following months, which could suggest a temporary boost or promotional activity during that period. Meanwhile, in New Jersey, Effin' Edibles has been performing relatively well, maintaining a position in the top 10 edible brands, although there's been a slight downward trend from 7th to 10th place over the four-month period. This consistent top-tier ranking, despite some sales fluctuations, underscores New Jersey as a particularly strong market for Effin' Edibles, highlighting a potential area for strategic focus and growth.

Competitive Landscape

In the competitive landscape of the edible cannabis market in New Jersey, Effin' Edibles has experienced some fluctuations in its ranking over the past few months. Starting from a strong position at rank 7 in December 2024 and January 2025, Effin' Edibles saw a slight decline to rank 9 in February and further to rank 10 in March 2025. This shift in ranking coincides with a dynamic market where competitors like OGEEZ improved their position from rank 11 in January to 9 in March, indicating a potential increase in their sales momentum. Meanwhile, Incredibles and Verano have maintained relatively stable positions, although both saw a decline in sales, which could suggest a market share opportunity for Effin' Edibles if they can capitalize on this trend. Notably, Savvy emerged as a strong contender, jumping from outside the top 20 to rank 8 by February, maintaining that position in March, which highlights the competitive pressure Effin' Edibles faces in sustaining its market position.

Notable Products

In March 2025, Effin' Edibles maintained its leading position with the THC/CBN 2:1 Goodnight Grape Gummies 10-Pack, which held the top rank for four consecutive months, achieving sales of 14,861 units. The Do It - THC/THCV 1:1 Amplified Apple Gummies 10-Pack consistently secured the second position, showing a steady performance since February. Chillin - CBD/THC 1:1 Relaxing Razz Gummies 10-Pack sustained its third-place ranking, signaling a stable demand. The CBG/THC 2:1 Sativa Social Citrus Gummies 10-Pack remained in fourth place, with sales figures indicating a slight increase compared to previous months. Lastly, the Sleep - THC/CBN 2:1 Goodnight Grape Gummies 20-Pack continued to rank fifth, reflecting consistent consumer interest.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.