Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

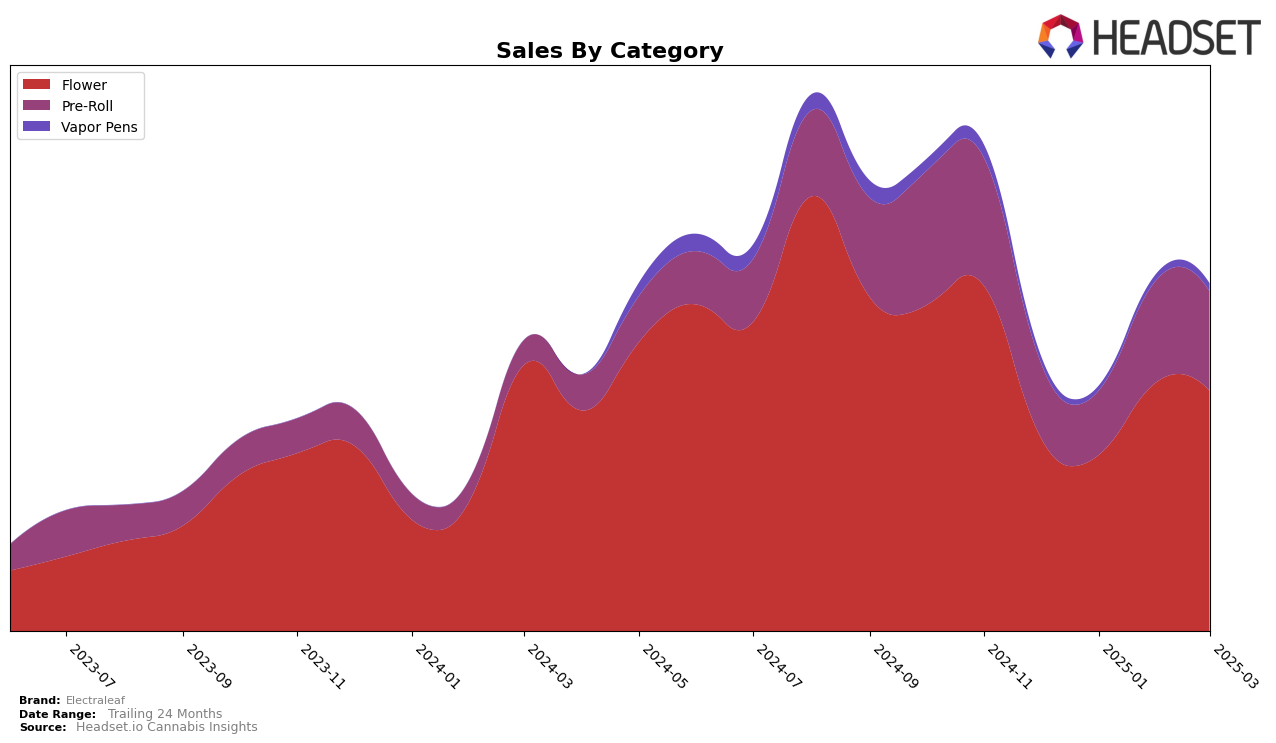

Electraleaf has shown a notable improvement in its performance in the New York market, particularly in the Flower category. Over the four-month period from December 2024 to March 2025, Electraleaf's rank has climbed from 20th to 16th position. This upward trend is supported by a substantial increase in sales from $486,225 in December to $629,236 in March, indicating a strong consumer preference for their products. In the Pre-Roll category, Electraleaf also experienced a positive trajectory, moving from 26th to 17th place, with sales peaking in February before slightly declining in March. However, it's worth mentioning that in the Vapor Pens category, Electraleaf did not make it into the top 30 in January 2025, which could be seen as a concern for their market presence in that segment.

Despite the challenges in the Vapor Pens category, where Electraleaf was ranked 79th in December and 68th in March, the brand seems to be making a concerted effort to improve its standing. The absence from the top 30 in January highlights a potential area for growth and strategic focus. Nevertheless, the overall positive movement in the Flower and Pre-Roll categories suggests that Electraleaf is successfully capitalizing on consumer trends in New York. This mixed performance across categories indicates that while Electraleaf is gaining traction in certain areas, there are still opportunities to bolster its presence and expand its market share, particularly in the underperforming segments.

Competitive Landscape

In the competitive landscape of the Flower category in New York, Electraleaf has shown a steady improvement in its ranking from December 2024 to March 2025, moving from 20th to 16th place. This upward trend suggests a positive reception of their products, despite a slight dip in sales from February to March 2025. Notably, Smokes (Canada) has emerged as a strong competitor, entering the top 20 in February 2025 and advancing to 14th place by March, with sales figures surpassing Electraleaf's. Meanwhile, The Botanist made a significant leap from outside the top 20 to 15th place in March, indicating a potential threat to Electraleaf's position. Additionally, Hepworth experienced fluctuations, peaking at 13th in January before dropping to 17th in March, while Platinum Reserve saw a decline from 9th to 18th, which might provide Electraleaf with an opportunity to capture more market share if these trends continue.

Notable Products

In March 2025, Laughing Buddha (3.5g) emerged as the top-performing product for Electraleaf, securing the number one rank with significant sales of 1626 units. Cannoli Pre-Roll (1g) advanced to the second position, showing a remarkable increase from its previous fourth place in February. Sour Pebbles Pre-Roll (1g) held strong at third place, maintaining a consistent presence in the top ranks since December 2024. Orange Cookie Mac (3.5g) made its debut in the rankings at fourth, while Animal Tsunami (3.5g) dropped to fifth from its peak position in January. These shifts highlight the dynamic nature of consumer preferences within Electraleaf's product offerings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.